CREDIT FUELED CONSUMPTION SUSTAINING 'AMERICA DREAM' (OR BASIC SURVIVAL FOR MOST!)

In 1980, household credit market debt stood at $1.3 Trillion. To move consumption, as a percent of the economy, from 61% to 67% by the year 2000 it required an increase of $5.6 Trillion in debt.

Since 2000, consumption as a percent of the economy has risen by just 2% over the last 17 years, however, that increase required more than a $6 Trillion in debt.

The importance of that statement should not be dismissed. It has required more debt to increase consumption by 2% of the economy since 2000 than it did to increase it by 6% from 1980-2000.

The problem is quite clear. With interest rates already at historic lows, consumers already heavily leveraged and economic growth running at sub-par rates – there is not likely a capability to increase consumption as a percent of the economy to levels that would replicate the economic growth rates of the past.“

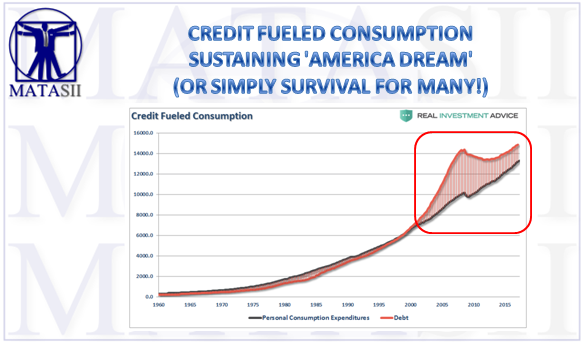

This can be clearly seen in the following chart of personal consumption expenditures (PCE) and debt. Up until 2000, debt expansion and PCE rose in tandem. But beginning in 2000, as economic growth rates plunged to 2%ish, which isn’t strong enough to foster job growth beyond population growth, debt took the lead in supporting consumption. This was primarily centered on those in the bottom 80% who were simply trying to maintain their current standard of living.