BOTH DEMOCRATS & REPUBLICANS COMING AFTER TAX REVENUES FROM 2017 BUYBACK TAX CHANGES

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

- SOURCE: 02-13-19 - CNBC - "GOP Sen Marco Rubio takes aim at stock buybacks, an issue under attack by Democrats"

- SOURCE: 02-12-19 - MarketWatch - "Marco Rubio rolls out his own plan to limit stock buybacks"

- SOURCE: 02-04-19 -NY Times - "Sanders, Schumer Submit Bill To Limit Stock Buybacks In Scathing NYT Op-Ed"

MATASII SYNTHESIS:

REPUBLICAN PLAN

'Any money spent by companies on buybacks would be considered, for tax purposes, a dividend paid to shareholders — even if investors did not actually sell their stock. Every shareholder would receive an imputed portion of the funds equivalent to the percentage of company stock they own'

DEMOCRAT PLAN

'Calls for a ban on stock buybacks unless companies can show that they have "invested in workers and communities" first' -- corporations won't be able to buy back their own shares unless they first pay all of their workers a minimum wage of at least $15 an hour, offer seven days of paid sick leave, and offer satisfactory pension and health benefits.

2017 TAX LAW

- Passed by Republicans in 2017 allows businesses to fully and immediately deduct their expenses, but the popular provision phases out after 2022.

- The new proposal would make that measure permanent and expand the types of investments eligible for the deduction. The report calls the Tax Cuts and Jobs Act a "missed opportunity."

- "The existence of non-productive alternatives to capital investment, as a result, makes the product of the firm's American workers less valuable while at the same time increasing profits, making possible a world of higher asset prices, lower investment in the economy, and lower worker pay," it states

GOP Sen Marco Rubio takes aim at stock buybacks, an issue under attack by Democrats

- Republican Sen. Marco Rubio is pushing a new proposal that tackles one of Democrats' favorite talking points: stock buybacks.

- The plan, unveiled Tuesday, would eliminate the preferential tax treatment of share repurchases as a way to change corporate behavior.

- The measure aligns Rubio with Democrats who have argued that the benefits of the GOP's tax law have primarily benefited corporations rather than households.

Marco Rubio pushes proposal to discourage stock buybacks 18 Hours Ago | 04:28

Republican Sen. Marco Rubio is pushing a new proposal that tackles one of Democrats' favorite talking points: stock buybacks.

The plan, unveiled Tuesday, would eliminate the preferential tax treatment of share repurchases as a way to discourage that behavior. Instead of falling under the capital gains rate, they would be taxed as dividends, which are subject to a wide range of rates.

Rubio is the chairman of the Small Business Committee, which is releasing a report on the issue today. It argues equal rates would remove companies' incentives to buy back stock in the first place.

"Tax policy changes to end this preference might, on their own, increase investment by shifting shareholder appetite for capital return," the report states.

Under the plan, any money spent by companies on buybacks would be considered, for tax purposes, a dividend paid to shareholders — even if investors did not actually sell their stock. Every shareholder would receive an imputed portion of the funds equivalent to the percentage of company stock they own.

Rubio expects the change would likely result in fewer companies pursuing buybacks. But if they do, the proposal could raise tax revenue in two ways: It broadens the base by increasing the funds that can be taxed, and it could result in higher tax rates if shareholders are subject to ordinary dividend rates instead of qualified dividends.

Rubio's staff said his intent is not to raise rates but acknowledged that more details need to be worked out before formal legislative text is introduced.

The report suggests that any revenue generated from the change could be funneled into encouraging more capital investment. The current tax law — passed by Republicans in 2017 with Rubio's reluctant support — allows businesses to fully and immediately deduct their expenses, but the popular provision phases out after 2022. The new proposal would make that measure permanent and expand the types of investments eligible for the deduction.

The report calls the Tax Cuts and Jobs Act a "missed opportunity."

"The existence of non-productive alternatives to capital investment, as a result, makes the product of the firm's American workers less valuable while at the same time increasing profits, making possible a world of higher asset prices, lower investment in the economy, and lower worker pay," it states.

