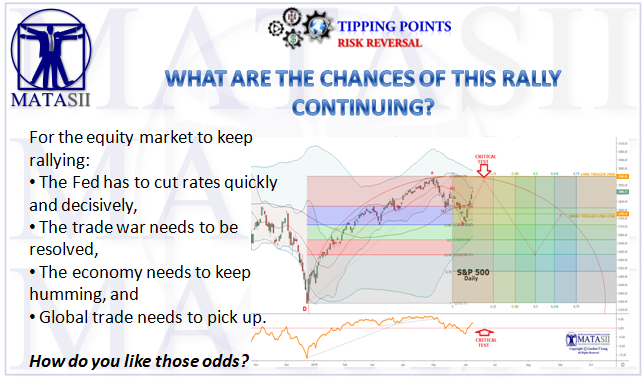

WHAT ARE THE CHANCES OF THIS RALLY CONTINUING?

For the equity market to keep rallying:

- The Fed has to cut rates quickly and decisively,

- The trade war needs to be resolved,

- The economy needs to keep humming, and

- Global trade needs to pick up.

How do you like those odds?

With markets now pricing in at least three rate-cuts and expectations for a July cut surging to over 80%, belief in a pre-emptive "insurance" cut is now consensus - and The Fed had better not disappoint!

ANNOTATED CHART

SUBSCRIBER CONTENT ONLY

Historically, preemptive Fed rate cuts have tended to boost the stock market, this time may be different.

What’s different this time is that the front-end of the yield curve is much more deeply inverted than in the 1990s. In other words, markets have more aggressively discounted policy easing. With Fed fund futures pricing in about 70 basis points of cuts by year-end, the FOMC has a high bar to keep equity investors happy without fomenting recession fears.

ANNOTATED CHART

SUBSCRIBER CONTENT ONLY

- While investors have priced in a fair amount of good news in terms of lower interest rates, they’re yet to factor in enough of the bad news on global trade. Historically, S&P’s EPS estimates track global trade volume fairly closely.

- Analysts are expecting earnings to grow a little less than 5%. Based on regression, that would require trade to increase 2% to 3% this year after, contracting 1% in 2018. That seems optimistic as exports from open economies, such as South Korea and Taiwan, continue to shrink.

- While investors have priced in a fair amount of good news in terms of lower interest rates, they’re yet to factor in enough of the bad news on global trade. Historically, S&P’s EPS estimates track global trade volume fairly closely.

- Analysts are expecting earnings to grow a little less than 5%. Based on regression, that would require trade to increase 2% to 3% this year after, contracting 1% in 2018. That seems optimistic as exports from open economies, such as South Korea and Taiwan, continue to shrink.

ANNOTATED CHART

SUBSCRIBER CONTENT ONLY

- Sure, President Trump dropped plans for tariffs on Mexican exports Friday night, a moved welcomed by his own Republican party. But the trade war against China is a different story because it has bipartisan support. The standoff between the world’s two largest economies shows no signs of easing.

- Sure, President Trump dropped plans for tariffs on Mexican exports Friday night, a moved welcomed by his own Republican party. But the trade war against China is a different story because it has bipartisan support. The standoff between the world’s two largest economies shows no signs of easing.

[SITE INDEX -- TIPPING POINTS - GLOBAL GOVERNANCE FAILURE]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS ABSTRACTED FROM:

SOURCE: 06-10-19 - - "For The Equity Markets To Keep Rallying, This Has To Happen..."

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.