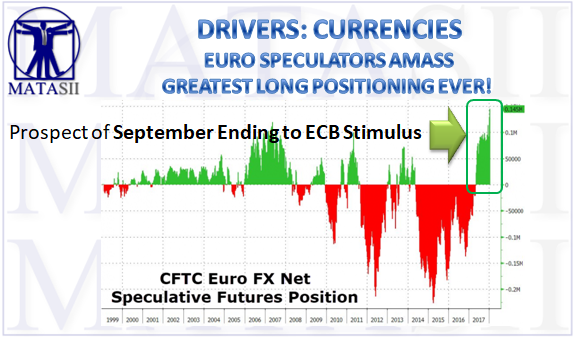

The last week saw speculators in the EURUSD FX futures market add dramatically to their long positions. In fact, as Bloomberg reports, hedge funds and other speculative investors have amassed the heaviest long positions on the euro ever, according to the latest CFTC data.

The G-10’s best currency in 2017 is getting fresh momentum from the prospect of a September end to European Central Bank stimulus and an upswing in growth.

A sudden 60 pips spike in EURUSD sparked a plunge in the Bloomberg Dollar Index below September's lows to its weakest since January 2015.

There was no obvious news-driven catalyst for the moves but as one veteran FX trader noted "shit's starting to break" reflecting on the chaos in stocks, crypto, credit, and VIX today...

This is the strongest Euro since 2014...

This spike prompted another snap lower in The Dollar Index...

However, the rates market is not reflecting that optimism..