ECONOMIC "FAKE NEWS"!

THE MEDIA NARRATIVE DOESN'T MATCH THE FACTS?

WHAT THE PROFESSIONALS ARE SAYING

Paul Craig Roberts (a former Assistant Treasury Secretary and WSJ Editor) who I have interviewed a number of times over the years recently released a short article entitled: "Ever more official lies from the US government". He starts it off by observing:

The false reality constructed for Americans parallels perfectly the false reality constructed by Big Brother in George Orwells’ dystopian novel 1984.

.... Domestically, Americans are assured that, thanks to the Federal Reserve’s policy of quantitative easing, that is, flooding the financial markets with newly printed money that has driven up the prices of stocks and bonds, America has enjoyed an economic recovery since June of 2009, which must be one of the longest recoveries in history despite the absence of growth in median real family incomes, despite the growth in real retail sales, despite the falling labor force participation rate, despite the lack of high value-added, high productivity, high wage jobs.

The “recovery” is more than a mystery. It is a miracle. It exists only on fake news paper.

He goes on to factually prove his point. We don't have time to go through his points here but I encourage you to read his article. What is important to investors is whether the economic news and its controlled narrative actually reflects reality, expected returns and degree of risk to achieve those returns.

Therefore I thought I would share with you some of what I personally look at to determine the real US investment reality. Because of space in this missive I will leave the Global landscape for another day.

DISCRETIONARY SPENDING

1-THE VICES

Vices normally leads overall retail sales. It is reflecting a very rapid decline and signaling we can expect overall retail sales to follow.

Gambling continues to slow and is now actually contracting as reflected by the average rates of gambling growth decline for Detroit, Maryland, Connecticut, Atlantic City, & Pennsylvania.

While comps play a role in exaggerating some of the contraction, the trend is clear: less gambling. And that means less hot money floating around households to play with.

Prostitution & Escort Service Price Inflation Is Slowing

A sampling of escort prices in major urban markets shows that, after moving up sharply in late 2016 and early 2017, escort prices hikes have leveled off recently.

The reasons are:

- Market dynamics: the recent big (~15% on average ) uptick in prices has to be absorbed

- No inflation pressure: hotels are the primary cost that escorts pass along. And hotel prices are flat and even down in most major markets (per Trivago’s Hotel Pricing Index)

- Opportunity has slowed: Price hikes have been largely opportunistic. That is, thanks to the surging stock market beginning in 4Q17, customers seemed to have extra disposable income. The S&P surged ~15% in the 4 months from November to February but only 1.5% in the 2 months since then.

Even more interesting is that mid-tier escorts have begun to offer discounts. The frequency is limited, but enough to stand out. And the price deflation is significant – it rolls back most of the recent price hikes.

Why the soft demand? Affordability.

It’s not that pay-to-play inflation outpaced affordability.

- Prices were raised ~9 months and demand remained strong.

- Suddenly the phones aren’t ringing off the hook.

- And it’s not stiffening competition.

- This is a demand problem.

- And price cuts are a great way to firm up demand.

If this is trend, we’ll see more discounting through the Summer.

