Dividends Send A Warning

EXTRACTED FROM: SOURCE: 3 Things: Price-To-Book, Dividends, 2100 Written by Lance Roberts Jul, 7, 2016

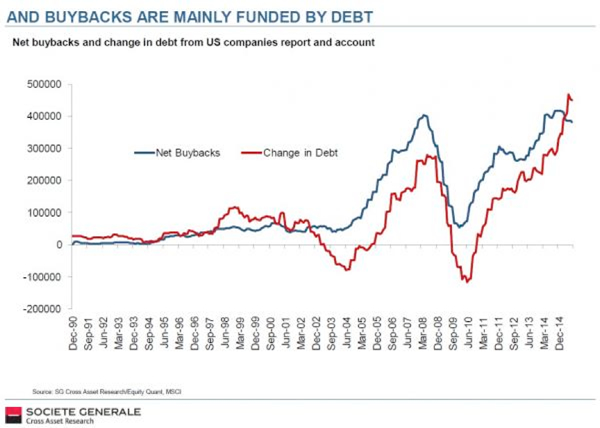

I recently discussed the issue of rising corporate debt levels to fund share repurchases:

“Corporate debt is a hot topic this year. Before the 2008–09 calamity, U.S. non-financial corporate debt teetered at $2.6 trillion dollars. It is now $5.8 trillion. The reported $2 trillion of corporate ‘cash on the balance sheet’ constitutes only 30–35% of the corporate debt. So much for that meme. ”

“So what’s all this debt being used to fund? Share buybacks, of course. More is spent on share buybacks than on capital expenditures (Capex). Companies are making corn dogs from their seed corn. The record buying spree is twice that of the early months of 2014.

Citi analysts noted that ‘if leverage is going up today because it’s funding tomorrow’s growth that might not be a bad thing. Unfortunately, that’s not what’s going on.’ Companies reaching for returns on their cash have found another overpriced investment on which to squander their shareholders’ value—other companies’ bonds. The sellers of these corporate bonds are reputed to be using the proceeds to . . . wait for it . . . buy back shares of their companies! This is financial engineering that would make Escher proud.”

But the problem currently is despite the rampant increase in share buybacks, earnings are no longer growing.

However, companies are not just borrowing to complete share buybacks but also to issue out dividends. According to the most recent S&P 500 company filings, the level of cash dividends per share have now reached $11.28 which is near the peak level of $11.35 at the end of 2015.

It is also the greatest deviation from the long-term trend of dividends per share since the financial crisis (highlighted in blue.)

The reality is that share buybacks create an illusion of profitability and increases in dividends continue to support the“chase for yield.”

However, the problem is that both of these means of boosting asset prices are “finite” in nature and eventually the“devil will be paid his due.”