IN-DEPTH: TRANSCRIPTION - GLOBAL RISK - APRIL 2019

COVER

AGENDA

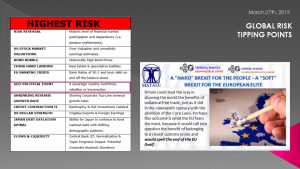

SLIDE 5 - TOP TIPPING POINTS

Let's begin by looking at the current Global Risk situation and reviewing some our recent posts on our top Tipping Points for 2019.

We are currently following 44 - all available at MATASII.

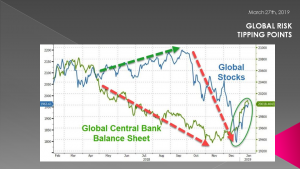

SLIDE 6 - RISK REVERSAL

Our top Tipping Point for 2019 is the expectations for a major long term Economic and Market Risk Reversal due to primarily the end of the Debt Super Cycle.

What we are seeing, and as should be fully expected, is the central banks and 'powers to be' trying everything in their powers to stop this natural adjustment within a Capitalist System from occurring

SLIDE 7

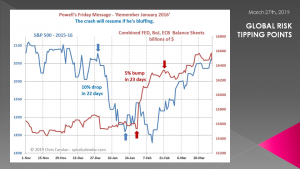

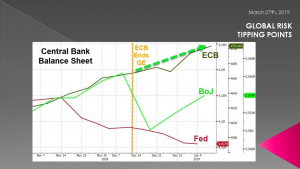

As such we have just witnessed yet another historic and unprecedented Monetary Reversal by the Global Central Banks.

When the global markets began to decline significantly in the fall of Q4 2018, the central banks again stepped in.

SLIDE 8

They have done this in a significant way, and across the board. The markets have reacted as you would fully expect when more money is chasing the same number (or possibly less) number of opportunities.

SLIDE 9

The question is how long will they continue to do this and will the longer term reaction by the markets be what we have witnessed since the advent of 'QE like' monetary policies & programs by the major global central banks.

SLIDE 10

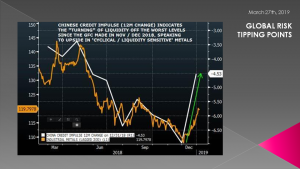

It all started with China in late November when they injected over $1T in liquidity.

The thing to watch will be how China's economy responds going forward. In today's Global Interconnected Trade World it is "As goes China, So Goes the World!"

SLIDE 11 - STOCK MARKET VALUATIONS

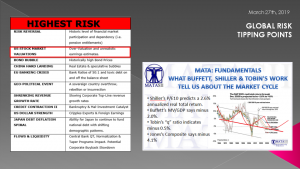

Our number two Tipping Point is the Financial Markets themselves and their correlation to historical valuations.

The forecasts of the historical measures and predictive indicators are all much lower than the S&P 500’s annualized real total return of about 6% from 1964 through 2018.

• Shiller’s P/E10 predicts a 2.6% annualized real total return.

Take today’s S&P 500 price and divide it by its companies’ average inflation-adjusted earnings over the past 10 years. This gives you a ratio that suggests whether the market is overpriced or underpriced. If you could buy one “share” of the S&P 500 index, your account would be worth around $2,700. After 10 years of 2.6% gains, you’d have $3,490. (Controversy alert: Various economists have proposed a number of improvements in the way Shiller’s ratio should be calculated.)

• Buffett’s MV/GDP says MINUS 2.0%.

Divide the S&P 500’s market value by the U.S. gross domestic product. Buffett wasn’t the first person to suggest this metric, but he’s said on the record that it’s “probably the best single measure of where valuations stand.” If the index fell 2.0% annualized, your $2,700 would turn into $2,206. Not so great.

• Tobin’s “q” ratio indicates MINUS 0.5%.

This metric divides the market value of all U.S. equities (not just the ones in the S&P 500) by the cost to replace all of the companies’ assets. It’s based on academic papers by economists James Tobin, a 1981 Nobel laureate, and William Brainard. This formula predicts that your S&P 500 account will drift slightly lower in real terms, not quite keeping up with inflation.

