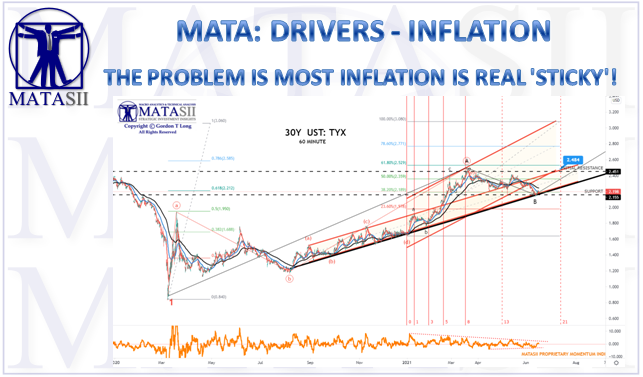

Gordon T Long Global Macro Research | Macro-Technical Analysis MATA DRIVERS: INFLATION THE PROBLEM IS MOST INFLATION IS REAL ‘STICKY’! I have spent years analyzing the nuances of Inflation, Disinflation, Deflation et al. and yet I still learn more with each cycle. In my analysis I have come to trust some data sources more […]

MM Drivers Inflation

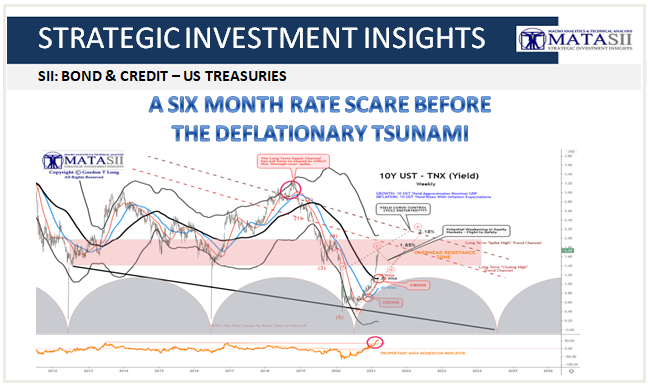

A SIX MONTH RATE SCARE BEFORE THE DEFLATIONARY TSUNAMI

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT IS THIS A RATE SCARE RATHER THAN A ‘TRANSITORY’ INFLATION SCARE? What exactly are we afraid of? It was always a safe bet that there would be an inflation scare at some point early this year. Just the base […]

RISING INFLATION YET RISING REAL RATES????

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES RISING INFLATION YET RISING REAL RATES???? We clearly have mounting inflation pressures yet we are also seeing rising real rates. How exactly does that work?? To understand how this could happen is to understand what lies ahead! First, Real Rates […]

UnderTheLens – 09-23-20 – OCTOBER – Inflation PLUS Deflation?

VIDEO: 16 Minutes with 40 supporting slides SUBSCRIBER CONTENT ONLY SUBSCRIPTION OPTION DETAIL

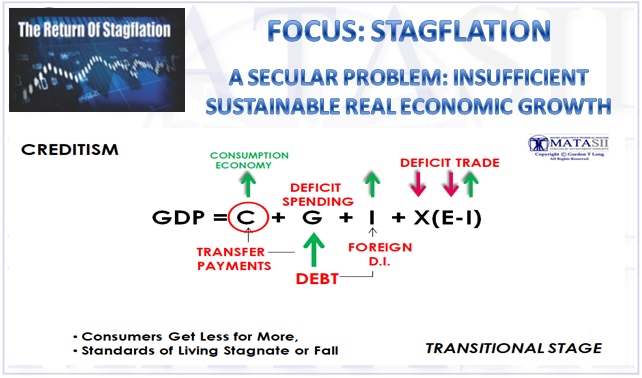

A SECULAR PROBLEM: INSUFFICIENT SUSTAINABLE REAL ECONOMIC GROWTH

Gordon T Long Global Macro Research | Macro-Technical Analysis FOCUS STAGFLATION A SECULAR PROBLEM: INSUFFICIENT SUSTAINABLE REAL ECONOMIC GROWTH ECONOMIC GROWTH WILL FAIL TO FULLY RECOVER TILL 2022 Investors are awakening to the fact that the V-shaped recovery was a fantasy! The markets have priced in the “V” shaped recovery as evidenced by a “V” shaped market […]

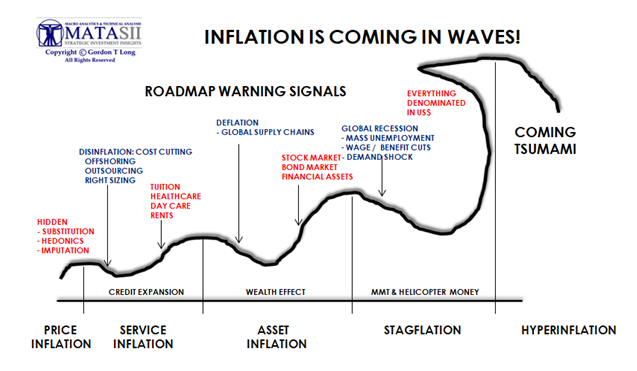

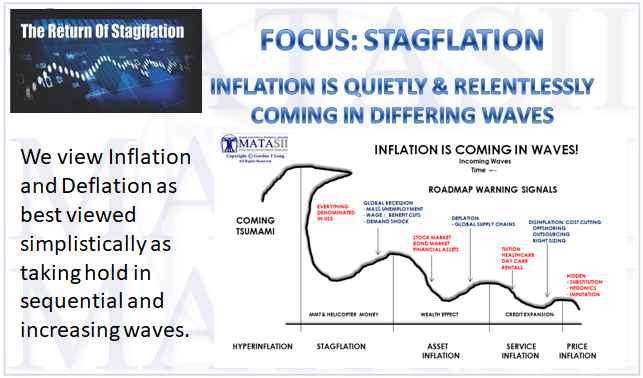

INFLATION IS QUIETLY & RELENTLESSLY COMING IN DIFFERING WAVES

Gordon T Long Global Macro Research | Macro-Technical Analysis FOCUS STAGFLATION INFLATION IS QUIETLY & RELENTLESSLY COMING IN DIFFERING WAVES As we outlined in this month’s LONGWave video we expect Stagflation to be on the economic horizon as a direct result of the forces of: Covid-19, De-Globalization, the Global Recession and De-Dollarization. These events will […]