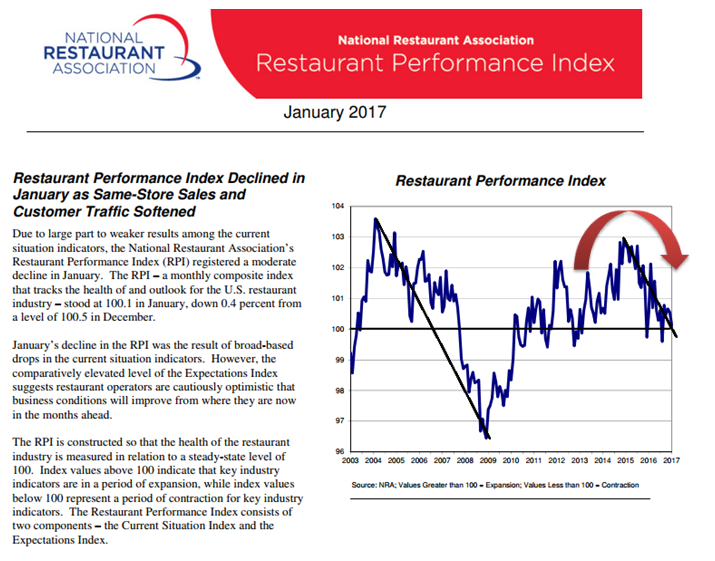

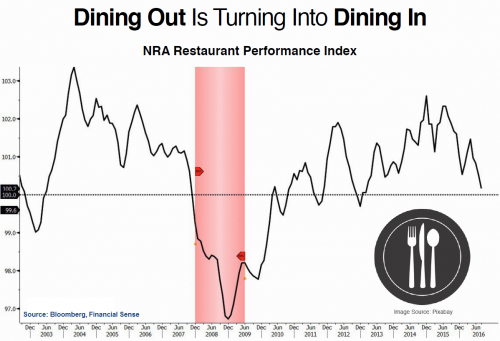

2-RESTAURANTS

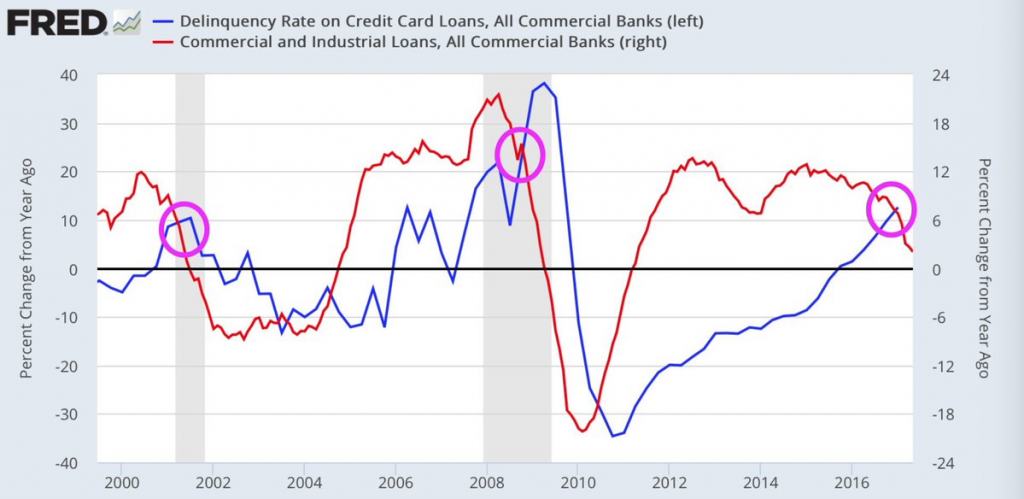

The last time this happened it was a pre-warning to the Financial Crisis. Usually however it is normally a sign of an approaching reversal in the Business Cycle and a coming Recession?

The National Restaurant Performance Index is suggesting that Restaurant industry growth is not only slowing but now bordering on decline.

We are seeing that restaurants in general are unable to base on employee wage increases due to increases in the minimal wage. They are being forced to cut labor and automate using Kiosks and other forms of rapidly appearing robotics.

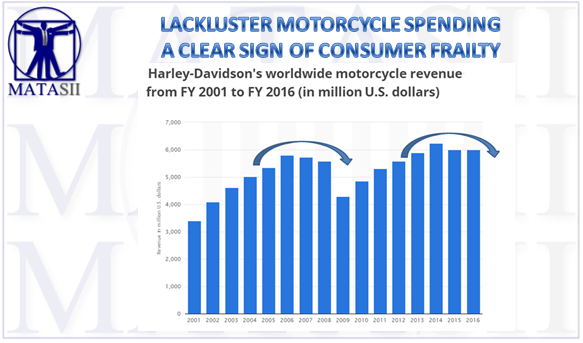

3-MOTORCYCLES

Economists like to look at sales of discretionary goods to determine whether or not the consumer is experiencing any potential weakness. Motorcycles tend to be a closely-watched discretionary barometer. For the last three quarters, Harley-Davidson (HOG) management as reported by Bloomberg has said that:

..... the industry is struggling amid soft used-bike prices, economic uncertainty and weakness in oil-dependent areas.

This looks like a top, especially when you consider the attendance at the spring rallies at Americade in upstate New York and Laconia in New Hampshire. Attendance was way down - again.

A relative who has attended these rallies for 20 years told me he was staying in hotels downtown when in prior years he had to find accommodations 20-30 miles away. In fact he stopped in to see me for only the second time in 20 years because he said I would likely offer more entertainment value than the failing rallies - that should tell you all you need to know about how bad it must have been!

