|

TURNING SCIENCE INTO POLITICS

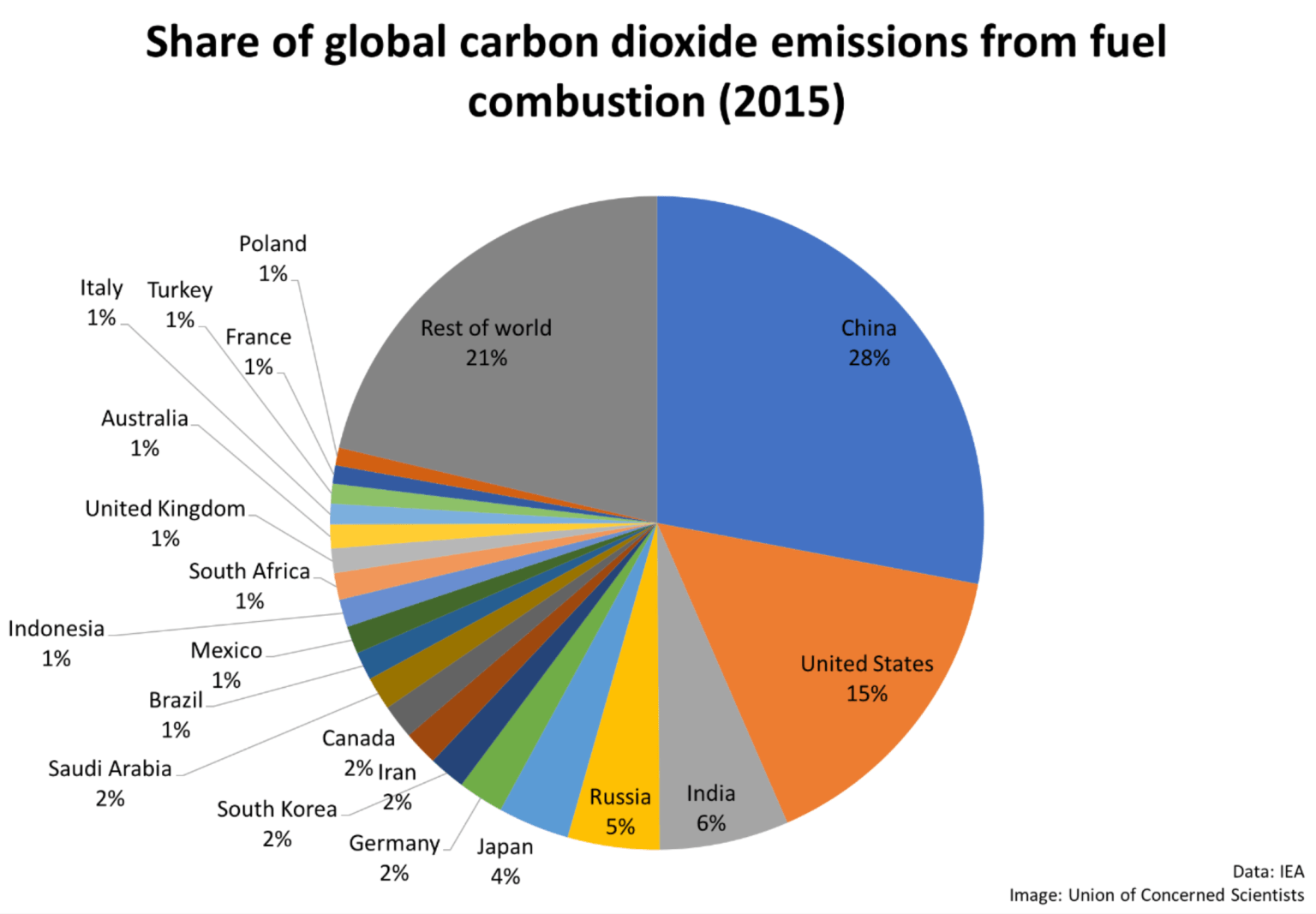

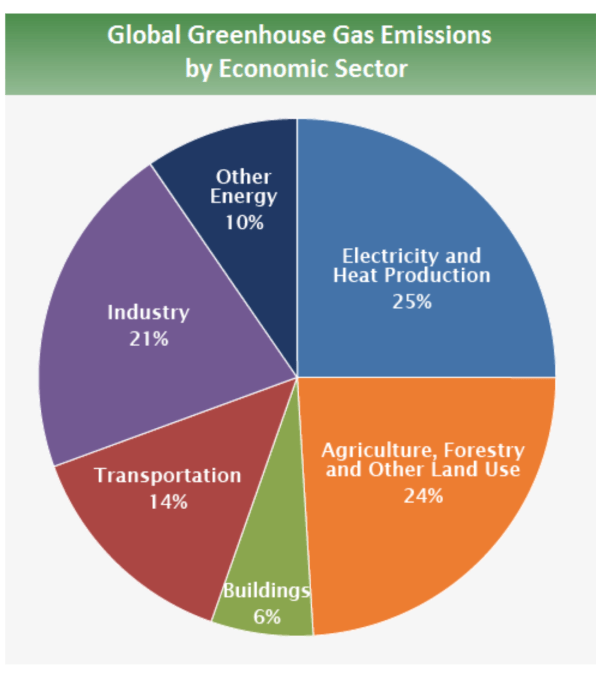

The vast majority of scientists agree that the burning of fossil fuels in parallel with global deforestation has led to an increase in carbon dioxide levels in the earth’s atmosphere. There is overwhelming proof this in turn has has led to the very gradual warming of the Earth since ~1880.

