EUROPEAN ELECTION WILL AVOID THE ENSLAVING ISSUE OF DEBT

Off-Guardian.org published the following article which we have put into a "net" bullet form. There message is simple:

- Across the EU, inequality is rising, corporations rule, and oligarchs impose their will,

- The European Parliament has no meaning as all important decisions are taken by the unelected heads of the European Commission and the European Central Bank,

- Europe is but one debt crisis away from the fate of Greece. And the global financial bubble is guaranteed to bring this crisis forward, sooner rather than later.

- The only responsible way to vote is to support parties promoting debt justice. This includes the abolition of odious public debt, and the resolution of non commercial private debt in favor of the many and poor debtors, instead of the few and rich creditors.

The citizens of the European Union are called to vote this week for the European Parliament.

- It is not a real parliament, and it lacks prospects for becoming one,

- All important decisions are taken by the unelected heads of the European Commission and the European Central Bank (dubbed “the worst-run Central Bank in the world”).

These elections capture however the general mood of exasperation with current policies.

- Conservative and extreme Right parties will rise, reflecting widespread skepticism as to the economic course of the EU and its lack of benefits for the common people.

- The conservatives generally blame the weak and scapegoat the refugees, the immigrants, the women, and the poor,

- While promising to save the middle class from the onslaught of big capital.

- They create false hopes of easy reform, and they never denounce the exploitation inherent in today’s system.

- History shows however that small owners manage to resist financial stranglehold only when they make common cause with workers and the poor, and they are not afraid to fight.

- The mainstream Left unfortunately neglects these issues, and it will pay the price.

The economy looks ever more frail.

- In all, the Eurozone’s nominal GDP stagnates, shrinking 12% in its six largest economies in 2008-2017.

- The European Union remains indifferent to the peoples’ needs, while it caters for every whim of the corporations.

- Even so, Quantitative Easing and other crony capitalist schemes promoted by the ECB, such as the Private-Public Partnerships (PPPs) or the new Targeted Long-term Refinancing Operations (TLTRO-III) cannot save the day.

Donald Trump declares bluntly “I don’t care about Europe”, showing that US considers our continent as little more than a collection of vassal states.

In all countries inequality rises, corporations rule, and oligarchs impose their will.

- Liberal France exhibits an abhorrent authoritarianism against the Yellow Vests.

- Italy chases the refugees and the Roma.

- Workers’ rights and incomes are eroded everywhere, with women workers hit particularly hard.

- Even in successful countries, such as Germany, real wages remain below their 1990 level.

Source here

Exploitation today is often effected through debt.

- Public and private debt are crucial mechanisms for the ongoing transfer of wealth and power from the poor to the rich, from the weak to the strong, from the many to the few.

- Public discussion so far neglects this issue, even though financial expropriation’s explosive potential is well known to insiders and to the mainstream parties.

