TIPPING POINTS

BOND BUBBLE

BOND MARKET NEEDS TO CONSOLIDATE

BOND MARKET NEEDS TO CONSOLIDATE

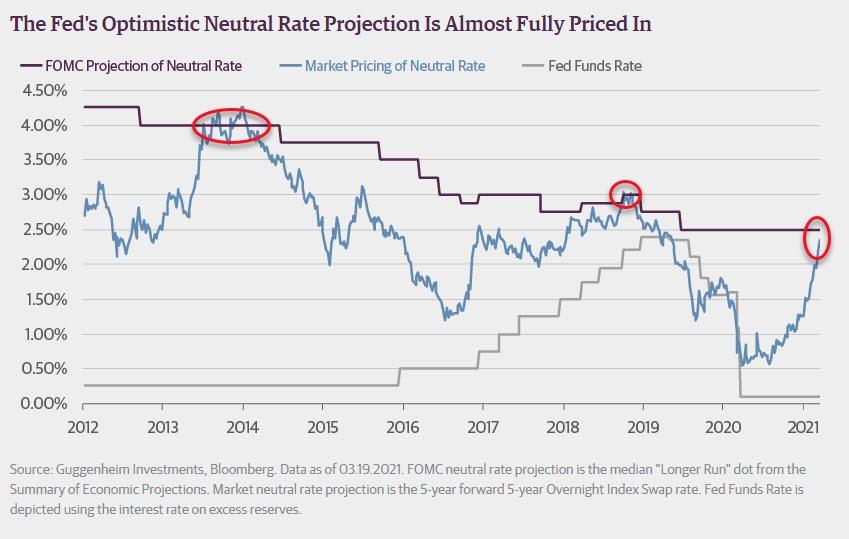

The historic lift in bond yields has rapidly changed the investment landscape. Bond holders have experienced ~3.7% losses so far in 2021. It has been one of the worst year-beginning starts since 1999, just prior to the implosion of the Dotcomm Bubble.

However, for new money or through potential equity rotation, currency hedged US Treasuries are suddenly the most attractive to foreigners that they have been in seven years!

|

|

|

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.

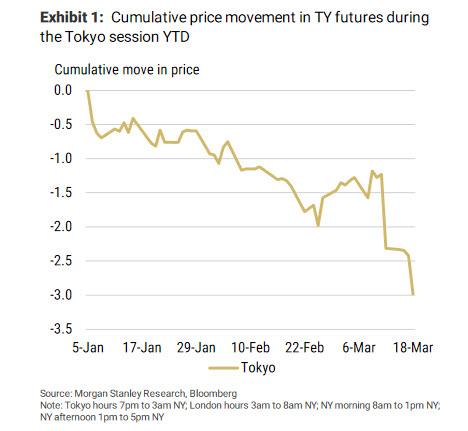

The 10Y UST Note now offers Japanese investors 105 basis points of un-leveraged carry. Additionally, the steep yield curve is now offering institutional investors good returns for taking on duration risk. We suspect that against a back drop of rather benign inflation and easy money, investors will be tempted to reach for yield. An upward sloping yield curve is one of the few avenues remaining that provides an opportunity for fixed income investors to boost current cash flow. At the end of the day, taking on duration risk to get any reasonable return on cash will highly likely prove a temptation too great to resist.

The 10Y UST Note now offers Japanese investors 105 basis points of un-leveraged carry. Additionally, the steep yield curve is now offering institutional investors good returns for taking on duration risk. We suspect that against a back drop of rather benign inflation and easy money, investors will be tempted to reach for yield. An upward sloping yield curve is one of the few avenues remaining that provides an opportunity for fixed income investors to boost current cash flow. At the end of the day, taking on duration risk to get any reasonable return on cash will highly likely prove a temptation too great to resist.