It's official: with the best earnings season since 2010 now essentially over, the numbers are in and S&P500 profit margins are at an all time high of 11.2%.

And yet, as turmoil spreads abroad, while capacity bottlenecks and rising wage pressures grow domestically, and with business tax cuts now behind us, Goldman Sachs ask if the rapid rise in profit margins can continue.

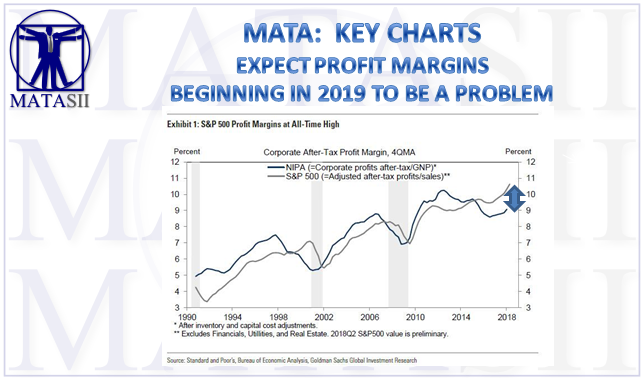

To answer that question, the bank first looks at corporate profits as a share of GNP, as reported in the national income and product accounts (NIPA), and notes that they have been significantly softer recently than S&P 500 profit margins. As the chart below shows, while NIPA margins exceeded S&P 500 margins until early-2015, they are now 1.25pp below S&P 500 margins.

Furthermore, as seen above, NIPA margins have often led S&P 500 margins. Should we therefore expect weaker S&P 500 margins given the softer recent NIPA margins growth?

The answer, it turns out, is most likely yes: while NIPA data are revised, turns in real-time NIPA margins have often preceded turns in S&P margins.