CORPORATE DEBT IS REACHING RECORD LEVELS

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: STUDIES - CORPORATE DEBT & "ZOMBIFICATION"

SOURCE: 12-29-18 - WSJ - "Corporate Debt Is Reaching Record Levels"

YOUR MATASII RESEARCH TAKEAWAYS:

CORPORATE DEBT GROWTH

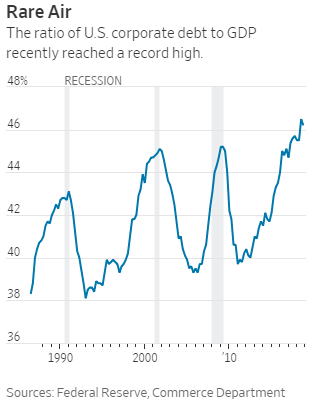

- U.S. corporate debt has climbed to roughly 46% of gross domestic product, the highest on record,

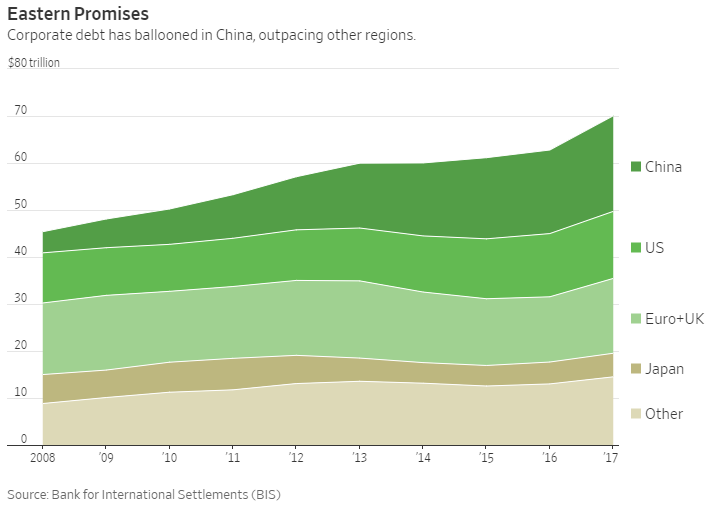

- Businesses in emerging markets, such as China, have gone on an even bigger borrowing binge, taking advantage of ultra-low interest rates and, in some cases, state-driven policies designed to propel economies forward,

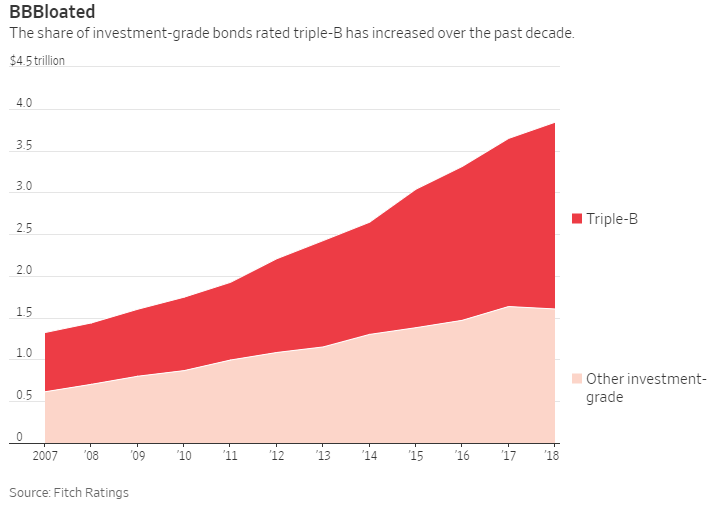

- Ratings firms have often allowed larger companies to load up on debt to fund acquisitions without taking away their investment-grade ratings.

- This has contributed to a large expansion in the amount of corporate bonds rated in the bottom tier of the investment-grade spectrum, a trend some analysts worry could be giving investors a false sense of security about the safety of their holdings,

NON BANK "DIRECT" LENDING (UNREGULATED SHADOW BANKING)

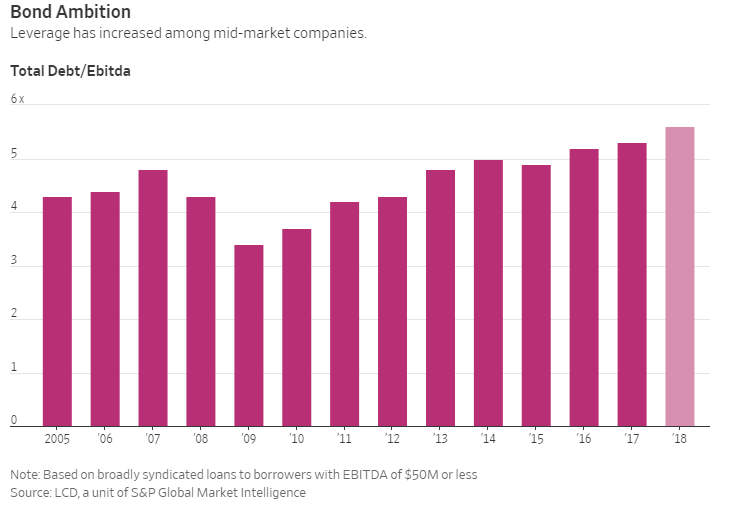

- Among midsize businesses, there is has been an uptick in so-called "Direct Lending" in which business obtain loans from non-banks,

- Many of the Non-Banks are Private-Equity firms, with traditional banks playing little part in the process,

- Non-banks held more than half a trillion dollars worth of loans to midsize companies at the end of 2017, up from roughly $300 billion in 2012,

- Some banks that have long relied on commercial lending have concerns about the growing role of non-bank lenders. Some have warned that their experience will be missed in the next downturn when businesses will be more at the mercy of “distant credit investors,”

Highly leveraged companies could pose a threat to the global economy if rates rise or profits slump

In the aftermath of the financial crisis, a swath of individuals and families began a long and painful deleveraging process.

Businesses, meanwhile, quickly moved in the opposite direction—loading up on cheap debt to the point where many observers now worry that highly leveraged companies pose a threat to the global economy.

In the U.S., leverage levels have climbed for both larger and smaller businesses. With the economy apparently on solid footing, ratings firms have often allowed larger companies, such as CVS Health Corp. and Campbell Soup Co. , to load up on debt to fund acquisitions without taking away their investment-grade ratings. That has contributed to a large expansion in the amount of corporate bonds rated in the bottom tier of the investment-grade spectrum, a trend some analysts worry could be giving investors a false sense of security about the safety of their holdings.

Among midsize businesses, there is has been an uptick in so-called direct lending in which business obtain loans from non-banks, many of them private-equity firms, with traditional banks playing little part in the process. Non-banks held more than half a trillion dollars worth of loans to midsize companies at the end of 2017, up from roughly $300 billion in 2012, according to estimates by private-equity firm Ares Management LP.

Not surprisingly, some banks that have long relied on commercial lending have concerns about the growing role of non-bank lenders. Some have warned that their experience will be missed in the next downturn when businesses will be more at the mercy of “distant credit investors,” as the chief executive of Buffalo, N.Y.-based M&T Bank Corp. , René Jones, recently wrote in a letter to shareholders.

Whether or not the banks have a case, it is certainly true that high corporate debt levels pose risks to investors, as well as businesses. Making the threat more severe, most recently issued bonds and loans to even the lowest-rated businesses carry minimal protections for investors, known as covenants.

While that could help businesses forestall bankruptcy in the short term by giving them greater leverage over investors, it also could cause their debt to be worth less in the long run, as businesses find it easier to do things like strip assets from lenders.