CORPORATE FUNDAMENTALS DISCONNECTED WITH 'BAKED-IN" FUTURE REALITY

MATASII RESEARCH ANALYSIS & SYNTHESIS:

The problem with current Corporate Fundamentals is:

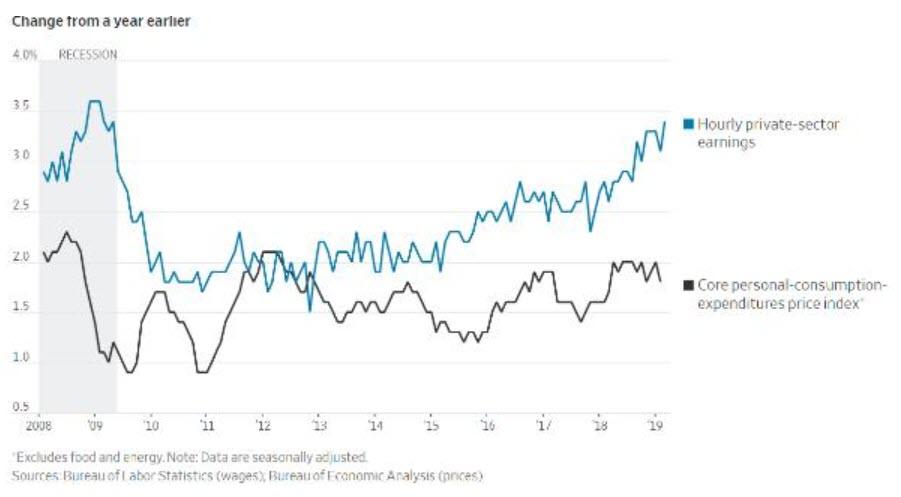

1- RISING LABOR COSTS & LOST PRICING POWER

- A big part of the past decade’s spike in corporate profits came at the expense of workers, who saw real wages stagnate while the cost of living rose. Now, with labor markets tightening and minimum wages rising, workers are getting a bigger slice of their employers’ revenues.

- That means shrinking corporate margins and, other things being equal, slower to negative earnings growth.

