-- SOURCE: 07-01-18 ZeroHedge - "Goldman Closes Out "Top Trade" To Short Treasuries" --

After calling the market's peak earlier in the year when it said that the January market meltup marked the top of the S&P, last Friday, Morgan Stanley took its top-calling ways to the bond market after its global head of interest-rate strategy Matthew Hornbach wrote in a note to clients that “3.12 percent was it" and adding that "we suggest investors buy 10-year Treasury notes outright" with the 2.9% level used in his trade recommendation.

Then, a few days later it was Goldman's turn, and late last week Goldman Sachs closed one of its “Top Trade” recommendations for 2018: shorting Treasuries.

“While we maintain our medium-term Treasury forecasts, the near-term outlook for U.S. duration is less certain given stronger forward guidance from the ECB and rising trade tensions,” Goldman strategists Danny Suwanapruti and Jonathan Sequeira wrote in a note to clients adding that "Treasuries are now the closest to our estimate of macro ‘fair value’ since the fourth quarter 2016.”

Last November, Goldman told clients to short the 10Y when the yield was at 2.36%, correctly predicting that the Fed would be more hawkish than the market expected. Goldman was correct, and the 10-year yield rose as high as 3.12% in May amid inflation fears, before a trade-war inspired rally in the market pulled the rate back to the mid-2.8% level.

"Close short 10-year Treasury Top Trade recommendation with a potential gain. Last November we recommended going short 10-year US Treasuries (at an entry yield of 2.36%) as we expected i) a more hawkish Fed than the market was pricing and ii) term premium to rebound from historically low levels. This thesis has largely played out. Treasuries are now the closest to our estimate of macro “fair value” since Q4 2016, the valuation gap between the US and the rest of G-4 looks increasingly stretched and net spill-overs from abroad have increased.

Even so, Goldman still maintains its target of 3.25% by year-end, and 3.60% in 2019, albeit clearly with far less conviction, it adds that "the near-term outlook for US duration is less certain given stronger forward guidance from the ECB and rising trade tensions."

We therefore close the trade, with a potential gain of 52bp.

And visually:

While 10-year yields have pulled back over the past month, they had been rising fairly consistently since rebounding from a low of 2.01% in September, supported by what was at the time a consensus on "coordinated economic growth", a robust outlook for U.S. growth, firming inflation, and the Fed’s commitment to policy tightening.

The Fed has already hiked twice this year, and in its latest projections in mid June suggested policymakers expect another two increases by the end of 2018, in line with what had been Goldman's estimate from the start of the year. However, more recently the long end of the curve has been weighed down by concerns about global trade tensions. More recently, the ECB also played a role in supporting global bond markets and capping yields, with officials not only saying they will keep interest rates at current levels until at least the summer of 2019 but also press reports suggesting an Operation Twist may be coming, further flattening global yield curves.

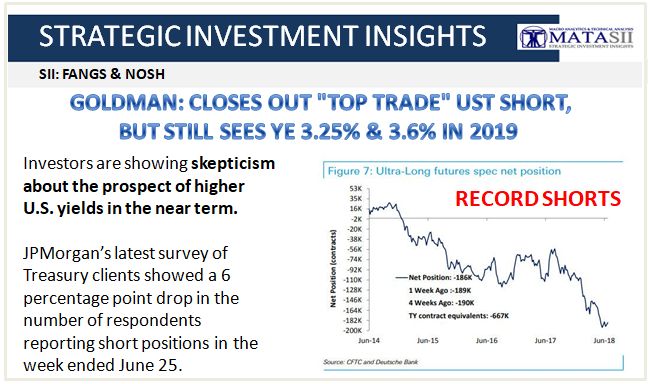

Meanwhile, other investors are also showing skepticism about the prospect of higher U.S. yields in the near term. JPMorgan’s latest survey of Treasury clients showed a 6 percentage point drop in the number of respondents reporting short positions in the week ended June 25. These participants aren’t ready to bet on a market reversal, however, as the proportion with long positions remained unchanged.

The market itself remains skeptical that the bond "bear market" is officially over, and despite some short covering among speculators, the short net spec position among Treasury futures contracts remains just shy of all time highs...

... while ultra long specs are about as bearish as they have ever been.

What happens next, however, remains unclear: as Bloomberg's Brian Chappatta writes, "even if you buy into the notion of a fleeting economic boom, the wild card for bond bulls will be debt supply in an era of diminished central-bank bond buying. Quantitative tightening — the opposite of the post-crisis stimulus known as quantitative easing — will begin in earnest globally as soon as the fourth quarter, according to some estimates.

It’s been a long time since traders have had to grapple with net positive bond issuance from the U.S., Europe and Japan. BlackRock Inc. warned a year ago that when it flips, it’s bound to cause “indigestion” and restore some term premium back to longer-dated securities.

As he concludes, "whether it’s enough to move 30-year bonds past the “mighty” 3.22 percent level remains to be seen."