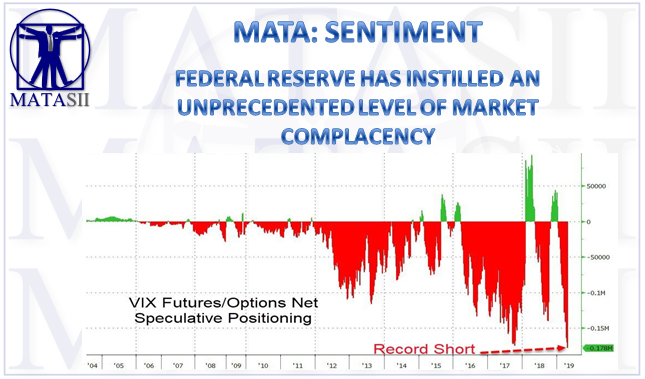

FEDERAL RESERVE HAS INSTILLED AN UNPRECEDENTED LEVEL OF MARKET COMPLACENCY

It is reported:

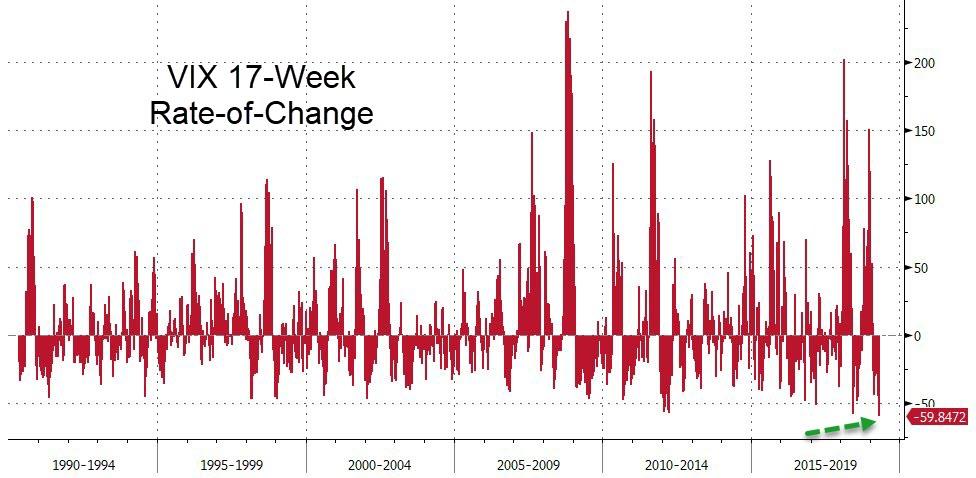

Last week we noted that something unusual had happened in the equity market volatility complex. Specifically, VIX had collapsed at its fastest pace in history.

From over 36 to almost a 10 handle a week ago, the Fed's flip-flop had re-energized the sell-vol-at-all-costs trade that has become the bread-and-butter of so many of newly-minted 'gurus' in this market.

As we pointed out, this was the biggest drop year-to-date and the biggest 17-week collapse in risk since records began (in the last '80s)

But things changed a little this week as the S&P (thanks to a panic bid at the close on Friday) pressed up to near its record intraday high, VIX ended the week higher...

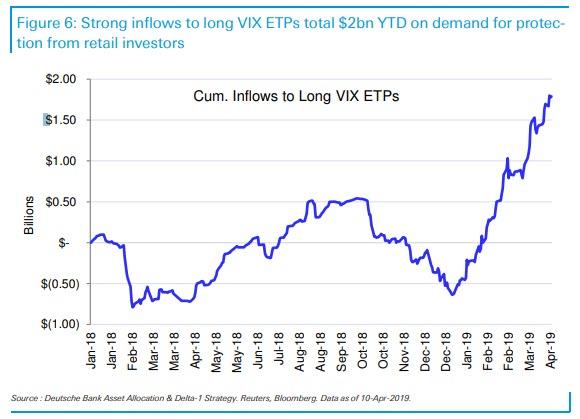

However, as we highlighted previously, when it comes to volatility-based asset flows in 2019, the picture is confused at best (remember, the S&P rise back to all time highs has occurred even as equity investors have been pulling money from equity funds week after week).

Commenting on the latest VIX flows, Deutsche Bank's Parag Thatte reiterates JPMorgan's point, observing that long VIX ETPs have seen significant inflows totaling $2bn YTD, as retail investors hedge equity gains. This record inflow into VIX ETPs, amounting to $2 billion in notional, is shown on the chart below.

Yet while retail investors, which traditionally prefer ETPs to hedge exposure, have been loading up on crash bets, institutional investors which traditionally prefer the greater liquidity of the futures market, are taking the other side of the volatility trade and as the latest CFTC commitment of traders report shows tonight, the speculative net short position in VIX futures has broken to a new record - the greatest short VIX position ever.

If one believes institutions, one look at the chart above confirms that market complacency is greater than it was either ahead of the Q4 mini bear market and February 2018 Volmageddon.

Ignoring the steam-roller of yield curve compression that signals this nickel-picking-up-plan won't end well...

But we are sure all those specs will know when to exit their position and escape unharmed.

They better hope that global money supply keeps surging...

So who will be right - retail or institutions. Since both positions are at record levels, the answer should emerge in the very near future.

[SITE INDEX -- MATA - SENTIMENT]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: SENTIMENT

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-26-19 - - "Traders Have Never Been This Complacent About Risk... Ever"

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.