GLOBAL TRADE CONTRACTING AS GLOBALIZATION REVERSES

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 03-19-19 - Mike Shedlock via MishTalk - "The Death Of Globalization Accelerates As Global Trade Declines"

MATASII SYNTHESIS:

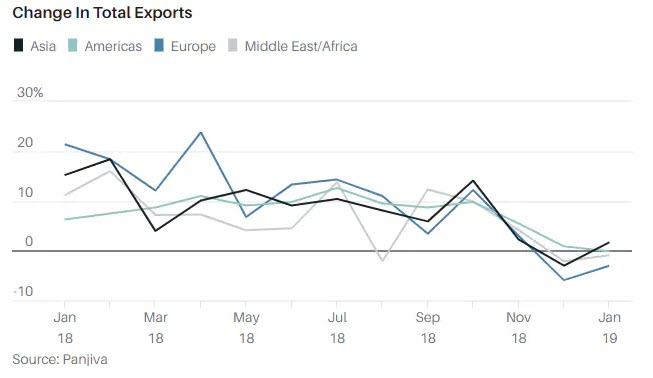

The change in total global exports has now gone negative...it is no longer slowing but shrinking!

- Globalization is being overwhelmed by populism, nationalism, and protectionism.

“The trend seems to be heading that way. Countries are becoming more focused on protecting their world and less on how to work together as a global economy.”

The change in total global exports has now gone negative...

Barron's has an interesting article How Investors Should Navigate Globalization’s Decline.

A decades long drive toward freer trade across borders has begun to reverse. Globalization is being overwhelmed by populism, nationalism, and protectionism.

Brexit threatens to erect new trade barriers between the United Kingdom and the rest of Europe. India just moved to limit foreign operators selling goods online.

“I probably never would have said it was going to end, but I’m starting to wonder,” says Don Allan, chief financial officer at Stanley Black & Decker. “The trend seems to be heading that way. Countries are becoming more focused on protecting their world and less on how to work together as a global economy.”

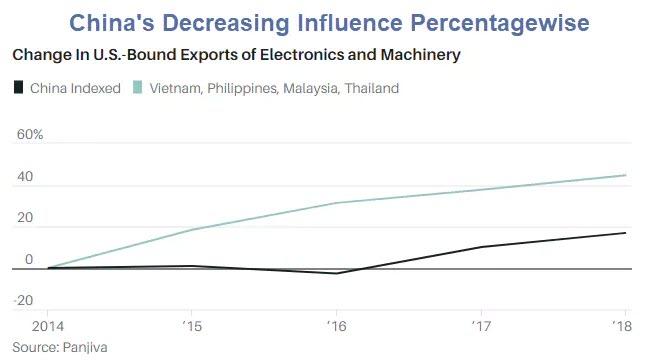

China Decreasing Influence Percentage wise

GoerTek , a Chinese company that makes Apple’s AirPods, reportedly told suppliers last year that it was moving production to Vietnam. It will join companies like LG Electronics (066570.South Korea) and Samsung Electronics (SSNLF). And it’s not just tech: Chemical company Huntsman (HUN) announced last summer that it had opened a plant in Vietnam, its first in Asia outside China. In fact, manufacturing grew more in Vietnam than in any other major Asian country last year, IHS Markit has calculated.

Misleading Percentages

The above chart and a focus on percentages is misleading.

The US trade deficit with China has been hitting fresh highs.

Tariffs, Robotics, Wages, Transportation Costs

The article concluded "The tectonic plates of global trade are in motion. Even a handshake between Trump and Xi won’t stop that shift."

I agree, but shifts were underway before Trump became president. But as the article notes, Trump's tariffs definitely accelerated the trend.

It was a rise in labor costs in China that led to China losing manufacturing jobs not only to robots but to Vietnam.

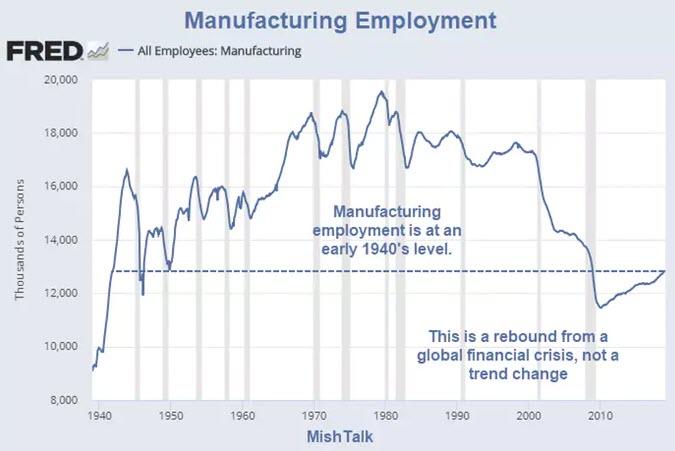

Manufacturing Employment

Thanks to robots, some manufacturing has returned, but without the jobs. It takes fewer and fewer people to do anything. Minus wages and transportation costs, it makes sense for manufacturing to be close to the end buyer.

Yesterday's Battle

Trump is fighting a losing battle.

Manufacturing those jobs are gone and they won't return.

Real Problem

Trump has his eyes in the rear view mirror. He wants to bring back manufacturing jobs when those jobs are in decline for the long haul.

More problematic for the US is China's new focus on high-end technology as opposed to routine assembly.

Huawei, a Chinese corporation, is the world's reader in 5G technology.

Trump seeks to put an end to that by claiming Huawei is an espionage threat. For discussion, please see Real Reason Trump Wants to Ban Huawei: US Wants to Spy and China Won't Cooperate.

The US needs to focus on the jobs of the future, not the jobs of the past.

Trade talks with a spotlight on soybeans, phone assemblies, etc will not do the US a damn bit of good. Tariffs have not and will not solve a single problem.

Meanwhile, somehow the US has fallen behind on 5G. That's not good to say the least.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.