THE GAUNTLET AHEAD

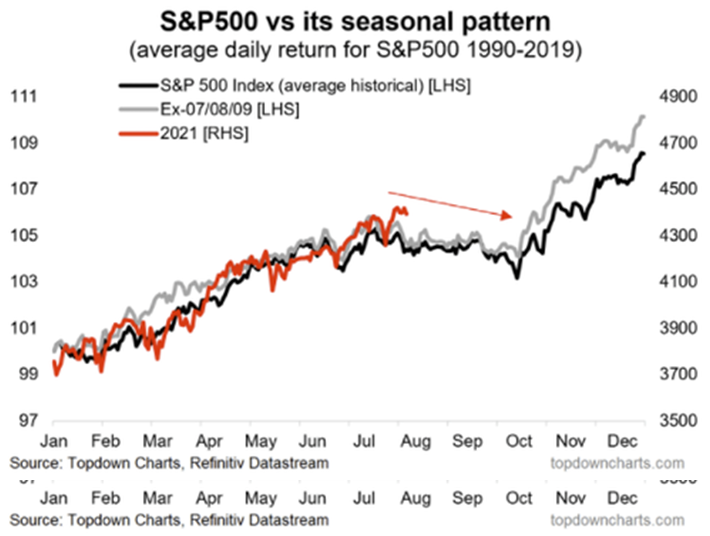

As we laid out in this month’s LONGWave video, August through October has historically been a weak period for the S&P 500. The 2021 market movement since January additionally mirrors the historical period of strength (Chart: Right Top). There is obviously no certainty that this pattern will be repeated, but the probabilities increase when distortions in fundamentals, risk and sentiment, which the current market is experiencing, are significantly above trend.

This window features a number of events that historically have been problematic for equity markets if the market is particularly fragile. Anyone of them has triggered abrupt market responses in the past. They are a tough gauntlet to run through if underlying market support is not strong. We believe this is the case, this time around!

This gauntlet kicks off during the height of the summer holiday period with the August Options expiration and historically low trading volumes.

The August Jackson Hole Economic and Monetary Summit is watched closely as it often signals subtle shifts in Federal Reserve policy thinking.

The September and October events are built around the realities of whether market analysts’ proverbial year end “hockey stick” forecasts will be met or not and how much they need to be brought down to match the realities of year-end financial statements.

Additionally, analysts and brokerages begin going on record with their calls for the following year. It is tough for distorted markets to get through this window unscathed. Problems with market fundamentals, risk and sentiment must be rationalized as sustainable or not with supporting analytics from market pundits who now place their reputations on the line.