The measure aligns Rubio with Democrats who have argued that the benefits of the GOP's tax law have primarily benefited corporations rather than households. The message has become a central theme for the early presidential contenders for 2020 — and a narrative that Republicans have fiercely resisted.

But Rubio was a GOP outlier during the debate over the tax law, arguing for a slightly higher corporate tax rate to offset the cost of a bigger child tax credit. Since then, he has repeatedly highlighted the relatively slow growth in wages to the massive jump in share repurchases.

"When corporation uses profits for stock buy back it's deciding that returning capital to shareholders is better for business than investing in their products or workers," he tweeted in December. "Tax code encourages this."

The tweet highlights Rubio's key philosophical difference with Democrats. Rather than blame companies for reaping the benefits of the law, the report suggests they are merely reacting to poor incentives.

"If there is a problem with the raising and deploying of capital, then, it is not attributable to the firm's response to its governors, but rather the terms upon which governance is set," it states.

Marco Rubio rolls out his own plan to limit stock buybacks

Getty Images

Sen. Marco Rubio (R-FL) talks about bipartisan legislation to create "red flag" gun law during a news conference at the U.S. Capitol March 22, 2018 in Washington, DC.

Sen. Marco Rubio on Tuesday is rolling out his own plan to thwart stock buybacks, aligning with Democratic rivals who have recently condemned corporate stock repurchases as a source of the widening gap between average Americans and the wealthy.

The Florida Republican and former presidential candidate, according to CNBC, would reduce the incentives for buybacks by eliminating the preferential tax treatment of such purchases, which would be taxed as dividends.

“We think there are perverse government incentives. It’s about creating the right incentives so that company’s want to invest [in their businesses],” a senior aide for Sen. Rubio told MarketWatch.

“He wants to encourage domestic investment and so we have a bill that would make full and immediate expensing permanent. The pay-for on that bill recognizes that share repurchases are tax-preferred over dividends, so we eliminate the advantage as a pay-for for full expensing,” the aide said.

The tax treatment for repurchases would be the same as the tax treatment for dividends so it would be taxed on the individual level.

The traditional criticism of share buybacks is that it is a way to enrich the wallets of CEOs and top-level executives because it can drive per-share gains of stock by reducing the outstanding float, while such practices take away from direct investments in the company and its workers. However, proponents say repurchases are a low-risk way of allocating capital for firms that are uncertain about the return on investment of higher wages and research and development, and therefore the best use of capital.

Former Treasury Secretary Jack Lew, who was nominated by President Obama, on Tuesday said on CNBC that Rubio’s “idea is something I want to take a look at – that ought to get people’s attention in and of itself,” acknowledging that it was rare for him to agree with the GOP member.

Rubio’s move follows a New York Times op-ed from Sens. Chuck Schumer and Bernie Sanders who sought to limit buybacks by making them contingent on a company investing in its workers and communities first, “including things like paying all workers at least $15 an hour, providing seven days of paid sick leave, and offering decent pensions and more reliable health benefits.”

Related: The Sanders, Schumer buyback test would block almost all company stock repurchases

Limiting stock buybacks could remove a source of demand for shares on major benchmarks like the S&P 500 index SPX, +1.29% and the Dow Jones Industrial Average. DJIA, +1.49%

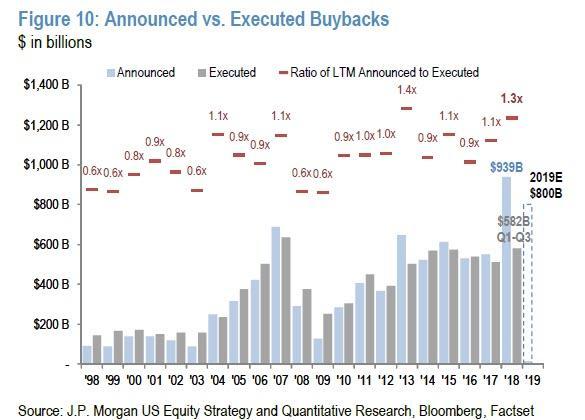

U.S. companies bought back a record $1 trillion in stocks in 2018, and that pace of share repurchases has only accelerated in the first weeks of 2019.

