GOLDMAN'S 3 BIGGEST THREATS TO PROFIT MARGINS

-- SOURCE: ABSTRACTED FROM: 10-07-18 David Kostin, Goldman Sachs via ZH - "Goldman Reveals The 3 Biggest Threats To Profit Margins" --

The main threat to the bottom line and the primary investor concern going forward relates to downward pressure on profit margins from three sources:

- Tariffs,

- Wage inflation, and

- Interest rates.

1. "Tariffs will have minimal impact on 3Q results for most companies given the bulk of the levies were not imposed until late in the quarter."

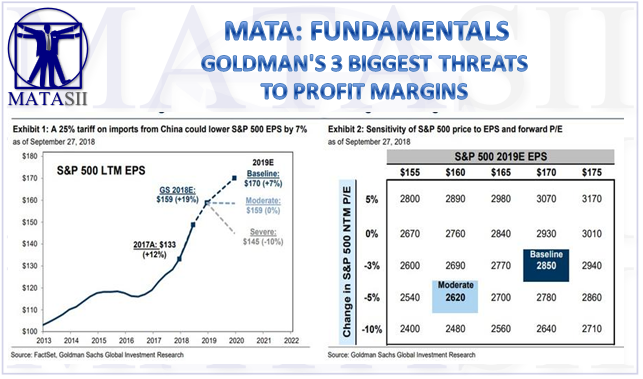

Still, affected firms will likely address concerns on their earnings calls. In fact, some firms have already discussed the potential impacts. For instance, MU reported that gross margins for upcoming quarters will be pressured by the imposition of the 10% tariff. Furthermore, the aggregate impact of tariffs on S&P 500 profits will depend on the specific rate and scope of products covered. Specifically, as Kostin explained last week, if a 25% tariff is placed on all imports from China, our estimate of 2019 S&P 500 EPS, currently $170, could fall as low as $159, eliminating all of Goldman's expected earnings growth.

Here, firms with high and stable gross margins will be best positioned to withstand input cost inflation regardless of the cause.

2. "Labor costs will continue to rise and put downward pressure on the margins of many companies"

One S&P 500 firm asked, “how does one grow a company without labor?” The simple answer: firms will need to boost worker pay in order to fill positions.This is why the Goldman Sachs economics’ Wage Survey Leading Indicator currently stands at 3.3%, the highest level this cycle. Meanwhile, Kostin also writes that AMZN’s announcement of a $15 minimum wage for all US employees has spurred discussion of economy-wide wage inflation. And while this change will not impact the 3Q results of the S&P 500’s 2nd largest employer, "investors will be observing the responses from other firms." Another risk: tight labor market will start weighing on small businesses; in the latest NFIB survey, one-third of respondents reported labor cost or labor quality as the single most important problem affecting their business.

To address client concerns about rising labor costs, Goldman has updated its list of firms with the highest (GSTHHLAB) and lowest (GSTHLLAB) implied labor cost as a share of revenue. "The intuition underlying our analysis is that companies with low labor cost exposure will have less risk from labor inflation, which would compress margins, lead to negative EPS revisions, and weigh on share prices."

3. Higher interest rates will weigh on margins for many companies.

The final concern expressed by Goldman clients is that rising rates will add to further downside on profit margins. Sure enough, the topic of last week was the sharp spike in US rates when the ten-year US Treasury yields jumped to 3.24% stands at the highest level in seven years. As we reported last week, the 36 bp backup in rates during the past month represents a roughly 2 standard deviation move, a shift that Goldman's research shows is typically associated with negative equity returns.

And despite the biggest two-day drop in equities since May, the S&P 500 index remains resilient and even though it slipped by 1% this week, it trades at virtually the same level today (2880) as one month ago (2888). Incidentally, Goldman's year-end 2018 target remains 2850 and its year-end 2019 target is still 3000.

Not everyone will cross unharmed: rising yields will weigh on firms with the heaviest debt load, as higher rates flow through to higher interest costs. Here, Goldman recommends investors focus on stocks with the strongest balance sheets: "Relative to Weak Balance Sheet companies (GSTHWBAL), our Strong Balance Sheet basket (GSTHSBAL) offers faster sales growth, albeit at a higher P/E premium (22x vs. 15x)."

* * *

In conclusion, despite the mounting margin threats, Goldman remains sanguine, and its top-down earnings model forecasts S&P 500 net margins "will hover near current levels until 2020."

We project margins will equal 11.0% in 2018 and 11.2% in 2019. In contrast, bottom-up consensus analyst estimates suggest margins will rise from 11.5% to 12.0%. The 80 bp gap in 2019 margin forecasts explains the $8 per share difference in our top-down EPS forecast of $170 and the bottom-up estimate of $178

While to some this baseline forecast may appear optimistic, there are numerous loopholes, the biggest of which is that should Trump place a 25% tariff on all Chinese imports - something which in light of recent trade, geopolitical and technological escalations appears to be inevitable - S&P profit growth will stall, and remain unchanged one year from today. As for how the market will respond, it may depend on China: should Beijing find itself it needs to sell more US-denominated reserves in order to support the Yuan, whether bonds or stocks as trade war intensifies, it is possible that a repeat of the near-bear market that took place in late 2016 will also be inevitable.