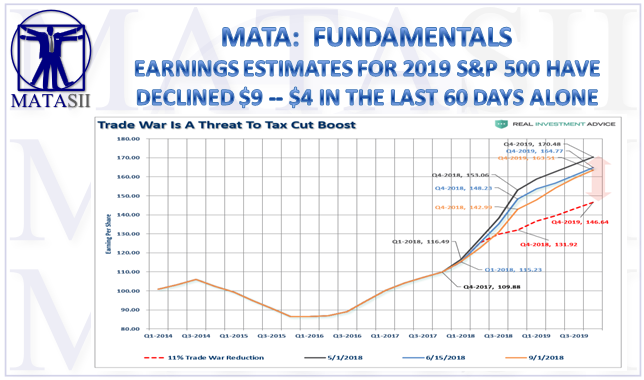

EARNINGS ESTIMATES FOR 2019 S&P 500 HAVE DECLINED $9 & $4 IN THE LAST 60 DAYS ALONE

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: FUNDAMENTALS

EXTRACTED FROM: 11-08-18 - RealInvestmentAdvice.com - "The Tailwinds To The Bull Market Have Shifted"

MATASII TAKEAWAYS:

- The risk to current estimates going forward remain higher rates, tighter monetary accommodation, and trade wars,

- An ongoing trade war could effectively wipe out the entire benefit of the tax cut bill,

- For the end of 2019, forward reported estimates have declined by roughly $9.00 per share,

- In just 2-months, the estimates for the end of 2019 have fallen by almost $4 per share,

- Year over year comparisons are going to become markedly more troublesome even as expectations for the S&P 500 index continues to rise,

- The deterioration in earnings is due to the late stage of the economic cycle, tariffs, a stronger dollar, and rising labor costs is notable and should not be readily dismissed,

- The bump in earnings growth will only last for one year at which point the analysis will return to more normalized year-over-year comparisons. The risk of disappointment is extremely high.

A tailwind quickly turning lower is reported earnings per share. As I discussed in our analysis of earnings for the second quarter:

“The risk to current estimates going forward remain higher rates, tighter monetary accommodation, and trade wars. As I wrote recently, the estimated reported earnings for the S&P 500 have already started to be revised lower (so we can play the “beat the estimate game”) but an ongoing trade war could effectively wipe out the entire benefit of the tax cut bill. For the end of 2019, forward reported estimates have declined by roughly $9.00 per share.”

Just since that writing, the estimates have deteriorated further as the ongoing “trade war” has now begun to drag future estimates lower. In just 2-months, the estimates for the end of 2019 have fallen by almost $4 per share.

But looking forward, year over year comparisons are going to become markedly more troublesome even as expectations for the S&P 500 index continues to rise.

As I stated previously, the deterioration in earnings is something worth watching closely. While earnings “beat lowered estimates,” it is important to keep earnings trends in perspective. The deterioration in earnings is due to the late stage of the economic cycle, tariffs, a stronger dollar, and rising labor costs is notable and should not be readily dismissed.

It is important to remember the bump in earnings growth will only last for one year at which point the analysis will return to more normalized year-over-year comparisons. While anything is certainly possible, the risk of disappointment is extremely high.