BUSINESS ACTIVITY

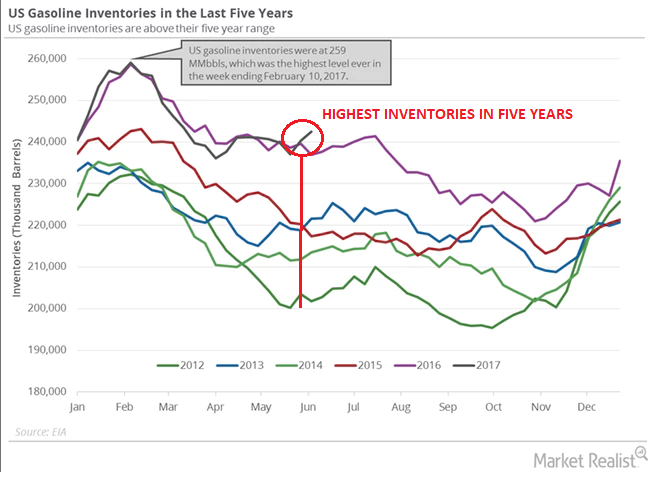

1-US GASOLINE SALES

Gasoline Inventories are now at the highest level in 5 yrs as average prices at the pump have fallen nationally. Its a DEMAND problem not just oversupply!

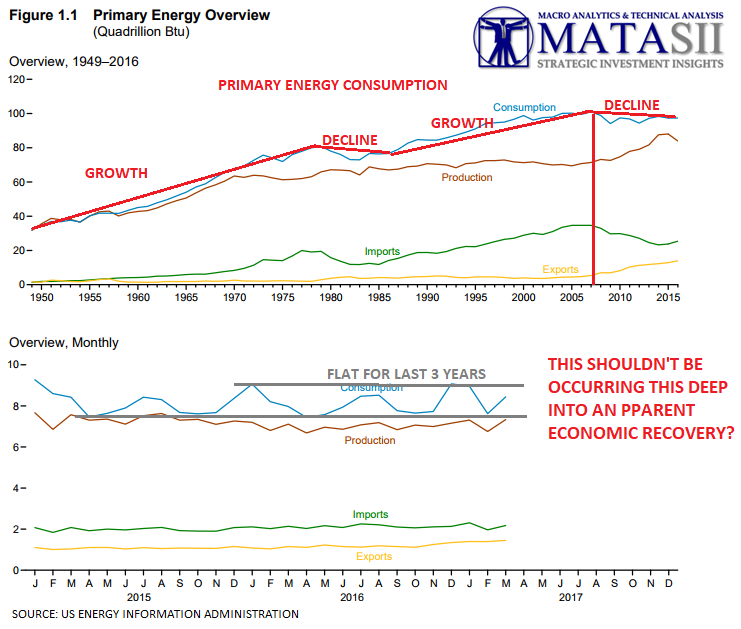

2- POWER & ENERGY CONSUMPTION

The June release from the US Energy Information Administration shows that total US Energy usage has been in decline since the financial Crisis and in the last three years has been basically flat. This shouldn't occur this deep in an Economic Recovery

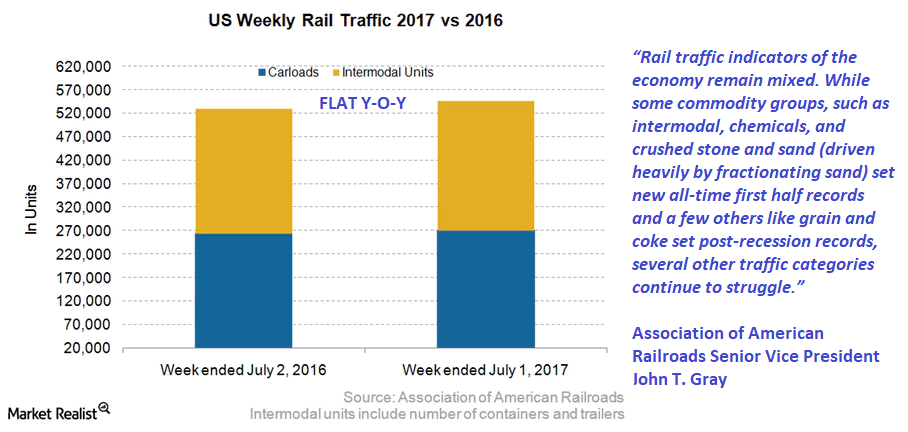

3- RAIL & INTERMODAL SHIPPING

AAR (Association of American Railroads) Senior Vice President John T. Gray stated the following: “Rail traffic indicators of the economy remain mixed. While some commodity groups, such as intermodal, chemicals, and crushed stone and sand (driven heavily by fractionating sand) set new all-time first half records and a few others like grain and coke set post-recession records, several other traffic categories continue to struggle.”

