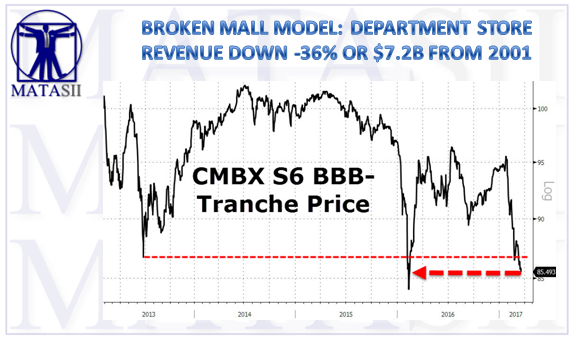

BROKEN MALL MODEL: DEPARTMENT STORE REVENUE DOWN 36% OR $7.2B FROM 2001

As longtime retail analyst Howard Davidowitz observed in 2014:

“What’s going on is the customers don’t have the fucking money. That’s it.

This isn’t rocket science.”

As a result of the hundreds of upcoming storefronts between just these two companies, mall operators are bracing for another collapse in rental revenue, which in turn continues to provide fuel to the "big short" trade, namely shorting the debt of mall REITs via CMBX, which as of this morning, hit new lows.

Between 2010 and 2013, visits to shopping malls declined 50%, according to data from real estate research firm Cushman and Wakefield.

As prosperity declines, shopping habits shift, and major retailers like Macy’s, Sears, and JCPenney close their doors, their decisions are likely to have ripple effects on smaller stores in shopping malls. Business Insider explains that in addition to dwindling attendance and income for mall owners, major department store closures can trigger “‘co-tenancy clauses’ that allow the other mall tenants to terminate their leases or renegotiate the terms, typically with a period of lower rents, until another retailer moves into the anchor space.”

As fewer retail giants seek retail space, many malls are facing dire fates, and many expect low-performing malls to be hit hardest by the changing scope of retail, noting roughly 30% of malls will face increased risk of shutting down.

- Shopping malls first became popular in the economically fruitful era of the 1950s and 60s.

- Inspired by major department stores of the 19th century — like Sears and Macy’s, which are now struggling — 20th-century malls grew rapidly, in part, because of government subsidies provided in the form of tax breaks.

- Smithsonian Magazine has explained that over the decades, real estate developers overshot their expectations, constructing increasing numbers of malls despite a lack of population growth. By 1999, the downward trend we see intensifying today had already begun:

“Shopping centers that hadn’t been renovated in years began to show signs of wear and tear, and the middle-aged, middle-class shoppers that once flooded their shops began to disappear, turning the once sterile suburban shopping centers into perceived havens for crime. Increasingly rundown and redundant, malls started turning into ghost towns—first losing shoppers and then losing stores.”

Almost twenty years later, the trend has only intensified, and retailers are evidently bracing for an even deeper plunge. As CNBC noted earlier this year:

“At $12.7 billion, U.S. department store revenue is $7.2 billion lower than it was in 2001, according to the U.S. Census Bureau. Expect these trends to continue.”