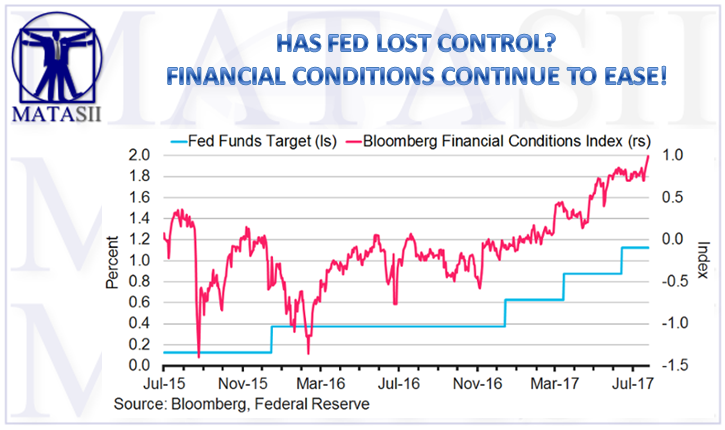

HAS FED LOST CONTROL? FINANCIAL CONDITIONS CONTINUE TO EASE!

ACCORDING TO BLOOMBERG: Further easing in financial conditions will continue to fuel the Fed’s concerns that financial distortions are developing. Despite the 100 basis points of tightening thus far in the cycle, the Bloomberg Financial Conditions Index has matched the peak reached in July 2014 — which was the highest level since in 2007. Meanwhile, labor market indicators show little slowing in the pace of job creation.

- The Fed intends to shrink the balance-sheet passively in the background, leaving the central bank to actively calibrate the stance of monetary policy via the fed funds rate. If successful, it will shift market speculation on the Fed’s reaction function toward the fed funds rate (a well understood policy lever) and away from yields on longer-maturity assets.

- Given the aforementioned “divorce,” policy makers are less inclined to delay the announcement of the start date for the balance-sheet unwind due to moderate economic under-performance, including the recent backsliding of inflation.

- BI Economics expects the unwind to commence in October, regardless of whether it is announced at the conclusion of the July or September FOMC meetings. However, Fed officials’ desire to act in a well-telegraphed, non-disruptive fashion favors an earlier reveal, giving Treasury officials more time to plan issuance and market participants more time to prepare, as well.

What to Expect

Interest-Rate Action: Market participants place near zero probability on an interest-rate move at this meeting. According to the fed funds futures market, the next rate hike is not expected until either March or May of 2018, with little tightening priced-in thereafter. This stands in stark contrast with the Fed’s forecast for one additional hike before year-end and three more next year.

BI Economics Rate Forecast: The next fed funds rate increase will likely be in December. Three additional hikes in 2018 will only be tenable if inflation pressures recover materially. This may yet be possible if reduced labor slack supports firmer wage gains, which in turn will filter through to consumer inflation through both cost-push and demand-pull channels. In terms of rate guidance, the July statement is unlikely to offer any enhanced clarity on the timing of the next move, deferring instead until updated economic and financial projections are released at the September meeting.

Economic Assessment: The statement’s summation of overall economic activity will change little from that of the June meeting, thereby reiterating the transitory nature of the first quarter’s weakness. The previous characterizations of economic activity (“rising moderately”), job gains (“solid”), household spending (“has picked up”) andbusiness fixed investment (“continued to expand”) all remain well-tailored to describe current conditions. As a result, the inherent signal is that policy makers are emphasizing their broader economic projections remain largely intact.

Inflation Assessment: The official characterization of inflation is more vulnerable to change, given the ongoing deceleration in both the headline and corePCE deflators since the start of the year. Headline inflation, as measured by the PCE deflator, fell to 1.4 percent in May from 1.9 percent at the start of the year,

while core inflation slipped to 1.4 percent from 1.8 percent over the same period. The committee already acknowledged the recent slowing in PCE-inflation measures in the June statement, but the trend has continued. As such, there may be some subtle language downgrades acknowledging a deeper and longer inflation soft patch in the near term; but officials will be sure to avoid any suggestion of eroding confidence in their ability to achieve the 2 percent objective in the medium term. The timeline may be extending modestly, but this will likely not be apparent until the September forecast update.

Federal Reserve Scorecard: The economic data have changed only marginally since the Fed last convened, consistent with the recent moderate pace of growth. Most notably, inflation gauges dipped further below the Fed 2 percent target.