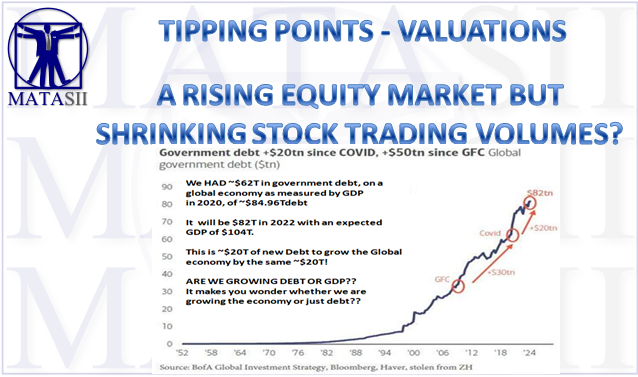

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS FUNDAMENTALS A RISING EQUITY MARKET BUT SHRINKING STOCK TRADING VOLUMES? OBSERVATIONS: THE FED NEEDS TO STOP ELECTION YEAR CHEER LEADING & COACH! The Fed is making yet another big policy mistake similar to assessing AFTER COVID-19 that “inflation was only transitory”! The mistake […]

TP US Stock Market Valuations

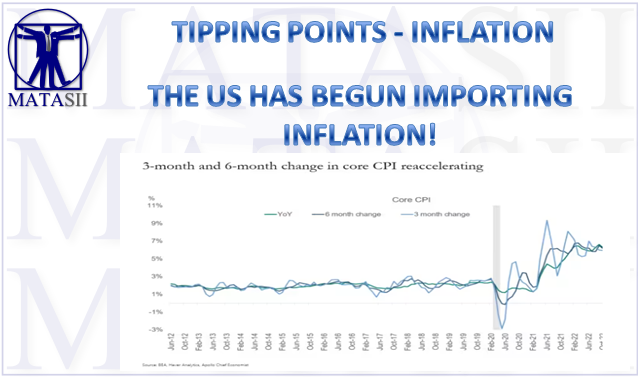

THE US HAS BEGUN IMPORTING INFLATION!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS INFLATION THE US HAS SLOWLY BEGUN IMPORTING INFLATION! OBSERVATIONS: THE REDISTRIBUTION OF WEALTH I remember visually and tentatively walking into the eastern University amphitheater of my first year Political Science class. It was 1968 and though Canada was far away from the Vietnam […]

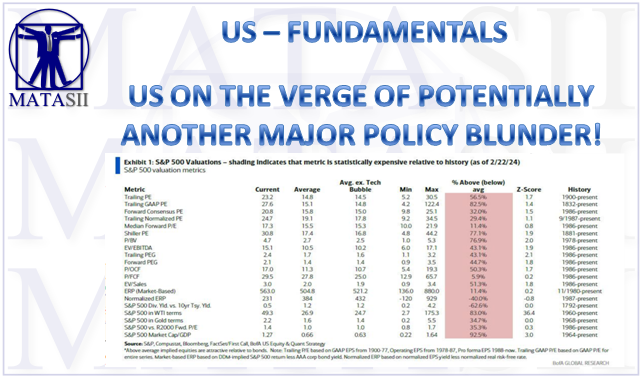

US ON THE VERGE OF POTENTIALLY ANOTHER MAJOR POLICY BLUNDER!

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS FUNDAMENTALS THE US IS ON THE VERGE OF POTENTIALLY ANOTHER MAJOR POLICY BLUNDER! OBSERVATIONS: US Asset Seizure of Russian Funds is Illegal – But Giving them To Another Country Is Financial Suicide! The US’s unprecedented freezing of U.S. dollars owned by a foreign […]

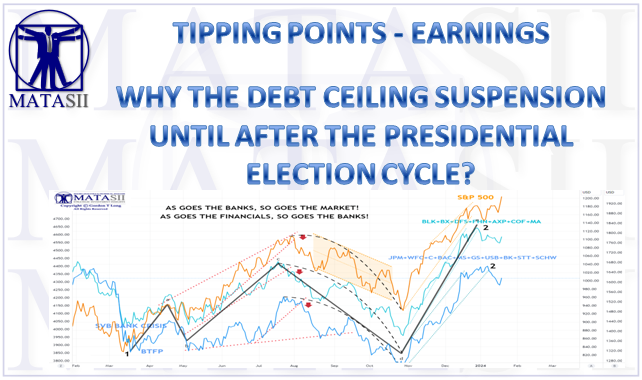

WHY THE DEBT CEILING SUSPENSION UNTIL AFTER THE PRESIDENTIAL ELECTION CYCLE?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS EARNINGS WHY THE DEBT CEILING SUSPENSION UNTIL AFTER THE PRESIDENTIAL ELECTION CYCLE? OBSERVATIONS: THE SUSPENSION OF DEBT CEILING WAS WELL PLANNED! Last June, Biden signed into law the suspension of the debt ceiling until 1 January 2025. Since then, the Federal Government’s debt has […]

