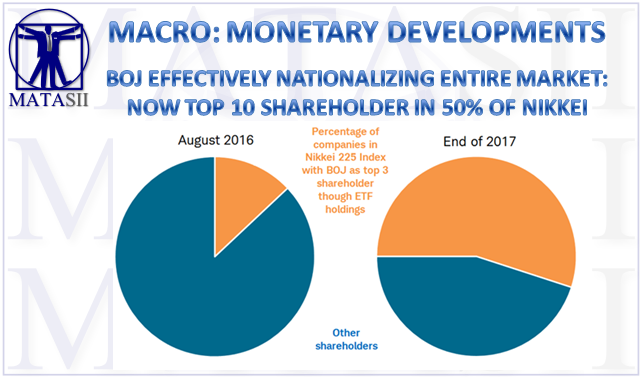

BOJ NOW TOP 10 SHAREHOLDER IN 50% OF NIKKEI

Japan's central bank is quietly nationalizing its entire market. The BOJ has gone from being a Top 10 holder in 40% Japanese stocks last March, to 50% just one year later.

- The Bank of Japan Is Now A Top-10 Shareholder In 50% Of All Japanese Companies.

- Bank of Japan now owns a stunning 75% of all Japanese ETF

- As of March 2018, the Japanese central bank had become a major shareholder in nearly 40% of all listed companies.

- This, of course, in addition to the BOJ's trillions in Japanese JGB holdings, which at last check were over 100% of GDP and 43% of all outstanding.

- The BOJ also become the top shareholder in 23 companies, including Nidec, Fanuc and Omron, through its ETF holdings, but as of Q1, it was among the top 10 holders for 49.7% of all Tokyo-listed enterprises.

The Bank of Japan will overtake a state-run pension fund - the world's largest - as the top shareholder in Tokyo-listed companies as early as 2020, even as concerns rise regarding the central bank's outsize role in the nation's capital market. Assuming that the bank maintains its current target of 6 trillion yen (just over $53BN at prevailing rates) in new purchases a year, its holdings would expand to about 40 trillion yen by the end of November 2020. This would place it above the Government Pension Investment Fund's TSE first-section holdings of more than 6%. In other words, Japan's central bank will soon be the biggest individual owner of Japanese stocks.

The BOJ is ushering in a new age for the Japanese market: the age of creeping nationalization, where a monetary authority is becoming the biggest owner of corporate assets using money printed out of thin air to fund the purchases.

The bank's ETF program "is eroding market discipline as companies are rewarded simply for being in major market indexes, rather than for having new business strategies or offering more dividends," the OECD said in a country survey published Monday, citing a previous Nikkei report.

"If the Nikkei Stock Average falls below about 18,000, the market value of the ETF holdings would fall below their book value,"

[SITE INDEX -- MACRO: MACRO MONETARY DEVELOPMENTS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: MACRO MONETARY DEVELOPMENTS

MATASII RESEARCH ANALYSIS & SYNTHESIS ABOVE WAS SOURCED FROM:

ABSTRACTED FROM: 04-17-19 - - "The Bank of Japan Is Now A Top-10 Shareholder In 50% Of All Japanese Companies"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.