COMPLACENCY

1- VIX

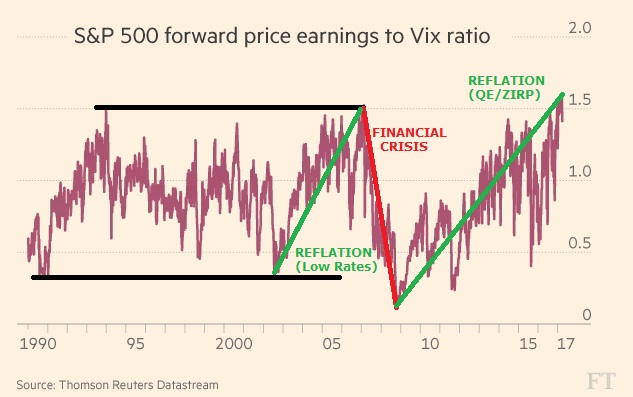

The markets have become incredibly complacent, yet the financial media fail to point this out. It tells us that the VIX is low which means the markets sees little Risk. it also tells us that earnings will continue to improve.

What it fails to tell you that overly optimist outlooks coupled with little fear over a long period o time is a prescription for disaster. The way to consider this is the forward PE to VIX Ratio. Peaks of be quite problematic

..especially when earnings have been as a result of cheap money and the central banks are being very clear that QE (Quantitative Easing) will soon become QT (Quantitative Tightening) ... more on that in a moment.

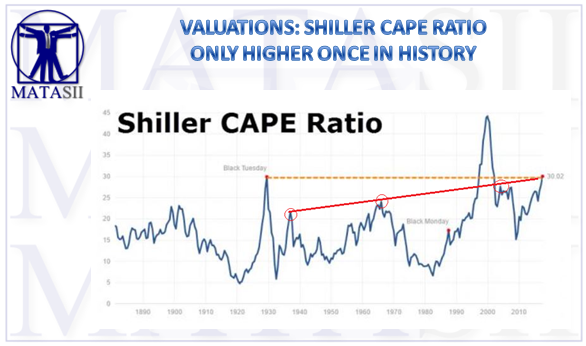

2- FUNDAMENTALS

I have spelled out a many prior occasions the degree of over-valuation by almost all measures. Again the media fails to warn of this. It only occasionally mentions it in basing so as not to worry investors and displease advertisers.

SLIDE #

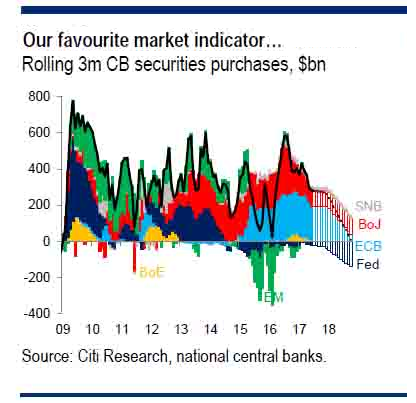

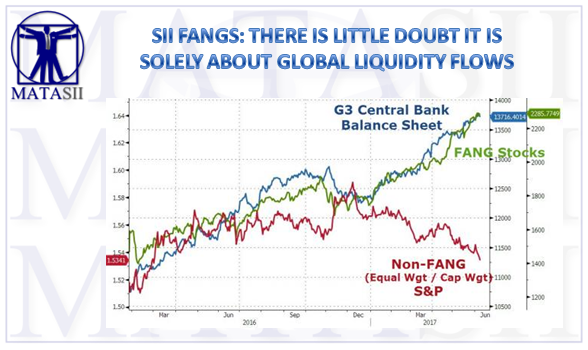

DON'T FIGHT THE FED

The Federal Reserve, BOJ and ECB have all sent clear directional communiques on their intent to shift from Quantitative Easing to QT (Quantitative Tightening) in late 2017 and 2018. These are seminal announcements.