• Jones’s Composite says MINUS 4.1%.

Jones uses Buffett’s formula but adjusts for demographic changes. For example, as America’s population ages, this reduces economic demand. The resulting Demographically and Market-Adjusted (DAMA) Composite has predicted the S&P 500’s 10-year returns more closely than any of the other formulas since 1964. Let’s hope he’s wrong. A 4.1% annualized loss would drive your $2,700 account down to $1,776 after 10 years. That would be a 34% decline, almost as bad as the “lost decade” of 2000 through 2009.

The markets are aligning with Tipping Point #1, that a major market reversal lies ahead.

With both Republican and Democratic leaders calling for taxation changes regarding Corporate Stock Buybacks.....

REPUBLICAN PLAN

'Any money spent by companies on buybacks would be considered, for tax purposes, a dividend paid to shareholders — even if investors did not actually sell their stock. Every shareholder would receive an imputed portion of the funds equivalent to the percentage of company stock they own'

DEMOCRAT PLAN

'Calls for a ban on stock buybacks unless companies can show that they have "invested in workers and communities" first' -- corporations won't be able to buy back their own shares unless they first pay all of their workers a minimum wage of at least $15 an hour, offer seven days of paid sick leave, and offer satisfactory pension and health benefits.

....this along with other tax law changes may be the initial catalysts for a long over due correction. Remember, the popular corporate tax provisions passed by Republicans in 2017 which allows businesses to fully and immediately deduct their expenses phases out after 2022.

2017 TAX LAW

- The new proposal would make that measure permanent and expand the types of investments eligible for the deduction. The report calls the Tax Cuts and Jobs Act a "missed opportunity."

- "The existence of non-productive alternatives to capital investment, as a result, makes the product of the firm's American workers less valuable while at the same time increasing profits, making possible a world of higher asset prices, lower investment in the economy, and lower worker pay," it states

SLIDE 12 - EU BANKING CRISIS

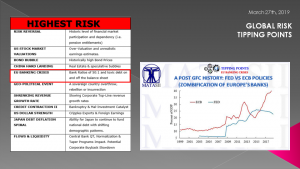

Our number five 2019 Tipping Point is an EU Banking Crisis which we have been posting more and more on as we see further evidence of this occurring.

In the euro area, shaky banks survive because they are kept afloat with national tax injections or via opaque network of rescue institutions such as EFSF, ANFA, EFSM, and ESM. The ECB's asset purchases and the TARGET2 payment system have turned out to be a quasi unconditional credit system: around a trillion euros have been handed out via TARGET2 to ailing southern European banks, with gradually eased collateral requirements.

The upshot is that the ECB’s monetary policy and financial supervision leave the euro area banks unprepared for an upcoming economic downswing (already occurring in Europe itself).

Shrinking interest margins and high regulatory costs are driving many small banks into mergers. (In Germany, the number of banks has fallen by 12% since 2008.) Failing banks are taken over by (still) more solid competitors - usually with the help of politicians.

SLIDE 13

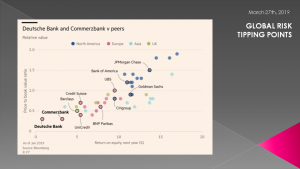

Witness the current Merger talks of Germany two largest banks - Deutsche Bank and Commerzbank. Something serious is occurring when something like this occurs.

Bad Bank Loans, Capital Outflows out of Europe and Progressive Zombification of EU banks and Corporations are only some of the areas we have been posting on which we don't have time to get into here.

BAD BANK LOANS

- The volume of bad loans in the euro area is estimated to be between 650 and 1,000 billion euros.

- In 2018, the officially reported share of non-performing loans was 45% in Greece, 12% in Portugal, and 10% in Italy (1.3% in the USA).

- In reality, the shares may be larger. In particular in the southern euro area, funding by central banks are keeping a growing number of zombie banks afloat.

CAPITAL FLOWS OUT OF EUROPE

- Finally, the diverging interest rate levels and the different successes of financial stabilization measures have triggered large capital flows from the euro area to the United States.

- The unresolved financial and government debt crises, the extended low interest rate policy of the ECB, and EU pressure toward fiscal austerity have all contributed to the huge capital outflows from the euro area (around two trillion euros since 2012).

