US MONETARY POLICY

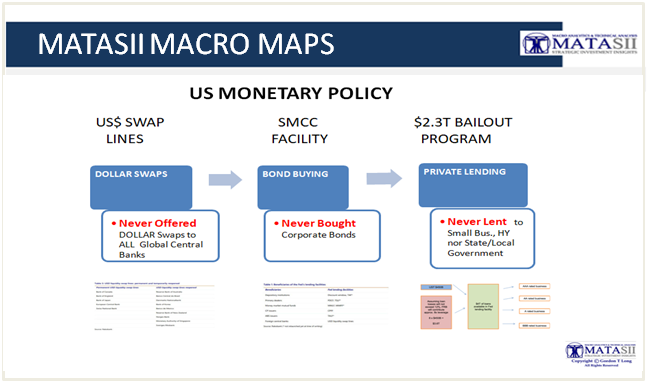

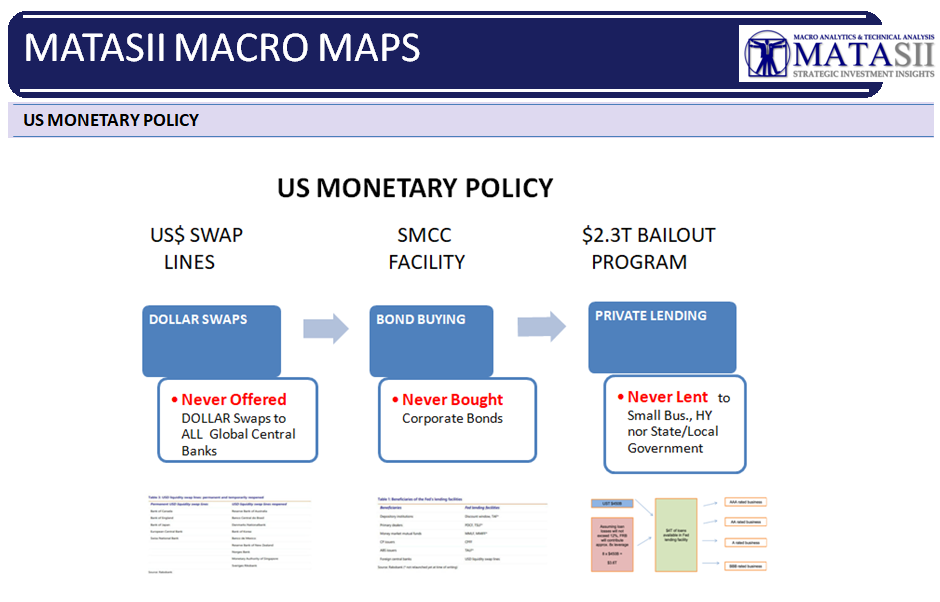

FED’S “3 HISTORIC FIRSTS” COMING UP SHORT IN HALTING A DEEP GLOBAL RECESSION

WHAT WE NEED TO UNDERSTAND

- April’s LONGWave outlined the serious perils within Over-Leveraged Corporate Debt, Fallen Angels, Zombie Corporations & the High Yield markets.

- Apparently the Fed also realized the magnitude of the coming devastation since the day after our LONGWave video release the Fed shocked the world with a $2.3 Trillion Bailout Program targeted at this problem along with others in the areas of small and medium size companies, & the Local /State Muni debt markets.

- This is the first time the Fed has ever LENT money as it is against the law for then to do so. To do this it required the cagey use of the US Treasury guaranteeing recovery of any losses thereby making them the “lender of record”. Since the US Treasury is controlled by the Administrative Branch, President Donald Trump can now effectively “print money” at will for any and all his perceived needs.

- The profound implications of this and other “first time” policy initiatives can not be over stated. We will discuss all of them further in the upcoming May UnderTheLens video release.

- The Fed’s SMCC Facility is restricted to the purchase of Investment Grade (IG) Corporate Debt. Not High Yield (HY)

- The new $2.3T Bailout Program restricts lending to only securities above Baa. Baa is the highest HY (Junk) level and one notch below the highly populated BBB (IG) level.

- The rate of Corporate downgrades by S&P, Moody’s and Fitch outlined in this months video threatens to push many below IG and out of the BBB charade that has been played for sometime. Insurance Companies, Pensions, Endowments and others depending on yield have been the primary BBB buyers since their covenants can’t hold securities below Investment Grade.

- The Fed is hoping to use the Baa to diminish some of the damage. Though Baa is still not Investment Grade it gives the Fed a “foot in the door” to potentially in our opinion move towards lower tranches out of public view. It is one of the reasons Blackstone has been contracted to execute the SMCC Facility on behalf of the NY Fed.

