COMPLACENCY IS ONCE AGAIN A MAJOR RISK

MATASII RESEARCH ANALYSIS & SYNTHESIS:

Investors fear volatility.

- Low levels of implied volatility are the result of investors that are complacent and not protecting against risks.

- Conversely, when volatility is higher, investors tend to be anxious, concerned about the future and as such take prudent actions to hedge and protect their assets.

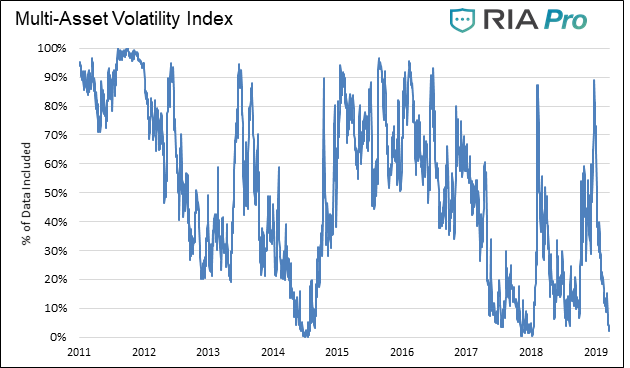

AGGREGATED ASSET CLASS RISK

The graph below is constructed by normalizing VIX (equity volatility), MOVE (bond volatility) and CVIX (US dollar volatility) and then aggregating the results into an equal-weighted index.

- The y-axis denotes the percentage of time that the same or lower levels of aggregated volatility occurred since 2010.

- The current level is 1.91%, meaning that only 1.91% of readings registered at a lower level.

Beyond the very low level of volatility across the three major asset classes, there are two other takeaways worth pondering.

First, the violent nature in which volatility has surged and collapsed twice since 2018. The slope of the recent advances and declines are much steeper than those that occurred before 2018. The peak -to- trough -to- peak cycle over the last year was measured in months not years as was the case before 2018.

Second, when the index reached current low levels in the past, a surge in volatility occurred soon after that. This does not mean the index will bounce higher immediately, but it does mean we should expect a much higher level of volatility over the next few months.

[SITE INDEX -- MATA: SENTIMENT]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: SENTIMENT

SOURCE: 03-27-19 - Authored by Michael Lebowitz via RealInvestmentAdvice.com - "Nothing To Fear But Complacency Itself..."

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.