CHINA CURRENTLY DRIVING US TREASURY YIELDS HIGHER

...the story is the cyclical upturn in China something commodities were foreshadowing. The slew of better data out of China is turning yields back higher along with it.

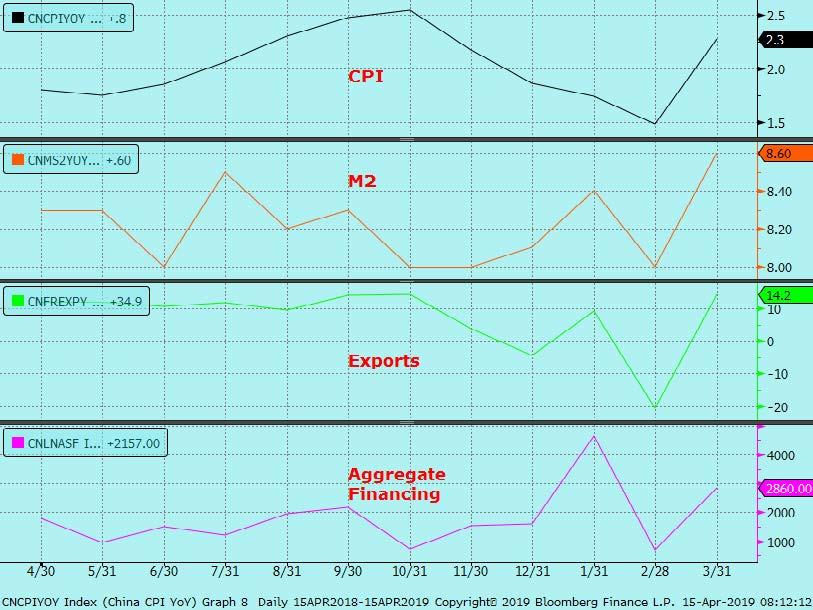

China CPI, M2, Exports, and Aggregate Financing all turning higher off the lows

- The bounce in the data has been led by the myriad of stimulus measures and the credit impulse.

China Credit Impulse 12 Month Change

- Thus, Chinese yields, which led US yields on the way down, is now leading US yields higher…

Chinese 10yr yields (blue) vs. US 10yr yields (black)…

- It still seems that US yields are too low for a number of reasons that would mean a tactical sell off can continue.

As a reflation type signal, the old Copper/Gold ratio continues to signal that rates should continue to rebound.

Copper/Gold ratio (black) vs. US 10yr yields (blue)….

- Despite the Chinese data turning higher, the US fixed income market still believes there will be cuts in the US in 2019.

April 2019/January 2020 Fed Fund spread implies 13bps of cuts in 2019…

The tactical sell off can continue until Fed cuts get priced out especially in the face of better Chinese growth that will feed into the rest of the world, at the same time short positioning is nil, and the Fed is neutral.

2019 rate cut/rate hike odds should be roughly equal and that means further tactical US fixed income weakness.

- Peaking oil is obviously important with regards to yields as it feeds through to inflation expectations and thus nominal yields. Therefore, if the upside in oil is now limited, so is the upside in yields.

- The second reason why yields are ultimately capped is although China has stimulated and there has been a credit impulse, it was noted in Bloomberg Monday that the PBOC will not “flood the economy with excessive liquidity.” That can be most clearly seen in the PBOC’s Open Market Operations (OMO’s) where they have skipped OMO’s for 18 consecutive sessions (until a modest injection on Tuesday). Thus from a net injection point of view, the PBOC has withdrawn liquidity – meaning letting things like reverse repo’s, MLF’s, etc. just expire.

So why not a 2.73% 10yr which happens concurrently with rate cuts being priced out that will keep yields in the new range?

There are certainly a confluence of reasons why yields can get up to that region in the near term until the larger structural forces ultimately cap them.

[SITE INDEX -- SII - BONDS & CREDIT]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - BONDS & CREDIT

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

ABSTRACTED FROM: 04-16-19 - Mark Orsley, Head of Macro Strategy at PrismFP - "How China Is Driving US Interest Rates"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.