Sanders, Schumer Submit Bill To Limit Stock Buybacks In Scathing NYT Op-Ed

In the latest indication of how the Democratic Party's formerly centrist, corporation-friendly establishment is tacking to the left, presumably to capitalize on the enthusiasm generated by "Democratic Socialists" like Bernie Sanders and Alexandria Ocasio-Cortez, Senate Majority Leader Chuck Schumer has joined with socialist standard-bearer Bernie Sanders to author an NYT op-ed decrying the corrosive influence of corporate stock buybacks.

The pair used the editorial to announce a bill they are co-sponsoring that calls for a ban on stock buybacks unless companies can show that they have "invested in workers and communities" first (because when has the government forcing decisions about capital allocation over management ever gone wrong).

If Schumer and Sanders have their druthers, corporations won't be able to buy back their own shares unless they first pay all of their workers a minimum wage of at least $15 an hour, offer seven days of paid sick leave, and offer satisfactory pension and health benefits. Because, in the Democrats' estimation, buying back shares while pensions remain underfunded is simply immoral.

That is why we are planning to introduce bold legislation to address this crisis. Our bill will prohibit a corporation from buying back its own stock unless it invests in workers and communities first, including things like paying all workers at least $15 an hour, providing seven days of paid sick leave, and offering decent pensions and more reliable health benefits.

In other words, our legislation would set minimum requirements for corporate investment in workers and the long-term strength of the company as a precondition for a corporation entering into a share buyback plan. The goal is to curtail the overreliance on buybacks while also incentivizing the productive investment of corporate capital.

Some may argue that if Congress limits stock buybacks, corporations could shift to issuing larger dividends. This is a valid concern — and we should also seriously consider policies to limit the payout of dividends, perhaps through the tax code.

Why wouldn’t it be better for our national economy if, instead of buying back stock, corporations paid all of their workers better wages and provided good benefits? Why should a company whose pension program is underfunded be able to buy back stock before shoring up the pension fund?

Whichever way a corporation chooses to invest in its workers, what’s clear to the vast majority of Americans is that companies should devote resources to workers and communities before buying back stock.

So, in this Congress, the two of us will attempt to get a vote on legislation that demands that corporations commit to addressing the needs of their workers and communities before the interests of their wealthy stockholders.

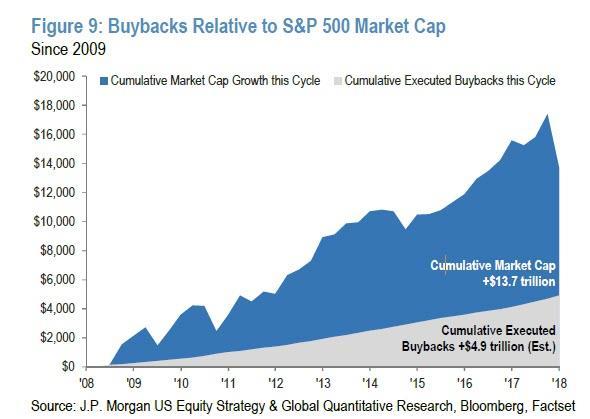

As regular Zero Hedge readers are probably aware, buybacks have been second perhaps only to QE in driving markets higher over the past decade. According to JPM, since 2009, S&P 500 companies have returned some $5 trillion to shareholders, contributing ~2% to annual EPS growth.

S&P 500 companies set a record last year after buying back roughly $1 trillion of their own shares.And while the number is expected to dip in 2019, at $800 billion, it will remain high relative to recent history.

