THE HEADLINE: Foreign Capital Has Been Propping Up China’s Currency. Here’s What Happens When It Leaves.

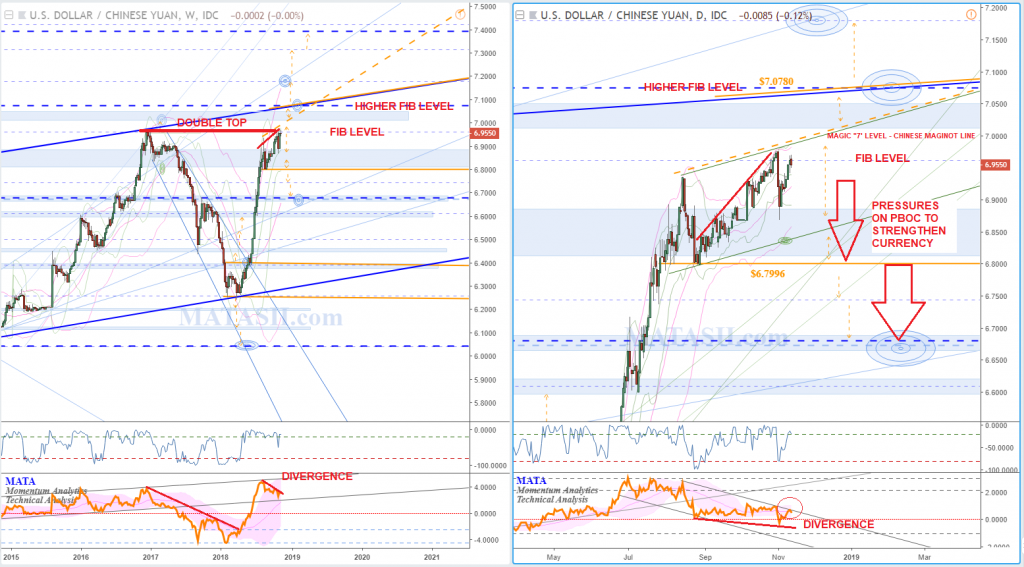

MATASII SII ANALYSIS: MARCH 13th, 2018 - USDCNY IDEA: In general, the drop we can see from the USDCNY since the start of 2017 has followed along with the fall off in the USD. Keeping an eye on the USD could offer some clues as to what to expect from the USDCNY.

A low was reached in Feb 2018; the market bounced and has been consolidating. Solid orange highlights the significant technicals currently bounding the consolidation, breaking these offers potential opportunities. Dropping past the lows of the consolidation could indicate a continuation of the larger trend down. Breaking up through the blue s/r zone and the weekly (blue) long term trend channel (starts 2017 highs), could represent a potential reversal for the market.

Looking at the daily chart (right) we can see a couple of shorter term or riskier technical considerations represented as dashed orange highlights. A green channel can be seen to have developed so far: breaking up past recent highs could see a continuation of the channel; dropping past recent lows would have the market moving past the channels support. These shorter term opportunities are considered riskier as the market could hold at the solid orange highlighted technicals and continue to bounce between them.

Initial Chart:

Prior Chart As of 11-02-18 Close - Pay particular attention to the "Fib" level (dotted) just ABOVE the "7" level which has acted as resistance for a 2 Year Double Top. Additionally, the Divergence with MATASII's proprietary MATA Indicator.

Current: As of 11-12-18 Close - The Divergence is suggesting that the PBOC may already be in the market to stop the USDCNY from weakening further.

NOTE: NOW SEE LATEST USDCNY IDEA (Subscribers Only) - LINK

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - CURRENCIES - USDCNY

11-09-18 - Council of Foreign Affairs "Foreign Capital Has Been Propping Up China’s Currency. Here’s What Happens When It Leaves"

MATASII TAKEAWAYS:

- Foreign portfolio investors have piled prodigiously into Chinese assets, helping to support the RMB, however history suggests this trend is about to reverse,

- Repatriation of liquid foreign capital will make it far more challenging for China to keep its currency up,

- There is every reason to expect that the PBoC will boost its support for the RMB by selling dollar reserves,

- if China were to sell reserves at the same pace as in 2015, its reserve levels would, by mid-2020, actually fall below the safety threshold implied by the IMF’s framework for reserve adequacy—(as shown in the right-hand figure below),

- All this highlights the urgency with which China must begin addressing the problem of high and rising corporate and local-government debt levels.

BREAKING NEWS STORY:

CHINA'S HARD LANDING HAS ARRIVED! - POLITBURO PREPARES FOR 2019 CRISIS

“I think China’s manipulating their currency, absolutely,” President Trump said back in August. Yet the People’s Bank of China (PBoC) was, and has been, intervening to keep the RMB up, and not to push it down, as Trump was alleging. And we believe such interventions are about to get much larger. Here is why.

Over the past two years, as our left-hand figure above shows, foreign portfolio investors have piled prodigiously into Chinese assets, helping to support the RMB. But history suggests this trend is about to reverse. While inflows have been rising, Chinese stocks have been tumbling—they are down over 20 percent from their January peak. Dreadful performance like this typically drives funds out of emerging markets. We may be seeing the beginning of such outflows in China.

Repatriation of liquid foreign capital will make it far more challenging for China to keep its currency up.

- Of course, China could change course and let it fall, but that risks exacerbating the foreign-debt burden of its highly leveraged corporates.

- It could raise interest rates, but that would further slow a slowing economy.

- It could, to keep capital at home, demand higher returns on its foreign lending, but that would mean sacrificing its efforts to subsidize its companies operating abroad, as well those aimed at putting dollars to the service of geostrategic objectives—like Belt and Road.

In short, then, there is every reason to expect that the PBoC will boost its support for the RMB by selling dollar reserves. This is what it did back in 2015, when a plunging stock market scared away foreign capital.

So in spite of President’s Trump’s repeated charges that China is manipulating its currency for competitive advantage in trade, all evidence suggests that it will continue to do the opposite. But if China were to sell reserves at the same pace as in 2015, its reserve levels would, by mid-2020, actually fall below the safety threshold implied by the IMF’s framework for reserve adequacy—as shown in the right-hand figure above.

The prospect of a balance-of-payments crisis, in which China would struggle to pay for imports and service foreign debt (a prospect considered outlandish a decade ago), highlights the urgency with which China must begin addressing the problem of high and rising corporate and local-government debt levels. The PBoC has no easy fix for these problems.