CENTRAL BANK GOLD BUYING SPREE REACHES 50 YEAR HIGH

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: DRIVERS - PRECIOUS METALS

SOURCE: 01-31-19 - "Commodities attempting breakout off 7-year support!"

MATASII SYNTHESIS:

FED FOMC REACTION

- If the Fed’s rate-hike cycle really has come to an end for now, the sooner-than-expected dollar weakness may help gold to “rise more quickly and more sharply,”

- The Fed have never, ever “paused” a full hiking cycle. The always end up cutting. Each cutting cycle has led to a recession except mid 1990’s and 1987. Odds are in favour of the Fed having gone too far already and the stock market figuring it out in due course

CENTRAL BANK ACTIVITY

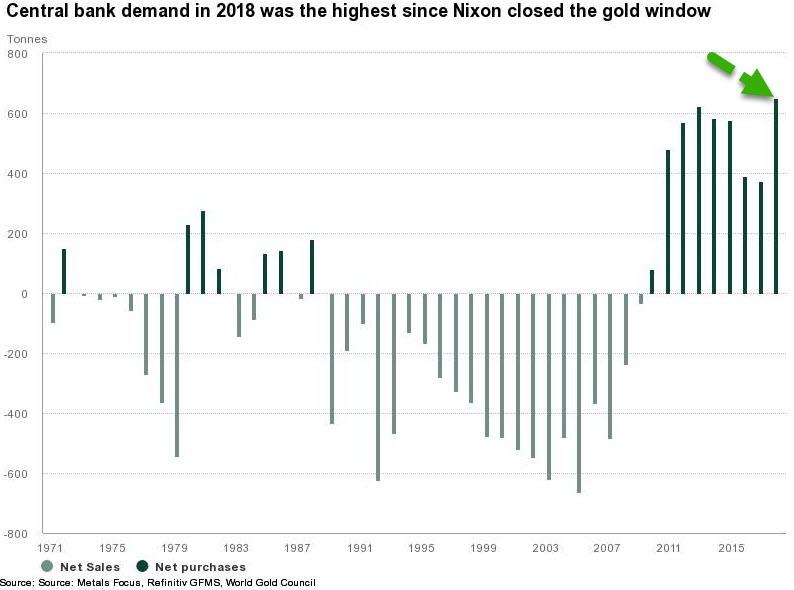

- Central banks bought last year the most gold in 47 years, with 651.5 tonnes (74% higher YoY).

- This is the highest level of annual net purchases since the suspension of dollar convertibility into gold in 1971,

- The 2018 gold buying spree by central banks isn't just the biggest in 47 years, but also the second highest annual total on record (only surpassed by 1967, when central bank gold reserves increased by 1,404 tonnes).

- Russia, Kazakhstan and Turkey again accounted for a large portion of demand in 2018.

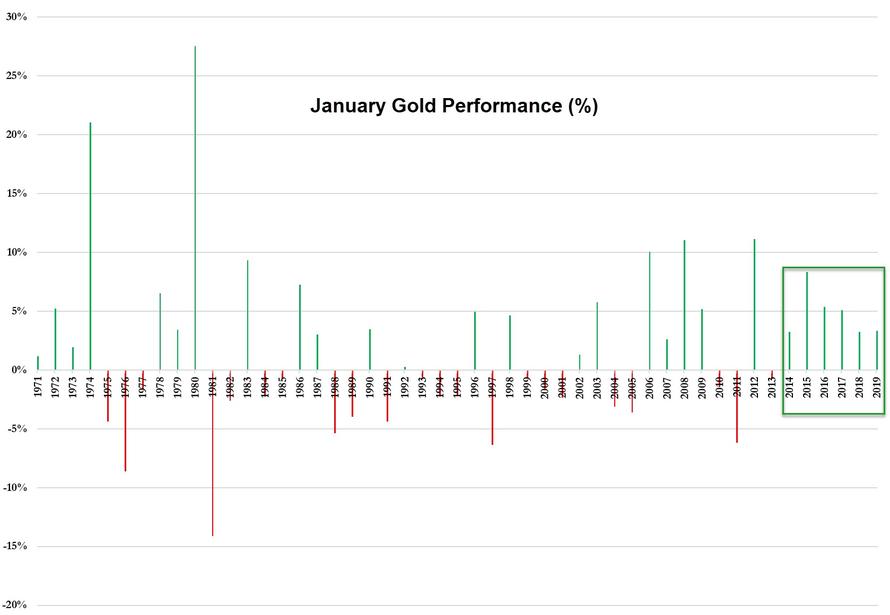

- Gold is poised to close out January with a fourth straight monthly gain,

Gold is poised to close out January with a fourth straight monthly gain after the Fed's uber-dovish flip-flop seemed to signal that it’s done raising interest rates (reportedly for a while but that's never happened before)...

Which has hurt the dollar, helping gold to its sixth January gains in a row as investors sought a haven against slowing growth and U.S.-China trade disputes.

