HARLEY-DAVIDSON: LOOKS LIKE ITS GOING TO CONTINUE TO BE A REAL ROUGH RIDE!

Summary

- Harley-Davidson has reported three consecutive years of flat-to-declining sales, and guidance doesn't imply any improvements for the foreseeable future.

- The company is not implementing any decisive measures to trigger a turnaround, and the main fundamental problems have not been addressed.

- I explain why I remain on the sidelines despite the apparently attractive multiples.

This idea was discussed in more depth with members of my private investing community, Consumer Alpha.

The Main Problems

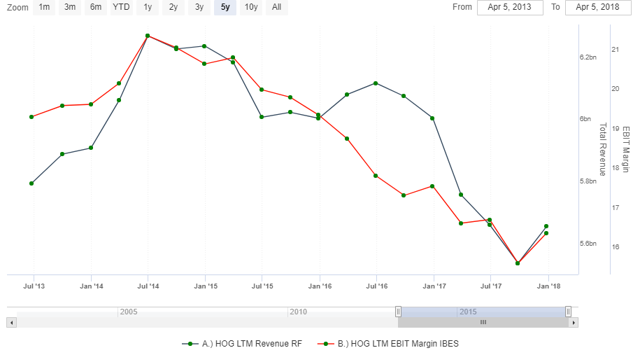

I think it’s fair to say that the past few years have been depressive for Harley-Davidson (NYSE:HOG) shareholders. The company doesn’t seem to be able to stabilize revenue trends and posted three consecutive years of flat-to-declining sales, coupled with a constant dilution of profitability:

Source: Sentieo.com

Harley-Davidson needs to address important issues. While the whole motorcycle industry is facing some issues since the recession of 2009, this company seems to be suffering even more than the average motorbike producer. Nonetheless, I have never seen the brand's image as the main issue for the company. There seems to be a widespread belief that Harley-Davidson is less attractive for millennials compared to the past generations. While this may be true in some markets, I think the main challenge has been the overall weakness in the motorcycle industry rather than the brand-specific attractiveness of Harley-Davidson.

Sales of motorcycles in the United States and other developed economies have been below the pre-financial crisis levels for a while, despite favorable macroeconomic conditions such as strong GDP growth, low interest rate levels and low unemployment rates. The main problem is that millennials are not embracing the motorcycling lifestyle as the older generations did, and that could be the result of a mix of factors. On one side, we have macroeconomic-related factors. According to Morgan Stanley, young people’s reluctance to buy motorcycles may be a consequence of “scars” from the great financial crisis:

I think we have got a very significant psychological scar from this great recession. (...) One in every five households at the time were severely negatively impacted by that event. And, if you think about the children in that house and how the length and depth of that recession really impacted people, I think you have an entire generation with permanently changed spending habits.

The vast majority of motorcycles (especially those in the 601+ cc category) are not perceived as necessary goods, unlike cars or scooters. In reality, they are usually considered as luxury goods for the majority of the population. The great financial crisis, with the deep problems it brought in terms of income and unemployment, has drastically changed people’s habits so that fewer customers actually want to take the risk of buying an expensive good that is totally unnecessary.

Besides that, and somehow linked to the point discussed above, we have to consider the fact that young bikers don’t seem to be as interested as before in the “big” motorcycles that Harley-Davidson used to produce and sell. While the previous generations grew up on dirt bikes and big, noisy motorcycles, those products don’t seem to be attracting millennials so much. As mentioned before, the higher prices, as well as the higher maintenance and insurance costs compared to scooters or smaller motorbikes, make potential buyers more cautious.

Harley-Davidson, perhaps hit hardest by the dearth of youth, is largely exposed to the 601+cc segment. And that’s not something the company can easily address without a drastic change in the brand’s positioning. For the moment, even many models that are mainly conceived to attract younger generations, such as the Street 750, Street Rod and Iron 883, remain firmly positioned in a category that is facing the aforementioned challenges.

On one hand, the company is largely exposed to big motorcycles, which we have seen is a highly challenged segment at the moment. On the other hand, the United States represents around 60% of the company's revenue, and that’s a problem if we consider that the USA is affected even more by those negative trends, besides the fact that it’s really a mature market from a macroeconomic and demographic perspective. Therefore, while the whole industry is facing some important headwinds, many competitors are in an overall better position, as they are more diversified than Harley-Davidson in terms of geographies and segments served.

