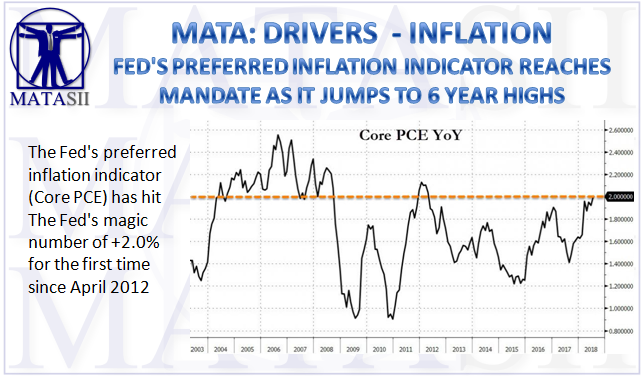

FED'S PREFERRED INFLATION INDICATOR REACHES MANDATE AS IT JUMPS TO 6 YEAR HIGHS

-- SOURCE: 08-30-18 - "Fed's Preferred Inflation Indicator Jumps To 6 Year Highs, Reaches Mandate" --

The growth rate of Americans' spending has slowed in the last three months (to +0.4% MoM as expected in July) and income growth has slowed, up just 0.3% MoM in July (below expectations of +0.4%).

However, while income growth year-over-year hovers at 3-year highs, it slowed in July, but spending growth year-over-year accelerated to near 4-year highs (highest since Oct 2014)...

Looking inside the income data, government worker wage growth accelerated as private worker wage growth slowed.

And the combination of faster spending and slower income gains pushed the savings rate down to 6.7% - the lowest since 2017 (remember the savings rate was revised and doubled last month)

But perhaps most notable is The Fed's preferred inflation indicator (Core PCE) has hit The Fed's magic number of +2.0% for the first time since April 2012...

More ammunition for continued rate hikes... despite the slow-moving trainwreck occurring in US housing markets (oh and the Emerging Markets).