While short interest in GLD (Gold ETF) has soared along with price...

Bloomberg survey results show a decidedly positive bias on the precious metal (Bullish: 13 Bearish: 2 Neutral: 2)

If the Fed’s rate-hike cycle really has come to an end for now, the sooner-than-expected dollar weakness may help gold to “rise more quickly and more sharply,” Commerzbank said in a note.

“Both the tone and language of the Fed statement and presser appeared more accommodative versus consensus expectations,” Citigroup Inc. analysts including Aakash Doshi wrote in a note. “To take advantage of an ongoing gold market rally, investors might consider positioning for upside.”

“Gold is benefiting from a lower dollar in general, as well as safe-haven buyers hedging against the outcome of the U.S.-China trade talks,” Jeffrey Halley, senior market analyst at Oanda Corp. in Singapore, said in a note.

Still, there’s no guarantee gold will keep appreciating at the same pace.

Ole Hansen, head of commodity strategy at Saxo Bank, said by email. While the bank maintains a bullish view on gold, “some caution may now be warranted,” he said.

“With stocks rallying and emerging market assets receiving a boost, the buy-gold story has faded, at least for now,” Hansen said.

And as BCS Global Markets said in a note, the big range in analysts’ outlook for gold this year shows “that there is actually no consensus."

However, there is one group of global 'investors' who are waving in those bullion trucks with both hands and feet - The world's central banks...

Central banks bought last year the most gold in 47 years, with 651.5 tonnes (74% higher YoY). This is the highest level of annual net purchases since the suspension of dollar convertibility into gold in 1971...

Additionally, Bloomberg's Javier Blas notes that the 2018 gold buying spree by central banks isn't just the biggest in 47 years, but also the second highest annual total on record (only surpassed by 1967, when central bank gold reserves increased by 1,404 tonnes).

"Heightened geopolitical and economic uncertainty throughout the year increasingly drove central banks to diversify their reserves and re-focus their attention on the principal objective of investing in safe and liquid assets," said the World Gold Council report released on Thursday.

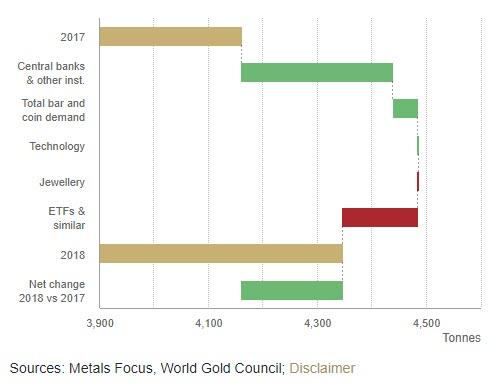

Strong central bank and consumer demand offset ETF outflows...

More central banks look to gold.

Russia, Kazakhstan and Turkey again accounted for a large portion of demand in 2018. But their share fell to 58 % – from 94 % in 2017 – as other central banks chose to significantly increase their gold reserves, reinforcing the importance of gold as a reserve asset.

Notably, European central banks also bought gold last year. Hungary made one of the largest purchases, increasing its gold reserves ten-fold in October, to 31.5t. This is the highest level for nearly 30 years. The central bank cited gold’s role as a hedge against future structural changes in the international financial system, as well as its lack of counterparty or credit risk, as reasons for the purchase. Similarly, Poland was another European central bank which bought last year. Gold reserves rose by 25.7t during 2018, +25% y-o-y.

Indian net purchases were another notable component of central bank demand in 2018. Monthly purchases began in March and picked up in the second half of the year. In total, gold reserves rose by 40.5t, the highest annual growth since the purchase of 200t from the International Monetary Fund In 2009.5 In its Annual Report 2017-2018 the bank stated: “Diversification of India’s Foreign Currency Assets (FCA) continued during the year with attention being ascribed to risk management, including cyber security risk. The gold portfolio has also been activated.”

Mongolia announced that it had bought 22t of gold in 2018, in line with its stated target. This represented a 10% increase on 2017 purchases. One of the drivers of this growth was a five-month “National Gold to the Fund of Treasures” campaign, which encouraged miners and individuals to sell their gold to the central bank.6

In September, the Central Bank of Iraq stated that it had taken advantage of lower gold prices to buy 6.5t. This was the first annual increase since 2014 and took total gold reserves to 96.3t, accounting for 6.7% of total reserves.

The State Oil Fund of Azerbaijan (SOFAZ) also re-entered the market last year. Gold reserves grew by 14.3t by the end Q3, an increase of nearly 50% from end-2017.7 Having been on the side-lines of the gold market since the end of 2013, this marked a change in policy for the fund. In December 2018, President Ilham Aliyev approved updated investment guidelines that would allow SOFAZ to invest up to 10% of its portfolio in gold. Currently, gold accounts for 4.3% of SOFAZ’s portfolio.

So, what do the central banks know that mom-and-pop FAANG-buyer don't?