APPLE EARNINGS IN JEOPARDY: GOLDMAN SEES "UNHEARD OF COLLAPSE IN CHINESE SMARTPHONE DEMAND"

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - FANGS & NOSH

10-15-18 - "Apple Earnings In Jeopardy: Goldman Sees "Unheard" Of Collapse In Chinese Smartphone Demand"

It's not just auto sales that are tumbling in China: according to Goldman there are "multiple signs" of rapidly slowing consumer demand in China across all products.

While this would have a dramatic impact on China's economy, which as we noted recently has been manipulating official data to represent solid industrial profit growth even as individual companies have indicted that profits have been shrinking sharply in recent months...

... Goldman is especially concerned how this could adversely affect Apple demand in China this Fall.

Specifically, Goldman references the substantial weakness in Chinese macro indicators, with the PMI dropping to 50.8 in September from 51.3 in August and 51.5 in June, auto sales deteriorated to -12% Y/Y in September vs. -4% Y/Y in August and July, "and early Golden week indications are lackluster."

But the punchline is that according to Goldman calculations, smartphone unit volume deteriorated by ~15% Y/Y in Q3 which is "unheard of in a typically seasonally strong Q3." And, as Goldman analyst Rod Hall notes, though most of the smartphone weakness was in the mid and lower range "we find it hard to believe that this general environment is going to be helpful to Apple unless things improve late in the year."

How would this plunge in smartphone demand impact Apple's bottom line?

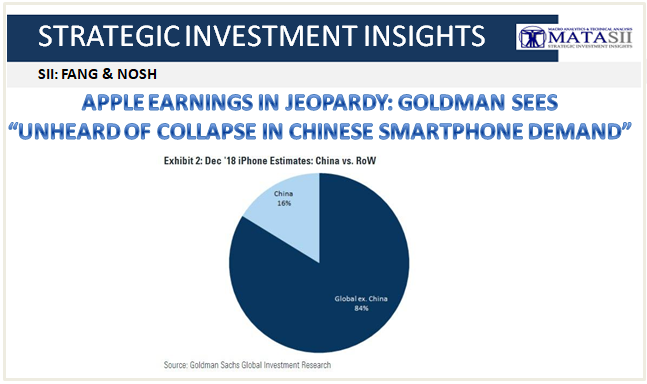

According to Goldman, China currently contributes ~13 million of Apple's ~80m total iPhone unit forecast in the Dec '18 QTR. That 13 million unit forecast implies that Apple will continue to lose share in the high end smartphone category (to 30% in Q4'18 from 32% in Q4'17) though it also assumes demand in that category is unaffected by macro.

Goldman then shows a sensitivity of Apple's China iPhone revenue, total revenue and EPS to various market growth and share conditions. Here are the details:

In our central case, we are assuming ~$11bn of revenue from China in Dec '18 quarter. In an even worse scenario, in which the China SP market declines 15% Y/Y in CQ4'18, our estimates for China could be 4.5% lower. We note, however, that this would have just a ~1% impact on our overall revenue growth estimate for Apple in CQ4. What we believe China really puts at risk is Apple's ability to beat market expectations on the FQ1 to Dec. guidance. A prudent forecast here (by Apple) would likely be very conservative given market conditions while consensus expectations for Apple are generally perceived to be conservative in our view.

China iPhone revenue is 18% of total iPhone revenue in our current estimate for Dec '18 and 12% of total revenue. In the tables below we show sensitivity of total revenue and EPS to market conditions in China discussed above.

The key takeaway from Goldman's analysis is that Apple's Dec '18 EPS could end up dropping 4% in a worst case scenario if China's weakness is indeed as bad as indicated.