- This has further destabilized European banks and enterprises.

- In contrast, the rising interest rates and the successful financial stabilization policies of the Fed have attracted large shares of these capital flows to the US, which have strengthened the quality of US credit portfolios.

PROGRESSIVE ZOMBIFICATION AHEAD

- The ECB may soon only be able to stabilize euro area banks through even larger purchases of securities and unconditional credit provision.

- This would be tantamount to progressive zombification, which promises nothing good for economic and political instability in Europe.

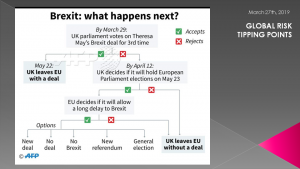

SLIDE 14 - GEO-POLITICS - BREXIT

There are many Geo-Politics that we lay out in this months Global Risk Report update. The one we must mention is BREXIT

BREXIT

When Britons voted on June 23, 2016 on whether or not to leave the EU there was no discussion of a "hard or soft Brexit". These terms were invented after Brexit passed by a surprisingly large margin and the mostly anti-Brexit Tory Party government, especially its leadership, decided that it needed to negotiate the terms of leaving.

Brexit supporters regard such terms as betraying the 2016 Brexit referendum itself. These 17.4 million Britons undoubtedly believed that Brexit would mean exactly that: Britain would no longer be governed by any EU laws, regulations, etc.

Nevertheless, all that the world has heard since that day in June 2016 is a debate over the terms of leaving, with any so-called terms being labeled as a "soft Brexit" and leaving without any agreement as a "hard Brexit".

SLIDE 15

In a "hard Brexit," Britain just leaves and all EU regulations, etc. are null and void. It's pretty clear cut. A "soft Brexit" can mean almost anything that is not a "hard Brexit"; i.e., Britain would agree to continue some or all of the manufacturing regulations, tariffs, and intergovernmental agreements — such as ceding jurisdiction to the European Court of Justice — that apply to EU countries.

The list is almost endless and the time frame very nebulous, a perfect playground for those who wish to have a Brexit In Name Only. If there is to be Brexit of any sort, however, Parliament must act. Experts in British constitutional law claim that only Parliament can actually take Britain out of the EU and only Parliament can decide under what terms, if any, it will do so. Of course, one of the terms of separation could be that there are no terms of separation — thus, a "hard Brexit."

There are serious issues concerning:

- The Effect on Imports

- The Effect on British Exports

- The Effect on the City of London

- The Effect on Controlling borders

The effect of a "hard Brexit" on Britain itself should be overwhelmingly positive, especially if Britain does in fact remove all tariffs and conclude free trade pacts with the rest of the world fairly quickly.

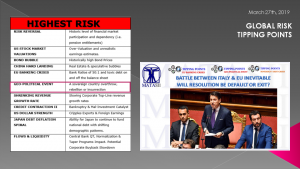

SLIDE 16 - GEO-POLITICS - ITALY

Another Geo-Political Tipping Point also concerns Europe, and that is Italy. Italy is in the process of massive political turmoil, conflicts with EU governance and serious banking problems

Bad bank debts of €185 billion were reported in Italy at the end of 2017 – a record for the European Union. Italy also accounts for roughly a quarter of the non-performing loans in the eurozone (i.e. loans that are not being repaid or are seriously overdue), and it is easy to see why Brussels considers the country to be the EU’s weak spot.

The worst hit by Italian Banking problems will be French banks, which Bloomberg estimates have Italian loans worth hundreds of billions of euros on their balance sheets. Such a shock could see foreign investors (and many European ones) beginning to flee the eurozone, adding a currency component to the banking crisis.

SLIDE 17

Time will tell whether the European Commission is willing to take such risks to punish Italy’s freedom-loving politicians,

Populist politicians in Europe love comparing the European Union to the late USSR, and this comparison is starting to ring true like never before.

The more the Commission tries to bring Rome into line, the wider the spreads on Italian bonds tend to grow, which in turn forces Italian banks to cut their lending. This risks deepening Italy’s economic slowdown, which would put even further strains on Italy’s fragile banking system. And that’s the last thing that France’s government or its banks want.

