GLOBAL TRADE COLLAPSE NOW FRIGHTENINGLY ON PAR WITH DOTCOM & GFC FALLOUT'S

"An industrial slump has been triggered by a perfect storm of factors, including China’s slowdown, the car industry downturn, Brexit paralysis and Donald Trump’s attempt to upend the international trade system with tariffs on European and Chinese goods," --- The Telegraph.

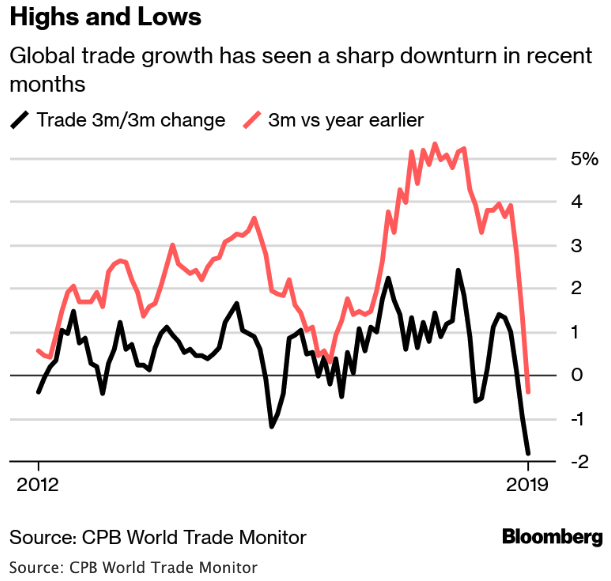

- According to The Telegraph the sudden loss in trade momentum is equivalent to the months after the dot com bubble imploded in 2001 when trade volumes sank as much as 2.2%.

- Today's current move is the biggest fall since the financial crisis of 2007–2008 when global trade plummeted, diving as much as 12.7%.

- Data from the CPB Netherlands Bureau for Economic Policy Analysis revealed that world trade volume dropped 1.8% in the three months to January compared to the preceding three months as a synchronized global downturn gained momentum.

THE INTERNATIONAL MONETARY FUND

- According to IMF Managing Director Christine Lagarde:

- "this is a "delicate moment" for the global economy as many countries are in the midst of a severe slowdown. The global economy has "lost further momentum" in the last six months",

- Lagarde pinned trade volume deterioration on decelerating global growth and "the impact of increased trade tensions on spending" on producer goods.

- The global downturn in trade is widespread geographically.

- The synchronized slowdown is expected to stabilize beyond 2020; however, in the meantime;

It's likely the world could be headed for a trade recession, if not already in one.

[SITE INDEX -- MACRO: MACRO INDICATORS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: MACRO INDICATORS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-17-19 - - "World Trade Suffers Biggest Collapse Since Financial Crisis"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.