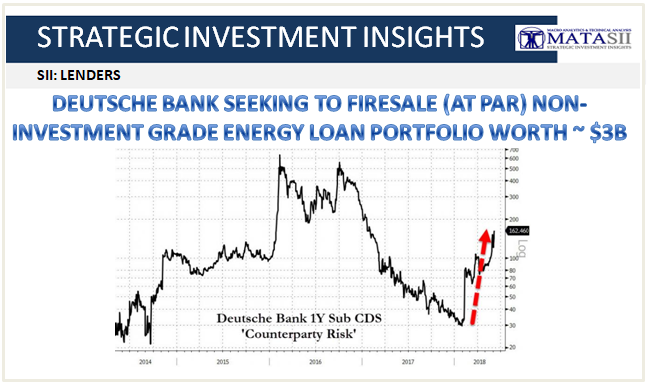

DEUTSCHE BANK SEEKING TO SELL NON-INVESTMENT GRADE ENERGY LOAN PORTFOLIO WORTH ~ $3B

-- EXCERPTED from: 06-07-18 ZeroHedge - "Does Deutsche Bank's Junk Bond Firesale Mean The Party Is Over? "--

Bloomberg reports Deutsche Bank is seeking to sell its portfolio of non-investment grade energy loans, worth about $3 billion, according to people with knowledge of the matter.

The potential firesale comes as Deutsche's short-dated CDS (counterparty risk) is soaring..

And comes as European HY Energy debt is weakening notably and US HY Energy is as good as it gets...

Bloomberg reports that Deutsche is planning to sell the loan book as a whole and has marketed it to North American and European peers, said one of the people. The portfolio is expected to sell for par value, said the people, who asked not to be identified because they weren’t authorized to speak publicly; good luck with that!

The bank’s energy business is expected to wrap up on June 30, one of the people said. The bank has been an active lender in the energy space in the past year, participating in the financing of companies including Peabody Energy Corp. and Coronado Australian Holdings Pty., according to data compiled by Bloomberg.

So to summarize: Moody's is warning that when the economy weakens we will see an avalanche of defaults like we haven't seen before; Corporate debt-to-GDP and investor risk appetite is reminding a lot of veterans of previous credit peaks; and now the most desperate bank in the world is offering its whole junk energy debt book in a firesale... just as high yield issuance starts to slump.

All of which raises more than a single hair on the back of our previous lives in credit necks... and reminds us of this...

Thank you all for coming in a little early this morning. I know yesterday was pretty bad and I wish I could say that today is gonna be less so, but that isn't gonna be the case. Now I'm supposed to read this statement to you all here, but why don't you just read it on your own time and I'll just tell you what the fuck is going on here. I've been here all night... meeting with the Executive Committee. And the decision has been made to unwind a considerable position of the firm's holdings in several key asset classes. The crux of it is... in the firms thinking, the party's over as of this morning.

"For those of you who've never been through this before, this is what the beginning of a fire sale looks like." - Sam Rogers, Margin Call

There's gonna be considerable turmoil in the Markets for the foreseeable future. And *they* believe it is better that this turmoil begin with us.