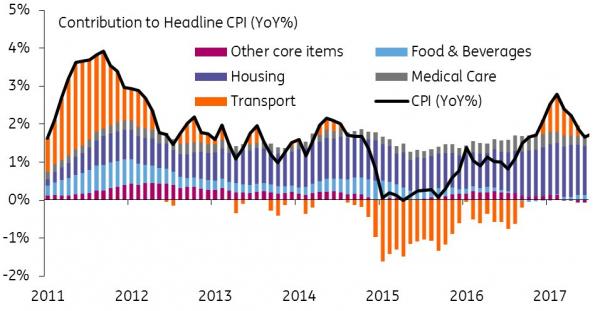

FOMC SIGNALS CONCERN ABOUT SHORT TERM INFLATION WEAKNESS

JULY FOMC MINUTES

The most notable takeaway was the reference to “most participants expected inflation to pick up over the next couple of years….and to stabilize around the 2% objective over the medium term”.

The most notable takeaway was the reference to “most participants expected inflation to pick up over the next couple of years….and to stabilize around the 2% objective over the medium term”.

However, many participants “saw some likelihood that inflation might remain below 2% for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.”

The debate on inflation echoed recent comments made public by various Fed presidents, while some members noted the “committee could afford to be patient….in deciding when to increase the rates further and argued against additional adjustments until incoming information confirmed that the recent low inflation were not likely to persist”.

However, those comments were balanced by the observation that “…some other participants were more worried about risks arising from a labor market that had already reached full employment and was projected to tighten further from the easing in financial conditions”.

On the balance sheet unwind topic, “several” members favored an announcement in the July meeting, but most preferred to defer that decision to the next meeting in September.