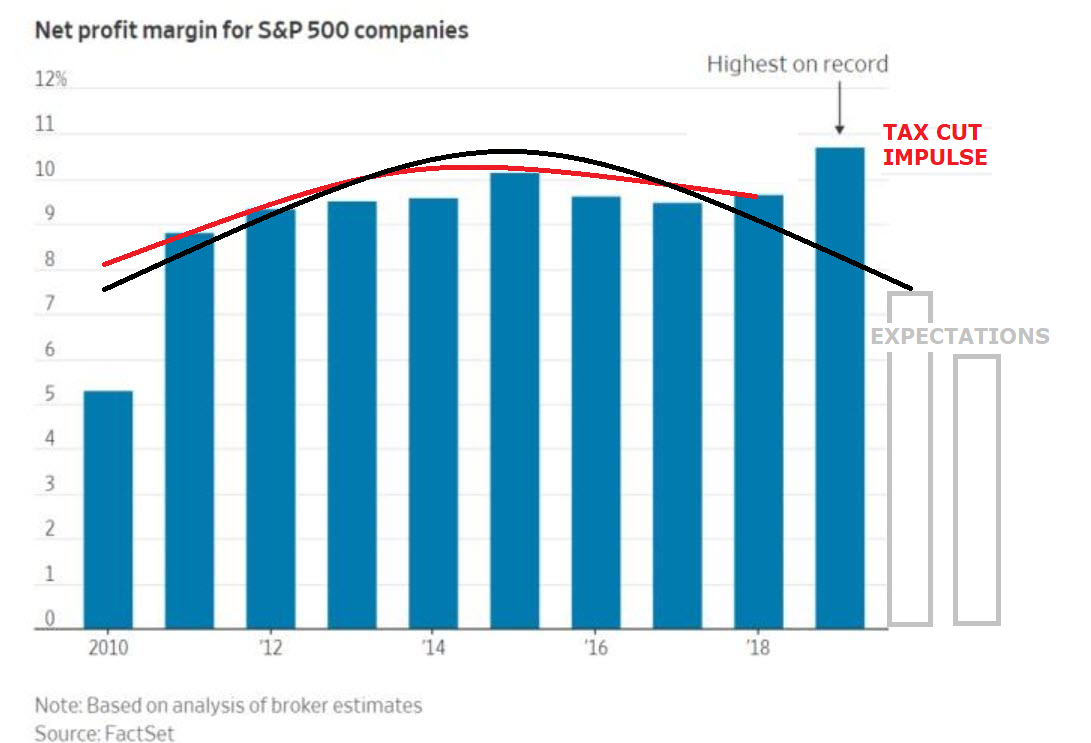

2-SUGAR HIGH OF TAX CUTS IS OVER FOR ALREADY ELEVATED PROFIT MARGINS

- Corporate profit margins stopped widening in 2015 as wage inflation began to bite.

- Then they spiked in 2018 when the Trump corporate tax cuts provided a one-time windfall. But that windfall is over and future comparisons will be with last year’s unbeatable earnings.

- Public companies are going to report lower year-over-year profits going forward.

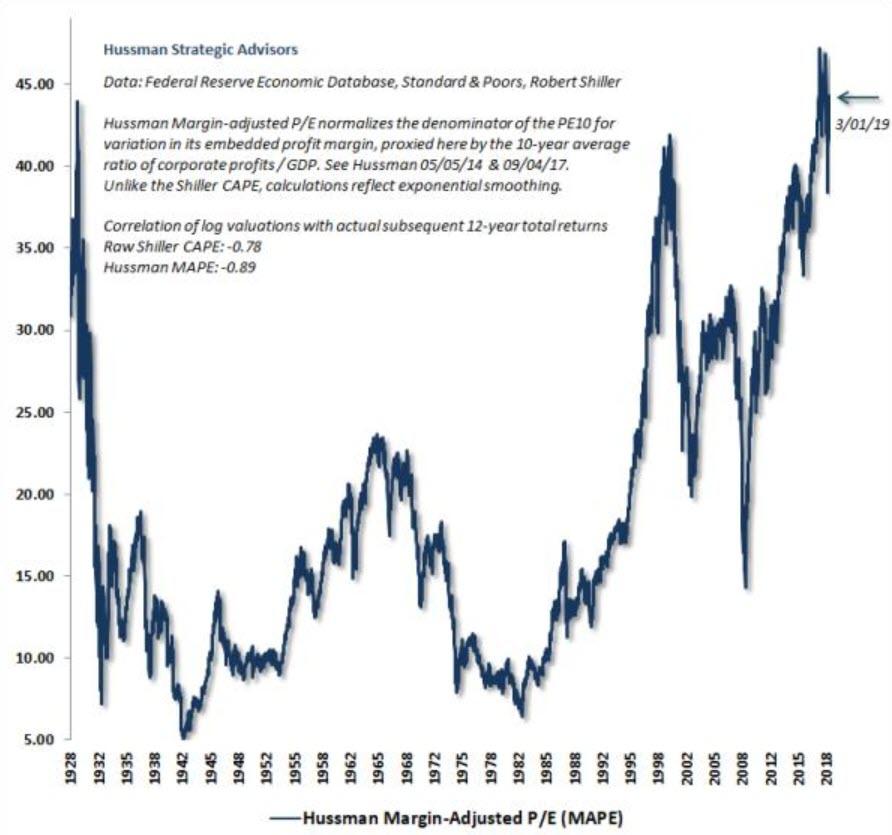

3-STOCKS CURRENTLY OVER-VALUED TO THE EXTREME

- Stocks are now a lot more expensive both nominally and compared to earnings than they were in 2015, which means the air pockets under them are much bigger.

- They’re priced for perfection, and falling earnings per share is the definition of imperfect for the stock market.

[SITE INDEX -- MATA: FUNDAMENTALS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: FUNDAMENTALS

SOURCE: 04-04-19 - Authored by John Rubino via DollarCollapse.com - "The End Of The Bull Market, In Three Charts"

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.