A GEO-POLITICAL PROBLEM

- Italy is undermining the unity of the European Union; blocking the EU’s recognition of those behind the coup in Venezuela as the legitimate authority; preventing the expansion of sanctions against Russia; and even supporting the ‘yellow vest’ movement in France, which is arousing the anger of the French government.

- The Conte government – a coalition of two populist, eurosceptic parties – came to power in June 2018. It tried to solve the country’s economic issues by increasing government incentives, but Italy is already in debt (Italy’s national debt is 131 per cent of its GDP). The European Commission warned it against enlarging its budget deficit and increasing its national debt too much, and threatened fines for violating budget discipline.

- Italian eurosceptic politicians suspect that the European Commission (in which the main roles belong to people hand-picked by Germany, France and the US) is punishing Italy and literally strangling its economy because of a political dislike of the Italian government’s geopolitical actions.

AN ECONOMIC PROBLEM

- Italy is once more sliding into a recession (economic growth was negative in the country); Italian banks are again facing financial problems; and the business media has already estimated that the Italian economic crisis could blow up the entire European banking system.

- Until recently, the Italian economy had been showing anaemic growth, but it began to decline over the last two quarters.

- In light of the European Commission’s threat of economic sanctions, the Italian government had to negotiate and make concessions in its fiscal policy, and now, due to Italy’s shrinking economy, Conte’s cabinet is once again facing a dilemma: either put up with the economic stranglehold by EU bureaucrats (and voter dissatisfaction) or go up against the European Union.

SLIDE 18 - GLOBAL RISK ASSESSMENT

Let's shift gears to the MATASII Global Risk Assessment by those institutions (and others) shown across the top of this slide.

Bloomberg economics' global GDP tracker has been downgraded to its slowest pace since the financial crisis, with world economic growth slumping to 2.1% on a quarterly basis. That's down from 4% in the middle of last year.

According to Economists:

- "The risk is that the downward momentum will be self-sustaining."

- “The cyclical upswing that took hold of the global economy in mid-2017 was never going to last.

- Even so, the extent of the slowdown since late last year has surprised many economists, including Bloomberg.”

The OECD joined the IMF in slashing its 2019 growth forecast, cutting its projection for aggregate global growth to just 1%, just over half of its previous outlook of 1.8%.

"as more central banks opt to retreat into the safety of stimulus, or at least back off their hawkish rhetoric, we'll see if disaster can be averted once again?"

OECD SLASHES GLOBAL GDP FORECAST, WARNS "OUTCOME COULD BE WEAKER STILL"

- OECD downgraded the 2019 GDP forecast of almost every Group of 20 nation including the US, China, UK and Euro Area,

- It now expects Italy to be headed to worst year since 2013.

- "Growth outcomes could be weaker still if downside risks materialize or interact."

- "The global expansion continues to lose momentum,"

- Weakness in the euro area and China are proving more persistent, trade growth has slowed sharply and uncertainty over Brexit has continued.

- The OECD's gloomy forecast may be already stale since central banks led by the Fed have already responded to the changed circumstances, and the ECB may follow soon,

- The OECD seemed especially worried about Europe's near-recession, noting that while central banks should stay in expansionary mode, the group called for structural reforms and fiscal stimulus in the European countries that could afford it (cough Germany), saying that “monetary policy alone cannot resolve the downturn in Europe or improve the modest medium-term growth prospects.”

- The OECD singled out Brexit as one of the persistent threats, warning that If the U.K. doesn’t secure a deal, it sees a risk of a near-term recession, with “sizeable negative spillovers” on other countries.

SLIDE 19 - WTO

Even the World Trade Organization (which we have traditionally not followed in our Global Risk Assessment until recently) are listing the following indicators (some of which we have not seen before) as serious concerns:

- Merchandise Trade Volumes

- Export Orders

- International Air Freight (IATA)

- Container Port Throughput

- Automobile Production & Sales

- Electronic Components,

- Agricultural Raw Materials

SLIDE 20 - WEF

The WEF (World Economic Forum) at DAVOS suggested we need to seriously be worrying about Weather and Natural Disasters. Natural disasters are becoming globally more and more common occurrences, not previously as frequent and massive. The economic impact is often profound, unplanned and financially destabilizing.