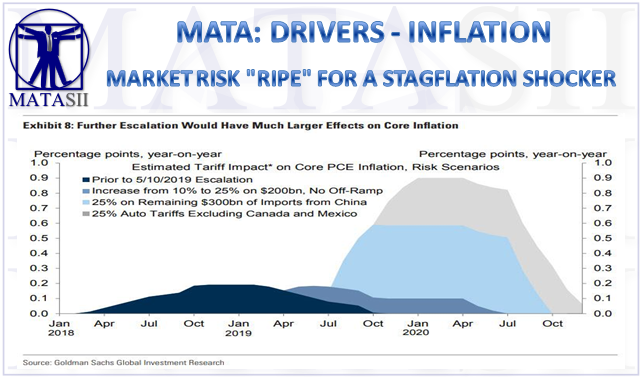

MARKET RISK “RIPE” FOR A STAGFLATION SHOCKER

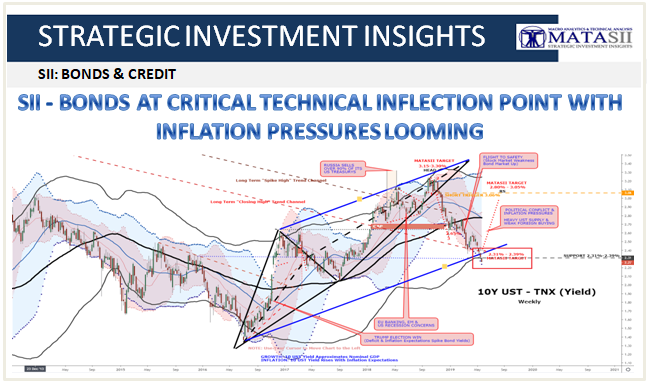

MARKET RISK “RIPE” FOR A STAGFLATION SHOCKER We have been arguing for some time now that the real concern for financial markets is an unexpected “Stagflation Shock”! We most recently outlined this in the following articles: SCHIFF: BOND MARKET RIGHT BUT MAKING WRONG BET TRADE WAR CONSUMER INFLATION DEAD AHEAD! SII – BONDS AT CRITICAL […]

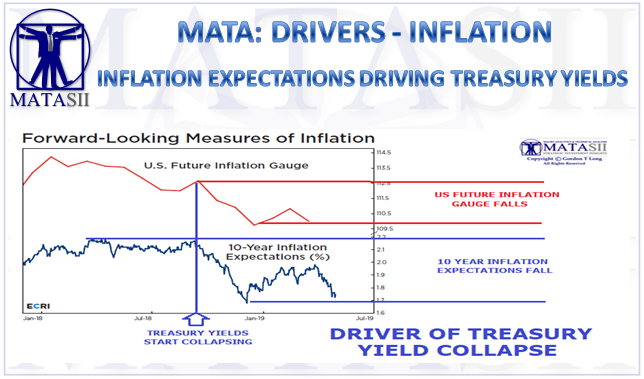

INFLATION EXPECTATIONS CURRENTLY DRIVING TREASURY YIELDS

INFLATION EXPECTATIONS CURRENTLY DRIVING TREASURY YIELDS The first charts shows the US Treasury Yields as represented by the 10Y Yield – “TNX”: Note in the above TNX chart the October Treasury peaked in yield. Now look at the ECRI’s reporting on US Future Inflation Expectations for both the US Future Inflation Gauge and […]

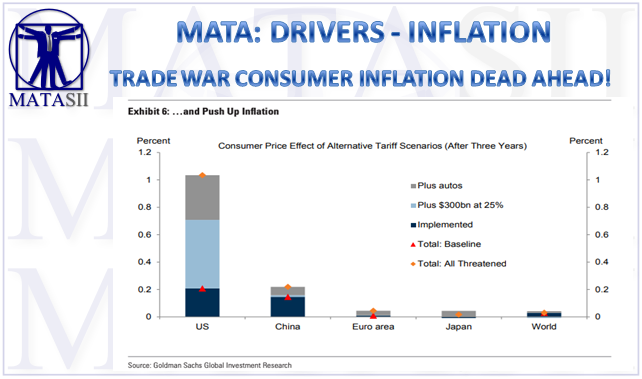

TRADE WAR CONSUMER INFLATION DEAD AHEAD!

TRADE WAR CONSUMER INFLATION DEAD AHEAD! Our expectations now are for a bounce in the US 10Y Note towards a potential right shoulder on a yield basis (SEE: SII – BONDS AT CRITICAL TECHNICAL INFLECTION POINT WITH INFLATION PRESSURES LOOMING). The unexpected reason for this will be inflation pressures, likely associated with: Tariff pressures on […]

SII – BONDS AT CRITICAL TECHNICAL INFLECTION POINT WITH INFLATION PRESSURES LOOMING

SII – BONDS AT CRITICAL TECHNICAL INFLECTION POINT WITH INFLATION PRESSURES LOOMING The Macro Analytics “Secondary” Indicators for the 10Y US Treasury illustrates that with the recent drop in yield we have achieved our target yield which we established last fall. Here is the current 10Y US Treasury for yield as measured by the “TNX”: […]