- The size of the Junk market is massive and has been increased dramatically with the collapse of oil to below $20/bl. Alarmingly, a significant percentage of HY securities are in the Energy Complex.

- Additionally, the recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act prohibits buybacks and dividends among companies that accept assistance directly from the Treasury for solely operating cost relief. The bill stipulates that any company that borrows money from the Treasury may not repurchase stock or pay a dividend until 12 months after the loan is repaid. Many companies rated BBB and below have been playing nefarious Financial Engineering games employing the use of debt to pay out artificially high dividends in what can only be seen to be a Ponzi scheme which is now exposed if new buying stalls.

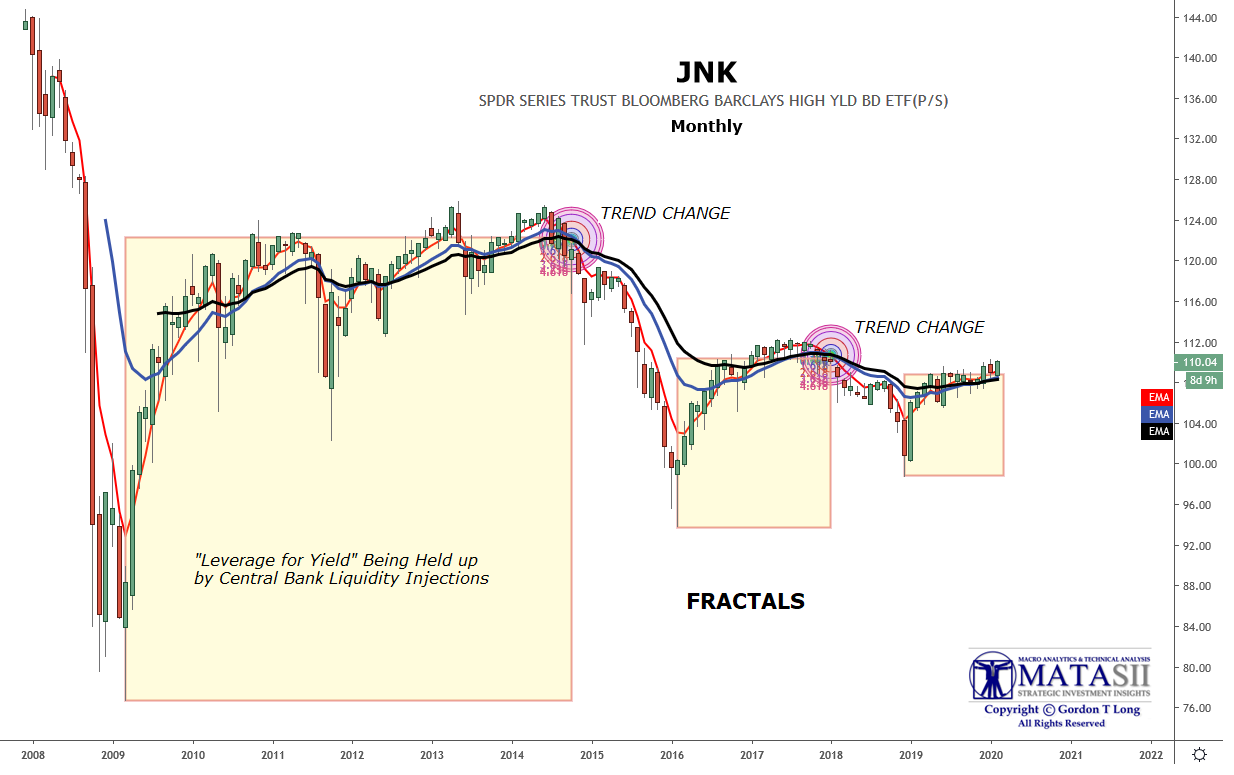

We recommend you keep an eye on the chart below to determine whether the Fed’s actions will actually support the HY and lower quality IG corporate debt markets. As goes the Credit Market and specifically the HY segment, so will go the overall financial markets!

- The Fed halted a Death Cross of the 40 WMA crossing the 80 WMA but this may not hold. The next two weeks will tell,

- Price was stopped by overhead resistance at a long term trend line (dotted line) and lower Bollinger Bands which may fail as the open gap is filled,

- Volume that drove prices up was extremely mute on the 04-09-20 announcement. Volume had been massive during the initial collapse on the Energy Price wars between Russia and Saudi Arabia.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.