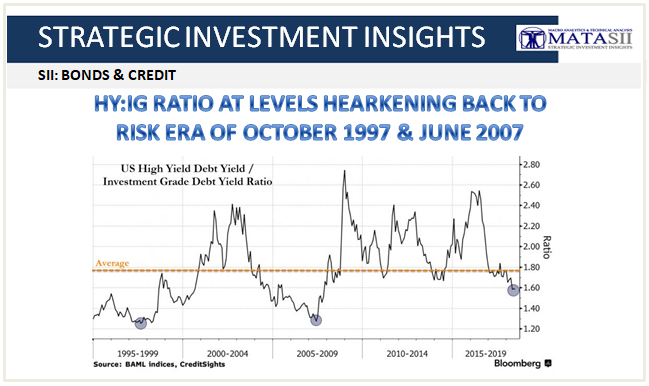

HY:IG RATIO AT LEVELS HEARKENING BACK TO RISK ERA OF OCTOBER 1997 & JUNE 2007

-- EXCERPTED from: 06-07-18 ZeroHedge - "Does Deutsche Bank's Junk Bond Firesale Mean The Party Is Over? "--

Less than a month ago, Moody's warned that "the prolonged environment of low growth and low interest rates has been a catalyst for striking changes in nonfinancial corporate credit quality," and adds that "the record number of highly leveraged companies has set the stage for a particularly large wave of defaultswhen the next period of broad economic stress eventually arrives."

This was followed by an ominous warning from Bill Derrough, the former head of restructuring at Jefferies and the current co-head of recap and restructuring at Moelis:

"I do think we're all feeling like where we were back in 2007," he told Business Insider: "There was sort of a smell in the air; there were some crazy deals getting done. You just knew it was a matter of time."

Which makes sense when one notes that since 2009, the level of global nonfinancial junk-rated companies has soared by 58% representing $3.7 trillion in outstanding debt, the highest ever, with 40%, or $2 trillion, rated B1 or lower. Putting this in contest, since 2009, US corporate debt has increased by 49%, hitting a record total of $8.8 trillion, much of that debt used to fund stock repurchases.

Meanwhile, as a percentage of GDP, corporate debt is at a level which on ever prior occasion, a financial crisis has followed.

And while all this chaotic risk is building, risk appetite is flashing red signals for the analysts at CreditSights. As Bloomberg reports, students of history will find two parallels to today’s credit market - and neither will provide much comfort. According to a key valuation metric, investors are headed for the kind of bullishness on high-yield bonds that’s been seen just twice before: during the halcyon days of 1997’s tech bubble before the Asia crash, and on the eve of the global financial crisis a decade later.

The ratio between U.S. junk-bond yields and their high-grade counterparts has reached levels that “hearken back to the high risk appetite days of October 1997 and June 2007,” CreditSights Inc. strategists Glenn Reynolds and Kevin Chun wrote in a note this week.

That’s “not a great set of dates along the credit market timeline of overconfidence,” they noted.

“The fear is that the market is underestimating the threat of trade wars and European political instability and what turns they could take,” Reynolds and Chun wrote.

And as that risk appetite surges, so LeveragedLoan.com reports that US High Yield Bond issuance tumbled in May...

In what is typically an active period for the U.S. high-yield market, just $15.3 billion of deals were issued in May, making it the lightest volume for that month since the paltry $9.5 billion in recession-era May 2010, according to LCD