Separately, at the Annual meeting of the American Economic Association the IMF warned in the starkest terms yet about an upcoming global recession and that the leaders of the world’s largest countries are "dangerously unprepared" for the consequences of a serious global slowdown.

The IMF's chief concern: much of the ammunition to fight a slowdown has been exhausted and governments will find it hard to use fiscal or monetary measures to offset the next recession, while the system of cross-border support mechanisms — such as central bank swap lines — has been undermined,

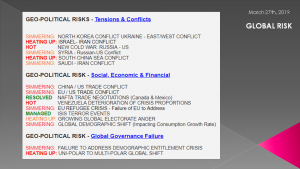

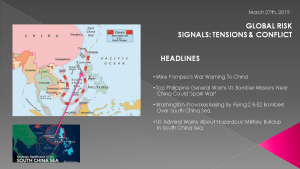

SLIDE 21 - GEO-POLITICS - CURRENT STATUS

Let's now run through our Geo-Political Risk areas which we traditionally group into three categories:

- Tensions & Conflicts

- Social, Economic & Financial and

- Global Governance

These are all exploded further on the MATASII site so we will just pick an important one from each group.

SLIDE 22

The South China Sea conflict is getting worse by the day.

The Secretary of State's visit to the Philippines after the North Korea Summit in Vietnam saw Mike Pompeo strongly warn China that any armed attack by China on a Philippine ship or plane in the South China Sea will be treated as an attack on an American ship or plane, bringing a U.S. military response.

He also said “China’s island building and military activities in the South China Sea threaten Philippine sovereignty, security and, therefore, economic livelihood, as well as that of the United States,”

“As the South China Sea is part of the Pacific, any armed attack on Philippine forces, aircraft or public vessels in the South China Sea will trigger mutual defense obligations under article 4 of our mutual defense treaty.”

SLIDE 23

Why make such a statement?

For years, Beijing has claimed as national territory virtually the entire South China Sea. Vietnam, Malaysia, Singapore, Taiwan and the Philippines all reject China’s claims to the Paracel and Spratly Islands within that sea. But Beijing has occupied and expanded half a dozen islets; landed planes and troops; and fortified them as military and naval bases.

Pompeo’s declaration amounts to a U.S. war guarantee.

Meanwhile, in parallel the US seized an island in the South China Sea for apparent training for war with China.

How would you expect the Chinese to react to this as additionally the

- "It is critical for us to be able to project power in the context of China, and one of the traditional missions of the Marine Corps is seizing advanced bases",

- "If you look at the island chains and so forth in the Pacific as platforms from which we can project power, that would be a historical mission for the Marine Corps and one that is very relevant in a China scenario."

SLIDE 24

Here are just some of the headlines we have read since our last report that strongly indicate the world is rapidly undertaking massive military buildups in a raft of hot spots.

SLIDE 25 - GEO-POLITICS - SIGNALS - SOCIAL, ECONOMIC & POLITICAL

From a Social, Economic & Political perspective we are seeing evidence of what the end of the Debt Super-Cycle likely portends.

How would you describe the social mood of the nation and world?

- Anti-Establishment?

- Anti-status quo?

- Anti-globalization?

- Choking on fast-rising debt?

- Stagnant growth,

- Stagnant wages

- Rising wealth/income inequality?

- Rising disunity?

- Political polarization?

These are all characteristics of the long-wave social-economic cycle that is entering the disintegrative (winter) phase.

- Souring social mood,

- Loss of purchasing power,

- Stagnating wages,

- Rising inequality,

- Devaluing currencies,

- Rising debt,

- Political polarization and

- Elite disunity

SLIDE 26

These are all manifestations of this phase of history which has been painstakingly assembled by Fischer and Turchin.

We can therefore anticipate:

- Ever higher prices for food, energy and water.

- Ever larger government deficits which end in bankruptcy/repudiation of debts/new issue of currency.

- Rising property/violent crime and illegitimacy.

- Rising interest rates (until very recently this was considered “impossible”).