The earth is on course for an average temperature increase of 3–4°C by 2100 unless CO2 emissions are reduced.

The major disagreements come from how the climate will change with slightly rising temperatures and to what extent those changes will take place.

The political Climate Change narrative is being positioned to believe that the world’s current greenhouse gas emissions trajectory will continue to result in dangerous and costly climate change impacts, both societal and economically resulting in:

- Substantial human migration,

- Regional conflicts over increasingly scarce resources, and

- Extreme weather events, causing devastating physical damages and economic costs.

A MINOR PROBLEM – EXTRAPOLATED INTO A MAJOR REACTION – TO BECOME A BIG INVESTMENT OPPORTUNITY!

Does anyone actually trust that politicians around the globe really believe Climate Change is the most pressing problem of the world? It is a great emotional talking point, since fear is the catalyst that always turns the public into a force demanding political action.

I learned in my very first Political Science course as a college freshman that politics is about the redistribution of wealth. That redistribution consensus comes from the will of the people. When the consensus becomes alarmed and fearful, the politicians’ jog is to appease it. Politically what comes first is what are you trying to achieve, then how do you create the public consensus to make it happen?

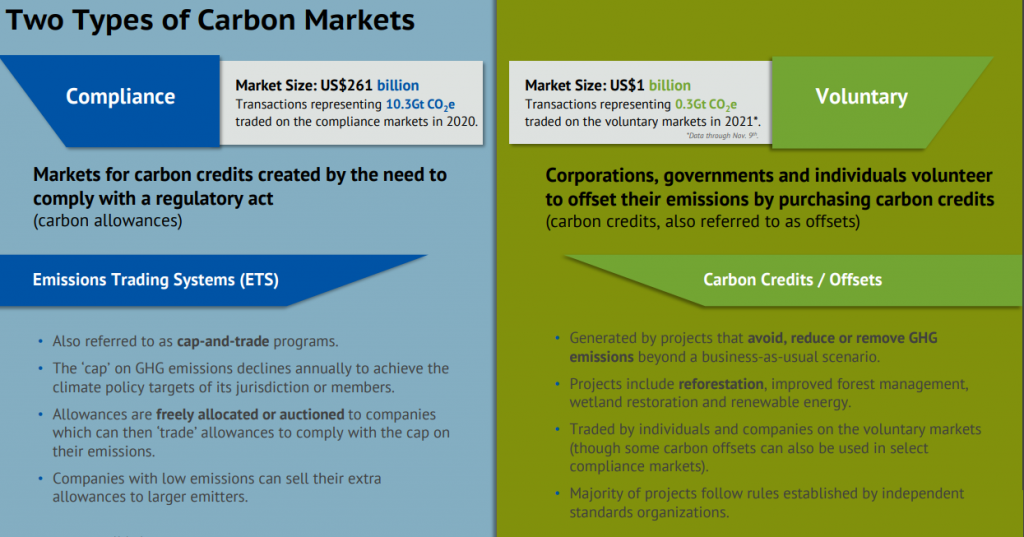

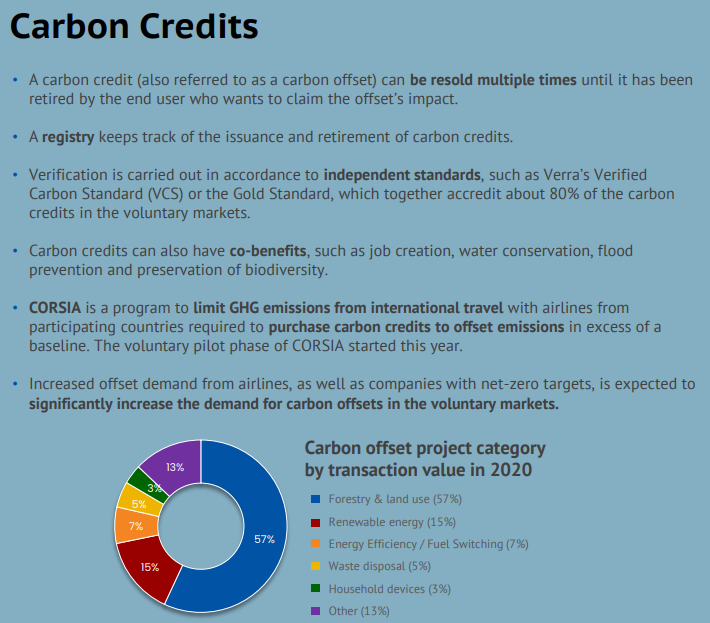

To answer what is trying to be achieved within the political realm you must always follow the money & power.

These are the life blood of the art of politics.

|

CARBON STREAMING

CARBON STREAMING