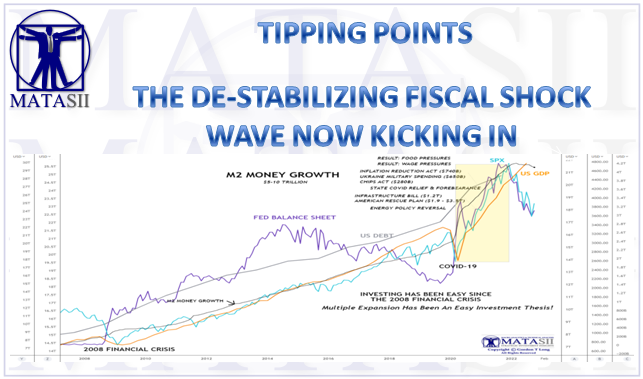

THE DE-STABILIZING FISCAL SHOCK WAVE NOW KICKING IN

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS MARKET RISK THE DE-STABILIZING FISCAL SHOCK WAVE NOW KICKING IN The spending and public policies implemented under the auspices of a Coivd-19 recovery are only now being felt. Rather than achieving their intended purpose, they are resulting in a de-stabilizing shock to the […]

AN ELLIOTT WAVE “DOUBLE COMBO – ZIGZAG” CORRECTIVE

Gordon T Long Global Macro Research | Macro-Technical Analysis MACRO US MONETARY POLICY AN ELLIOTT WAVE “DOUBLE COMBO – ZIGZAG” CORRECTIVE We are seeing strong evidence that we are in a classic Elliott Wave corrective pattern called a “Double Combo” or “ZigZag”. It is a fractal showing itself across multiple asset classes. It is […]

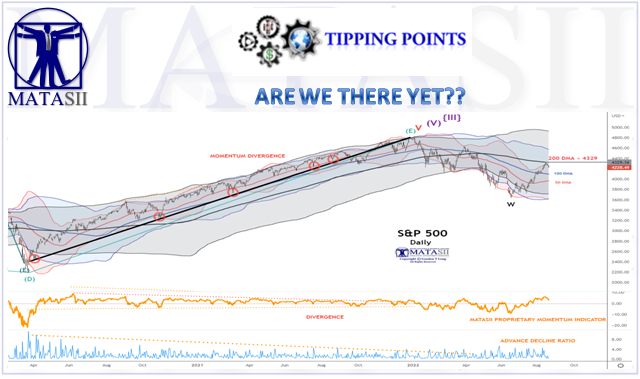

ARE WE THERE YET??

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US STOCK MARKET RISK ARE WE THERE YET?? This newsletter is focused on being a follow-on to our recent August LONGWave video and last week’s newsletter. Friday’s August Options expiration was an important event with technical patterns achieving critical levels. Corporate earnings came […]

A BEAR MARKET COUNTER RALLY OR SOMETHING ELSE?

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS US STOCK MARKET RISK A BEAR MARKET COUNTER RALLY OR SOMETHING ELSE?? The US equity markets have reached a critical signaling juncture of whether we are in a longer term bear market or the bear market is over and we are headed higher […]

KEEP YOUR EYES FIRMLY ON INFLATION PRESSURES

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES KEEP YOUR EYES FIRMLY ON INFLATION PRESSURES GM joined Nissan & Ford this week in suspending production due to semiconductor shortages used in their vehicles. Global factory growth is being stymied by stalling exports and supply constraints. Meanwhile, US Services […]

THE LULL BEFORE THE COMING STORM

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS RISING INTEREST RATES THE LULL BEFORE THE COMING STORM Both the US 5Y/5Y Forwards and 5Y Break-Even (see chart below) have firmed above their psychologically important 2% cut-off, as investors have started to accept a more robust shift towards fiscal stimuli […]