Recent Results and Ambitions

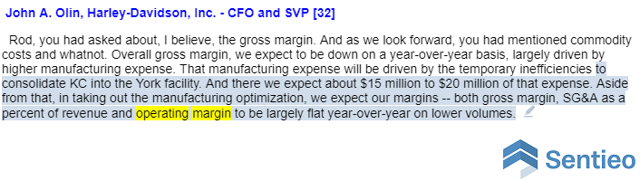

These problems have been evident for years, and recent results didn’t indicate any improvement. Shipments fell by 7.9% in 2017 to 241,500 units, and are expected to fall further to 231,000-236,000 units in 2018, which translates into a 3-4% decline. Moreover, operating margin is expected to be down to the 9.5-10.5% range, which translates into a 2-3% decline compared to 2017. Nonetheless, this seems to be a temporary phenomenon mainly triggered by a $120-140 million increase in manufacturing costs and a new accounting pronouncement related to pensions, which requires the company to move approximately $10 million of operating income to non-operating income. Besides that, it’s good to see that the company expects flattish margins going forward:

Source: Q4 earnings call

If that is accurate, Harley-Davidson wouldn’t be losing pricing power, which is a good sign in a context of increasing concerns about the brand’s attractiveness. The relative weakness seems to be confined to sales, which could be more related to the company’s concentration in less attractive segments and geographies. To make a comparison, a more diversified company like BMW (OTCPK:BMWYY) expects a solid increase in deliveries for 2018 with constant EBIT margins (between 8% and 10%), which somehow confirms the problem is currently more confined to specific segments of the industry.

As mentioned before, Harley-Davidson is not doing much to address this problem of diversification, at least in terms of product segmentation. Its main focus at the moment seems to be on cutting costs, together with a shy expansion in the EV segment and an apparent international push. The outcome remains highly uncertain, and those measures don’t look decisive in any case, for a number of reasons:

- Cost-cutting measures are actually translating into higher costs in the short term, while the positive effects (estimated to be between $65 million and $75 million after 2020) should come in the long term and can be subject to a changing environment, excessive optimism, or wrong estimates.

- The EV segment is still tiny and not detached from the rest of the industry. Only total growth is what matters now, besides the fact that electric vehicles have actually shown to have worse economics compared to traditional vehicles, in many cases.

- International growth is expected to be positive but not to make any difference, as the weakness in the core North American segment is expected to more than offset any international growth.

With expected EPS around $3.30 in 2018, HOG would be currently trading at a P/E multiple of roughly 13. It’s also trading at roughly 9x 2017 FCF per share of $4.75, although the figure was helped by below-average capex and above-average D&A. These kinds of multiples may look cheap if we focus on Harley-Davidson’s past success, but may be well-deserved if we consider the recent trends and the low visibility into the future sources of stabilization/growth. Moreover, the apparently low multiples may even translate into a perfect value trap if the current weakness in North America persists and leads to a further decline in sales, which will surely bring much lower EPS as a result of negative operating leverage.

My view is that we can’t say this stock is cheap unless we start to see signs of stabilization or, at least, potential sources of stabilization, which are completely lacking at the moment. The company's strategy of doing basically the same thing it has always done in an environment where customers’ habits, tastes and needs have changed dramatically doesn’t seem to be effective.

I am constantly looking for cheap stocks to buy, and HOG has been on my screeners for more than two years now. Nonetheless, I can’t find reasons to accumulate a position at these levels. Harley-Davidson’s deliveries, revenue and margins continue to decline and are expected to decline further despite the strong economy, low unemployment rates, and low interest rates. In this context, and without decisive measures that include the expansion into lower but healthier segments of the motorcycle industry, I don’t see reasons to bet on a turnaround.

While the company’s brand power, scale, and good financials (strong cash flows, decent balance sheet, healthy margins) justify maintaining the stock on the watchlist, I don’t think it’s worth betting on a turnaround until a potential catalyst becomes a bit clearer.

In particular, there are a few factors I would consider as good catalysts to start a long on HOG. These potential catalysts include:

- A stronger/decisive expansion into different but healthier segments of the motorcycles industry, which may spark the interest of customers, especially millennials. That seems to be unlikely considering the strategy the company is implementing, and the uncertain outcome, due to the different positioning it would imply.

- A merger with Italian rival Ducati. The news that Ducati’s owner, Volkswagen (OTCPK:VLKAY), is working on a potential sale of the division is a year old now, but not necessarily old enough to be thrown away. Volkswagen doesn’t have any financial need or any type of urgency on that side. The move would change the competitive environment dramatically and help Harley-Davidson on several fronts. First, it would make revenue more diversified across motorcycles classes, categories, and geographical markets. Second, it would bring excellent technological capabilities and open several opportunities on the front of product innovation, with the possibility of blending styles and technological features to create many interesting and highly appealing models for younger customers.

Besides those potentially highly effective catalysts, only an unexpected reversal in consumer tastes may help stabilize the situation at the moment, and I can’t find any reason to expect that kind of sudden change. In conclusion, being on the sidelines has been a good choice so far, and considering that the situation hasn’t changed in the meantime, I think it’s still worth maintaining a neutral stance at the moment, at least until a catalyst or potential catalyst starts to be more evident.