Gordon T Long Global Macro Research | Macro-Technical Analysis SII: COMMODITIES FOOD & AGRICULTURE PHASE III of the COMMODITY SUPER-CYCLE will be a GLOBAL FOOD SHORTAGE In the last Newsletter we discussed our expectations for Phase II of the Commodity Super-Cycle. Today we want to follow on with our expectations for Phase III. Indications […]

SII Commodities

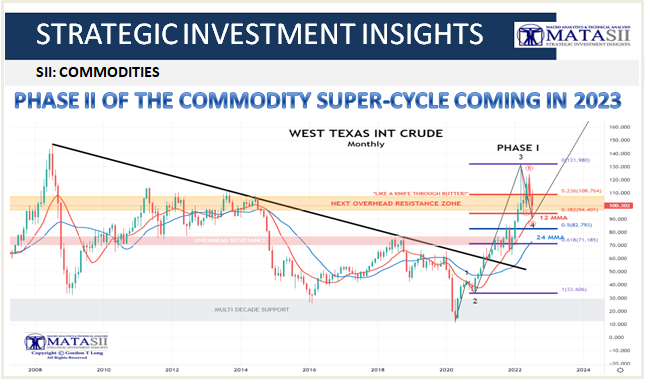

PHASE II OF THE COMMODITY SUPER-CYCLE COMING IN 2023

Gordon T Long Global Macro Research | Macro-Technical Analysis SII: COMMODITIES ENERGY PHASE II OF THE COMMODITY SUPER-CYCLE COMING IN 2023 I spent the 70’s through to 2000 involved in focused on strategy formulation for two of the Fortune 500’s largest corporations. What I came to clearly understand is that “Strategy is something to […]

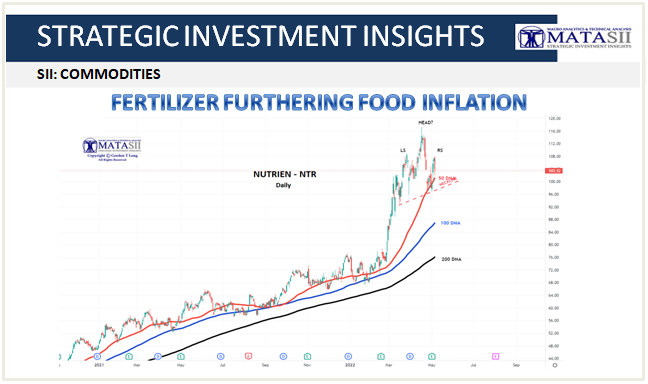

Fertilizer Furthering Food Inflation

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INSIGHTS COMMODITIES FERTILIZER FURTHERING FOOD INFLATION Cost push inflation can often be absorbed within the production distribution process before attempted to be passed on to cash strapped consumers. Food which starts with the farmer is decidedly different because of razor thin margins. Any […]

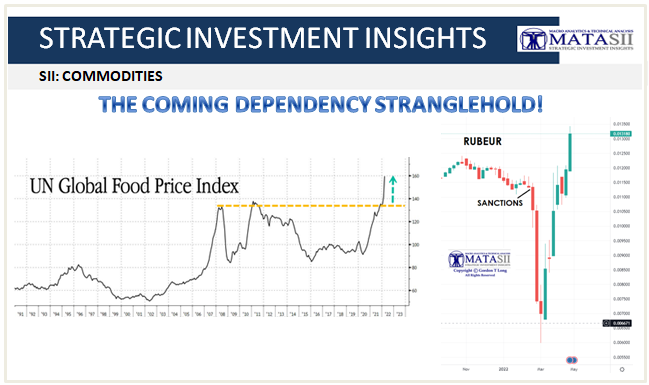

The Coming Dependency Stranglehold

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INSIGHTS COMMODITIES THE COMING DEPENDENCY STRANGLEHOLD In this month’s UnderTheLens video I continued with last month’s Theme of “Putin’s Chessboard”. Since releasing this month’s video, I continue to see increasing proof. In this newsletter I want bring to your attention further evidence […]

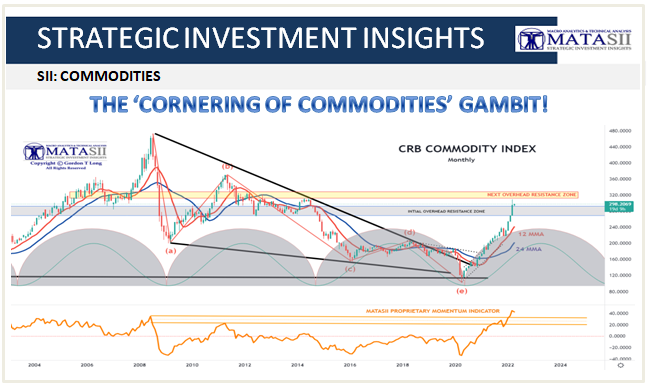

THE ‘CORNERING OF COMMODITIES’ GAMBIT

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INSIGHTS COMMODITIES THE ‘CORNERING OF COMMODITIES’ GAMBIT As John Connally Jr., President Richard Nixon’s Treasury secretary, put it in 1971 to his astonished G-10 counterparts: “The Dollar is our Currency, but your problem!” It was reflective of the international economic turmoil at the time which ushered in […]