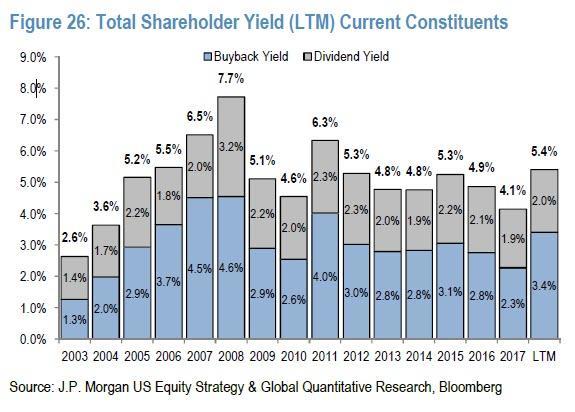

Buybacks have also contributed to substantially to shareholders' annual yield, often moreso than dividends...

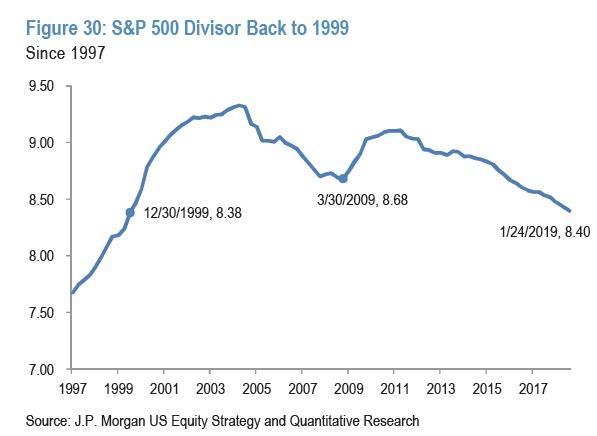

...and sent the S&P 500 divisor back to levels last seen in 1999.

Touching on the eternal capex vs. buyback debate, Sanders and Schumer pointed out that companies apparently now view buybacks as preferable to capex and investing in their workers, a sign that boardrooms have become "obsessed" with maximizing shareholder earnings.

But over the past several decades, corporate boardrooms have become obsessed with maximizing only shareholder earnings to the detriment of workers and the long-term strength of their companies, helping to create the worst level of income inequality in decades.

One way in which this pervasive corporate ethos manifests itself is the explosion of stock buybacks.So focused on shareholder value, companies, rather than investing in ways to make their businesses more resilient or their workers more productive, have been dedicating ever larger shares of their profits to dividends and corporate share repurchases. When a company purchases its own stock back, it reduces the number of publicly traded shares, boosting the value of the stock to the benefit of shareholders and corporate leadership.

But all other metrics aside, according to Sanders and Schumer, with fewer Americans sharing in the wealth of the stock market's advance (the vast majority of equity ownership is concentrated among the wealthiest 10% of Americans) wages indexed for inflation have declined, leaving workers relatively poorer today than they were in the early 1970s.

First, stock buybacks don’t benefit the vast majority of Americans. That’s because large stockholders tend to be wealthier. Nearly 85 percent of all stocks owned by Americans belong to the wealthiest 10 percent of households. Of course, many corporate executives are compensated through stock-based pay. So when a company buys back its stock, boosting its value, the benefits go overwhelmingly to shareholders and executives, not workers.

Second, when corporations direct resources to buy back shares on this scale, they restrain their capacity to reinvest profits more meaningfully in the company in terms of R&D, equipment, higher wages, paid medical leave, retirement benefits and worker retraining.

It’s no coincidence that at the same time that corporate stock buybacks and dividends have reached record highs, the median wages of average workers have remained relatively stagnant. Far too many workers have watched corporate executives cash in on corporate stock buybacks while they get handed a pink slip.

Of course, the bill has no chance of passing the Senate (though, if it gains similar traction in the House, it may have a chance of passing that chamber). And it's fairly unlikely that Trump would sign anything so strongly endorsed by one of his political arch-rivals.

But corporations and executives reliant on buybacks to boost their equity-based compensation will take notice. This could be the beginning of the end of the good times. Because once buybacks are taken out of the equation, and should Democrats win the presidency in 2020 and also sweep Congress, it's difficult to imagine the market replacing that bid (unless wage gains spur the creation of hundreds of millions of active RobinHood accounts).

We give the last word to Peter Schiff, who warns "This form of socialism is called fascism. Political risk for U.S. investors is rising!":