|

QUESTION: What has prompted this?

IT’S NOT DOLLAR STRENGTH BUT FURTHER EURO WEAKNESS!

ECB Chief Christine Lagarde delivered her much anticipated new monetary for Euro Monetary Policy on Thursday July 8th. As the folks at the Mises Institute wrote: “Old, absurd, and unfit for purpose!“

The ECB’s New Inflation Plan Is Like the Old Plan. But Worse!

The ECB has adopted many new radical tools to make this happen. Following on from the 2 per cent statement, the ECB confirms the setting of interest rates remains the primary tool, but many other tools are available as well: “The Governing Council also confirmed that the set of ECB interest rates remains the primary monetary policy instrument. Other instruments, such as forward guidance, asset purchases and longer-term refinancing operations, that over the past decade have helped mitigate the limitations generated by the lower bound on nominal interest rates, will remain an integral part of the ECB’s toolkit, to be used as appropriate”.

In other words, the new plan tells us the ECB plans to be much more activist and it plans to use many “tools” that were once considered to be unacceptably radical.

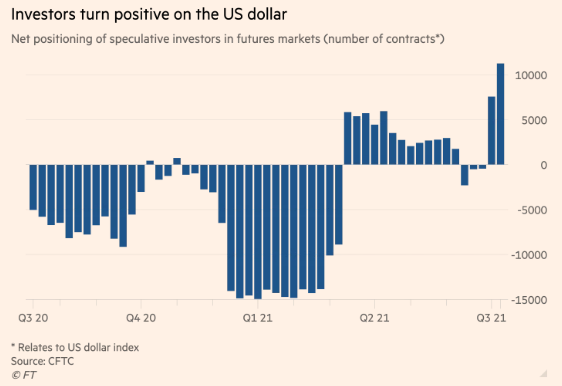

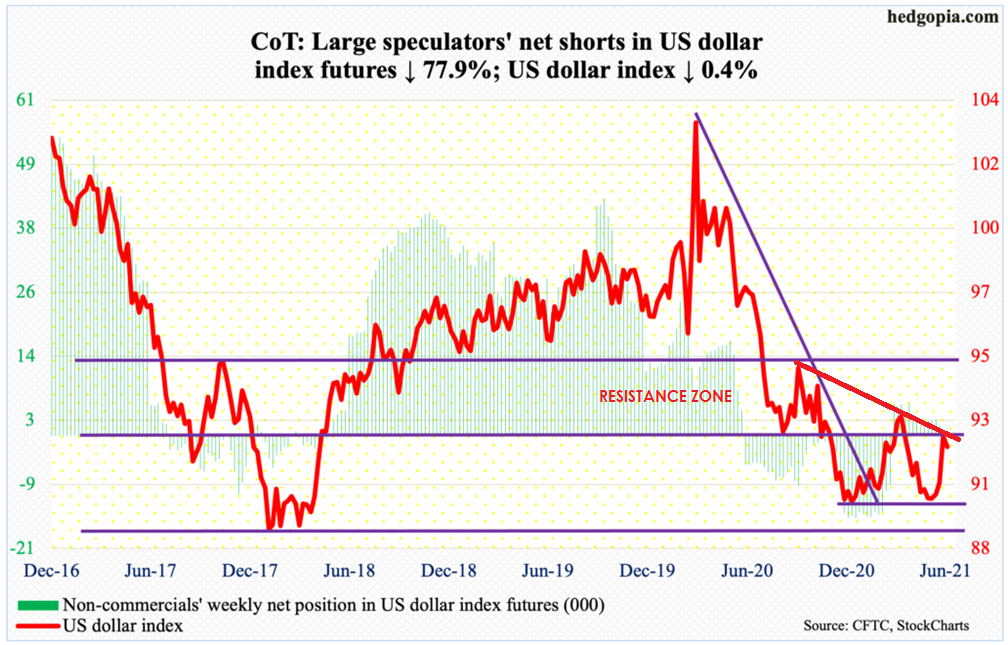

Without boring you with the details, the conclusion is that it means a dovish ECB and elevated risk aversion which could send the EUR/USD pair even lower while providing support to other cyclical currencies. The bank has previously announced that the PEPP will run at least to March 2022 and adopted a new inflation target from “below, but close to 2%” to “2%”, which, itself, somewhat dampened expectations of earlier policy normalization. This all lends itself to more upward pressure on the US Dollar.

|

But there is more going on than just this.

But there is more going on than just this.