SLIDE

Unless you have been living in outer Mongolia you are fully aware that the financial markets have been a happy prisoner of the captive central banks and their unrelenting liquidity pumping.

Without it there can be little doubt that at some point the markets are going to abruptly and violently react to this. Knowing this should be enough, however when "Greed"has hold of the markets (or performance bonuses) then scalping every last 'tick' appears important.

To me it is no more than picking up dimes in front on a steamroller. The risk return simply doesn't merit it!

The media however doesn't relay this nor point it out. They actually don't see that to be their responsibility and their corporate lawyers advise them not to. Report markets are rising and talk about positive things. No one gets sued for that. Talk about negative things and they have found they get sued and blamed for the market falling. The media learned this painfully during the Dotcom Bubble collapse when public securities litigation and 'Green Mail' became a cottage industry for lawyers.

That is one of the reasons why market corrections always come as an apparent surprise to retail investors even though all the signals were readily apparent.

SLIDE

It is my personal opinion that the central banks are trying to "gingerly" tap on the breaks because they see Speculation. Leverage and Financial Conditions sentiment to be in the danger zone. They also know that the Business Cycle in historically 5-7 years from recovery to peak. The maximum it has been in the modern era in 10 years.

However, like taping your breaks on an icy road you can quickly and suddenly find yourself in a spin and completely out of control.

SLIDE

Their are many Cassandras out there warning of the damage the central banks are going to do with their shift in policy direction.

- "The Tide Is Going Out" - JPMorgan's Dimon Warns QE Unwind Could Be Far Worse Than Fed Hopes

- "Who Moved My Punch Bowl?"- Morgan Stanley Says A Repricing Of The "Central Bank Put" Is Imminent

- Derivatives Trading Legend: "As Little As A 4% Decline In One Day Could Start A Critical Crash"

- Pimco CIO Says Firm Is "Reducing Risk Across The Board"

1- INVERTED YIELD CURVE

2- REACTION TO POLICY SHIFT

3- BOND BOUNCE

TIPPING POINT

So what and when will reality be forced upon the markets? The list of possibilities is endless.

1- NORTH KOREA - A policy mistake or miscue which quickly escalates out of control,

2- A TRUMP DUMP - Due to failure to deliver against inflated and unrealistic expectations

Obamacare Repeal and Replace is seen as nothing more than a camouflaged spending cut to finance Tax Reductions,

Infrastructure Fiscal Stimulus becomes bogged down because PPP (Private Public Partnerships) only barely work for high return projects like toll roads, airport parking garages, toll bridges etc.

Tax Relief comes off the board in any major fashion because Federal, State and City Tax revenues are presently falling like a rock,

3- A TERRORIST ATTACK - A desperate ISIS escalates its attacks to another level of destruction like "smart bombs", chemical attacks or brutal, highly visible suicide attacks on global leaders.

4- A CYBER ATTACK - Where Ransomware becomes a new widespread and destructive terrorist tool to finance itself and wreck widespread disruption within the western financial system.

If history is any indicator, you can be assured whatever it is, it will come as a complete shock & surprise.

CONCLUSION

The famed short-seller, Jim Chanos of Kynikos Associates recently stated when asked:

LP: How serious do you view the weaknesses in the economy we’ve discussed?

JC: ..... One of these things that we’ve talked about wouldn’t be so bad, but you put them all together and the U.S. economy doesn’t look so great.

The big 3 drivers are still housing, autos, and health care. They disproportionately count for a huge amount of activity. What we see is that housing has stalled, autos have turned down, and health care is possibly about to turn down. Retail is also turning down. Nike is laying off 2 percent of its workforce. I can’t remember the last time Nike said it was laying off people.

Again, this could simply be cyclical, and as we reach the end of the expansion it gets harder and harder to generate new sales as peoples’ leverage has gone up. It could be that, but the problem is that we’re not well equipped to handle anything other than a downturn that’s mild because the Fed is already at near-zero interest rates.

Interestingly, the deficit is starting to go back up because of lower tax receipts. That’s the wrong way for the deficit to go up. New spending, like government spending on infrastructure, would be the right way.

I thought he summarized it pretty well. It isn't even close to what the media portrays. Advertisers and owners don't want that sort of message potentially impacting consumer confidence, investment and/or consumption.

EVERY-TIME THIS HAS OCCURRED -- BAD THINGS HAVE SUBSEQUENTLY HAPPEN!

But you will NEVER find this in the public news narrative!