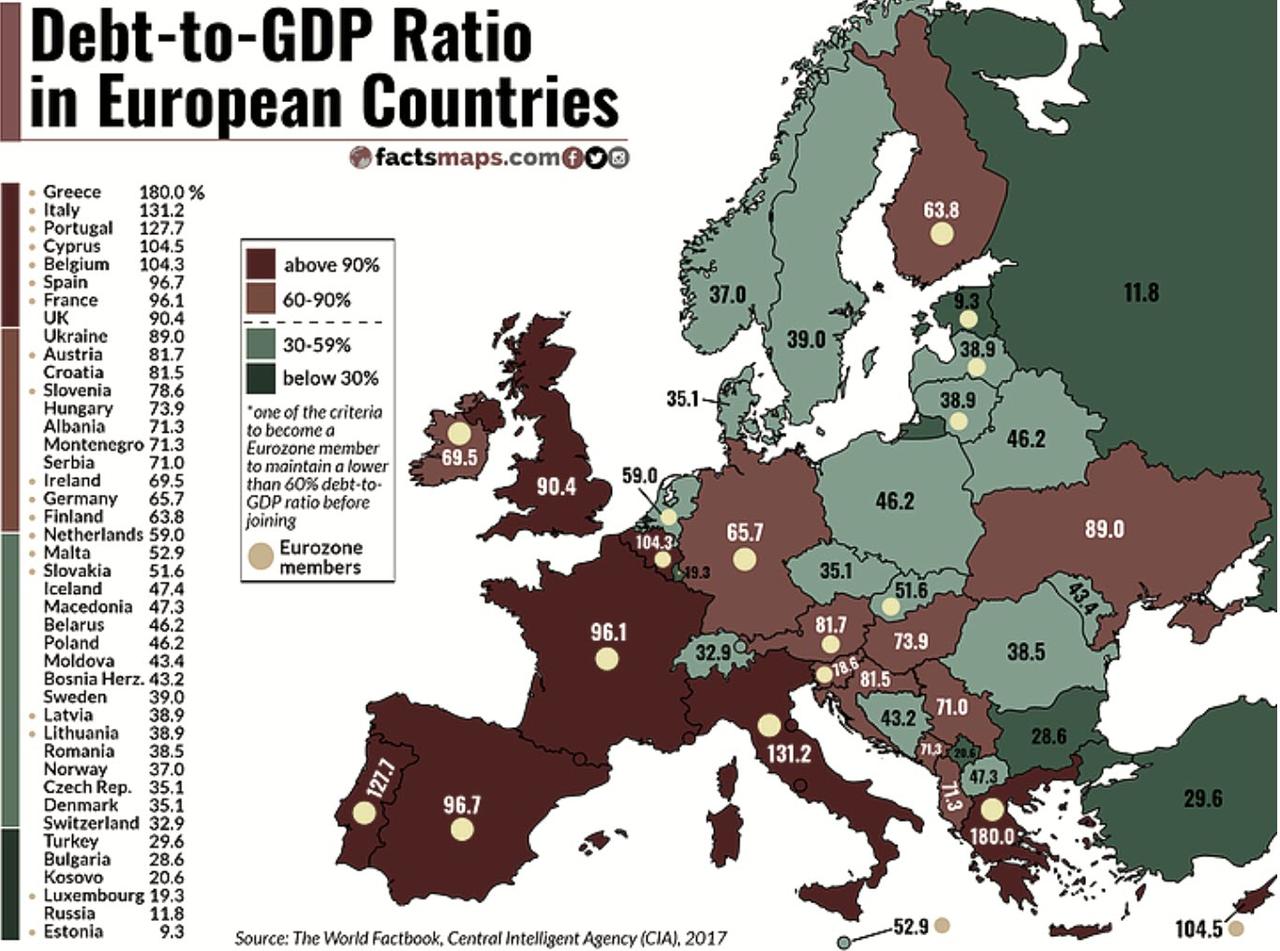

Public debt in today’s European Union totals 13 trillion euro, reaching 80% of its GDP.

- This average masks huge variations between the European periphery and the core.

- For example, Greece owes 335 billion euro or 181% of its GDP,

- Italy 2.3 trillion (132%), and

- Portugal 225 billion (122%).

- On the other hand German public debt at 2 trillion is 61% of the GDP, and

- Tax haven Luxemburg’s 12 billion is only 21%.

Public debt is a political choice, not a law of nature.

- In today’s Europe it is used to subsidize corporations, not the vanishing social state.

- Instead of covering their needs by taxing the rich, states beg them for loans, get gleefully indebted to them, and promptly pay huge interest to them.

- Falling further down into the debt trap, states transfer huge resources from the periphery to the center, and from poor to rich.

- This gigantic public debt entails the destruction of democratic institutions, turning citizens into debt peons, and stealing our children’s lives.

In 2010 the Troika appointed itself as savior of Greece from its excessive debt, which then stood at 109%. The European Commission, the European Central Bank and the International Monetary Fund imposed draconian austerity and the liquidation of public property. The Greeks’ sacrifices did not save them, but led to destitution and debt slavery. Parliamentary government became an empty form and a far Right criminal organisation, modeled on Hitler’s Nazis, surged. No European or national institution took responsibility for the debacle. But the peoples of Europe took heed.

The rest of Europe is but one debt crisis away from the fate of Greece. And the global financial bubble is guaranteed to bring this crisis forward, sooner rather than later.

Fiscal pressure leads to revolts or even cataclysmic change – it ushered to the French, the Russian, and the Chinese revolutions. But the debt crisis is not insoluble in itself. States have always the sovereign right to abolish debt, as Iceland did recently. This does not hurt the economy, but gives it a boost. It simply means that the rich will not foreclose for themselves bigger and bigger parts of future production.

We call on all European citizens, within or without the European Union, to check parties’ policies on debt. Parties lacking a clear policy on this issue either do not recognize its seriousness or simply side with the financial oligarchy.

The only responsible way to vote is to support parties promoting debt justice.

This includes the abolition of odious public debt, and the resolution of non commercial private debt in favor of the many and poor debtors, instead of the few and rich creditors.

[SITE INDEX -- MACRO: REGIONAL - EU]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: REGIONAL - EU

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-23-19 - Off-Guardian.org - "Debt Is The Hidden Issue In The European Elections"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.