- Rising income inequality in favor of capital over labor.

- Continued debasement of the currency.

- Rising volatility of prices.

- Rising political unrest and turmoil (see “Revolution”).

And there you have our future, visible in the 13th, 16th and 18th century price-revolution waves which preceded ours.

With this list of manifestations in hand, we can practically write the global headlines for 2019-2025 in advance.

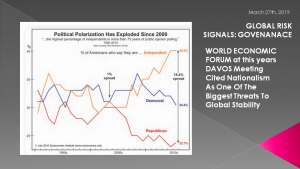

SLIDE 27 - GEO-POLITICS - SIGNALS - GOVERNANCE

Finally the third of our Geo-Political Signals - Global Governance.

The WEF is worried that the world won't be able to nimbly cooperate and respond to threats if something isn't done about the increasingly "state-centered" politics (that is growing populism and nationalism),

To quote them in their Annual Global Risks report presented at DAVOS in January:

Is the world sleepwalking into a crisis? Global risks are intensifying but the collective will to tackle them appears to be lacking. Instead, divisions are hardening. The world’s move into a new phase of strongly state-centered politics, noted in last year’s Global Risks Report, continued throughout 2018. The idea of “taking back control”— whether domestically from political rivals or externally from multilateral or supranational organizations— resonates across many countries and many issues. The energy now expended on consolidating or recovering national control risks weakening collective responses to emerging global challenges. We are drifting deeper into global problems from which we will struggle to extricate ourselves.

[...]

If another global crisis were to hit, would the necessary levels of cooperation and support be forthcoming? Probably, but the tension between the globalization of the world economy and the growing nationalism of world politics is a deepening risk.

In searching for something - anything - to blame for the rise of populism (that is, aside from policy decisions dictated by increasingly out-of-touch elites) - the report hits on the growing occurrence of mental illness around the world, though they elide over the drivers of the "societal changes" that the WEF researchers believe are at the root of this problem.

In my opinion the driver behind much of the growth in populism, nationalism, mass migrations and much of the social unrest is INEQUALITY - recently made much worse by failed Monetary Polices to stem the end of the Debt Super-Cycle.

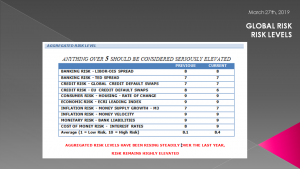

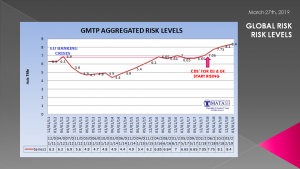

SLIDE 28 - GLOBAL RISK LEVELS

All of the above shows in the updated MATASII Global Aggregated Risk Level which has deteriorated over the last 5 months from 8.1 to 8.4.

SLIDE 29

At 8.4 we are well above levels last seen during the EU Banking Crisis and have been above that level since EU & UK CDS' began rising during the run up to the UK BREXIT.

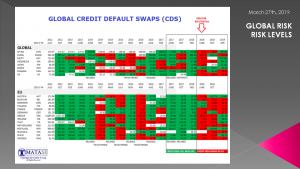

SLIDE 30 - GLOBAL CDS TRENDS

You can see the reversal here in the MATASII tracking of Global CDS changes.

SLIDE 31 - CONCLUSION

There is lots to worry about - any of which could trigger major financial market reactions.

As we show in this months mailing we are particularly concerned from an overall Situational Analysis perspective about:

- AN EMERGING NEW "COLD WAR"

- THAT GROWING "POPULISM" WILL LEAD TO SOCIALIST LEADERS and

- SLOWING GLOBAL TRADE & THE IMPACT OF DE-DOLLARIZATION

SLIDE 22 - GEO-POLITICS - SIGNALS - TENSIONS & CONFLICT

SLIDE 32 - TRUMP

So, in closing, as I always remind you – remember the answer will be to print more money.

It is the only answer politicians will ever agree on.

Until No one wants it or Trusts It!

Invest accordingly.

SLIDE 33 - DISCLAIMER & WRAP

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeably and well informed financial advisor.

So until we talk again, may 2019 turn out to be an outstanding investment year for you and your family.

Thank you for listening