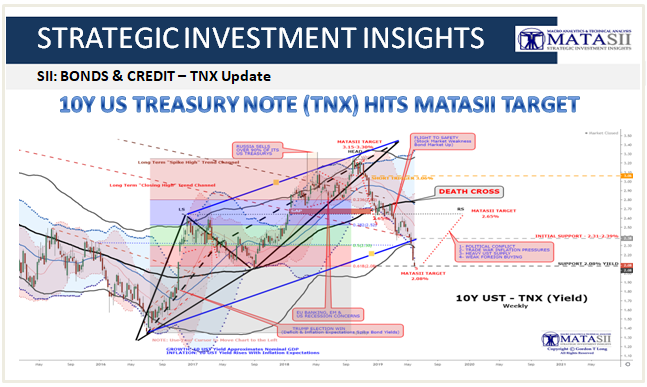

10Y US TREASURY NOTE (TNX) HITS MATASII TARGET

We have hit the MATASII yield target of 2.08% for the 10Y US Treasury Note. This is exactly a 61.8% Fibonacci Retracement.

Note that the recent TNX plunge was technically precipitated by the cross of the 80 WMA (black line) of the 40 WMA (blue line).

WHERE TO FROM HERE?

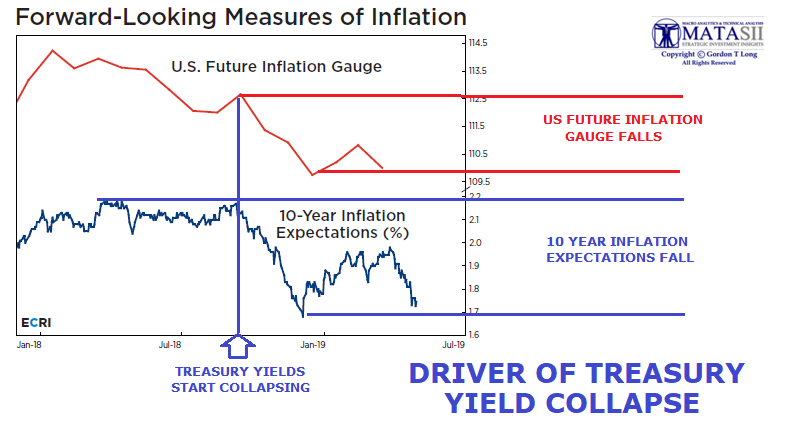

From a fundamentals perspective the drop is about the plunge in Inflation expectations...

... which is triggered by the drop globally of the 5Y-5Y and 10Y-10Y forward swap rates.

CHART

SUBSCRIBER CONTENT ONLY

CHART

SUBSCRIBER CONTENT ONLY

Calls for the Fed to ease policy heated up on Friday after the official non-farm payrolls report showed the U.S. economy had added 75,000 jobs in May, falling short of analysts’ estimate for 180,000. Market Watch reports:

Banks are rushing to cut their year-end forecasts for the benchmark Treasury yield, but Commerzbank might just have topped them all.

The contention is that once the Federal Reserve embarks on rate cuts, it would move more aggressively than investors expect. Once slowing economic growth and tariff fears force the central bank’s hand, the 10-year Treasury rate would fall toward a record low of 1.25% by year-end, wrote Christopher Rieger, head of rates at the bank. Yields fall as bond prices rise.

“Our Fed view with three 25 [basis point] rate cuts by March 2020 is close to what the market is pricing. Once the Fed begins easing, however, the market will not stop there. Following the comments at this week’s Fed conference, it should account for a scenario of more aggressive pre-emptive steps, which looks set to take U.S. Treasury yields to record lows,” Rieger said.

The us Treasury market is following the global move based on rapidly falling trade statistics and the shift of central bankers to an "Easing Bias".

CHART

SUBSCRIBER CONTENT ONLY

MATASII'S POSITION

MATASII continues to believe we will now begin to see a counter rally which will put in a "right shoulder" before US Treasury yields head lower as the above contends. This will be the results of:

1- POLITICAL CONFLICT

2- TRADE WAR INFLATION PRESSURES

3- HEAVY UST SUPPLY

4- WEAK FOREIGN BUYING

[SITE INDEX -- SII - BONDS & CREDIT]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - BONDS & CREDIT

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.