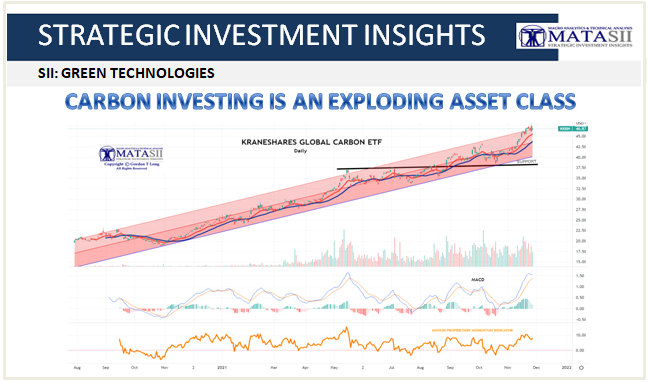

CARBON INVESTING IS AN EXPLODING ASSET CLASS

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INSIGHTS CARBON CREDITS & OFFSETS CARBON INVESTING IS AN EXPLODING ASSET CLASS NEVER MIX POLITICIANS WITH SCIENTISTS! The data is pretty clear that atmospheric carbon dioxide levels and global temperatures have been increasing for the last several decades, starting when fossil fuels […]

WHAT DO REAL YIELDS TELL US ABOUT YELLOW & BLACK GOLD?

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES COMMODITIES – HARD ASSETS WHAT DO REAL YIELDS TELL US ABOUT YELLOW & BLACK GOLD? Today, official Inflation Breakeven is the forecast that is derived from the difference between the yields on inflation-linked and fixed bonds of a given maturity or as […]

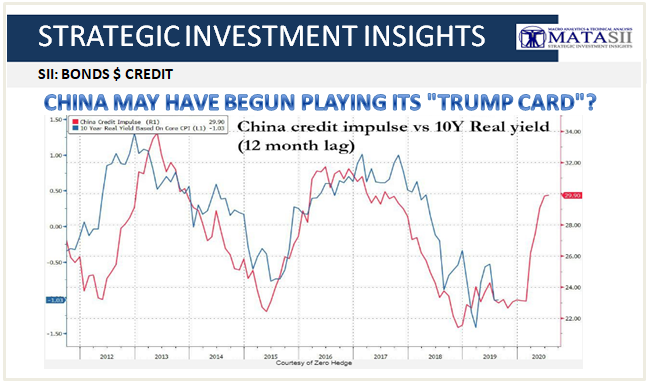

CHINA MAY HAVE BEGUN PLAYING ITS “TRUMP CARD”?

Gordon T Long Global Macro Research | Macro-Technical Analysis SII COMMODITIES – BONDS & CREDIT CHINA MAY HAVE BEGUN PLAYING ITS “TRUMP CARD”? What most are forgetting is that when it comes to any global reflationary spark, China – and its $40 trillion financial system which is double that of the US – has been […]

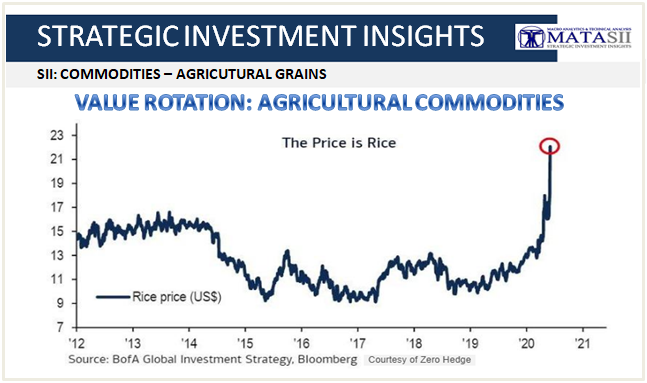

VALUE ROTATION: AGRICULTURAL COMMODITIES

Gordon T Long Global Macro Research | Macro-Technical Analysis SII COMMODITIES – AGRICULTURAL GRAINS VALUE ROTATION: AGRICULTURAL COMMODITIES In this month’s LONGWave we identify Commodities as one of many expected areas for the coming secular sector rotation to impact. We didn’t have time to further expand on the ‘why’ and ‘where’ in the video. As […]

OROCOBRE: GAINS AT 29.8% BUT TESTING CRITICAL SUPPORT

OROCOBRE: GAINS AT 29.8% BUT TESTING CRITICAL SUPPORT ORL CHART AS OF CLOSE 12-07-18 Business Summary (Yahoo Finance)) Orocobre Limited explores for and develops lithium and potash deposits in Argentina. Its flagship project is the Salar de Olaroz lithium project located in north-west province of Jujuy. The company also produces boron minerals and refined chemicals. Orocobre Limited […]