IN-DEPTH: TRANSCRIPTION - LATE CYCLE INVESTING & RECESSIONS

COVER

AGENDA

SLIDE 5

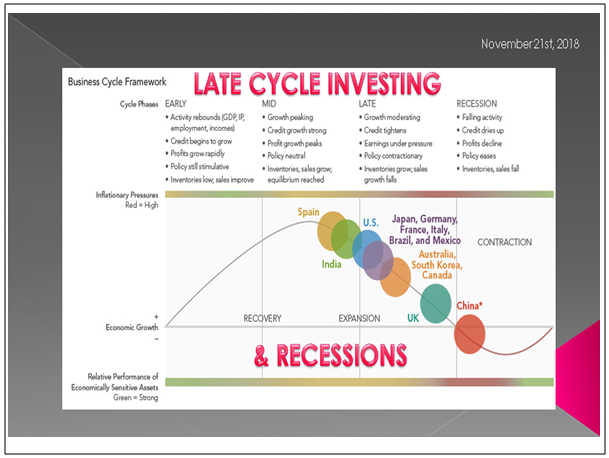

Most would agree with the general analyst consensus that we are late in the Economic / Business cycle and that there is a Recession coming sometime within the next two years.

What does that mean and what do you do about it?

To answer that question let me first spend a little time on what are philosophy at MATASII has been in this regard and how we have effectively learned to position ourselves for it.

Let me take you behind the curtain at MATASII.

It is critical to understand that everything an investor can try to do to improve performance falls under one of two headings: Cycle Positioning OR Asset Selection.

- Cycle Positioning consists of having more investments and more aggressive investments when the market is poised to do well and fewer investments and more protective investments when the market is poised to do poorly.

- Asset Selection consists of owning more of the things that will do better and less of the things that will do worse.

As ridiculous simple as this sounds few have a proven methodology that assures this occurs!

SLIDE 6

Let's start with Cycle Positioning.

Let’s assume your goal is to have a defensive posture at the right time and an offense posture at the right time. There are two possibilities to achieve that:

First you need to have a forecast of what’s going to happen. You can do this by predicting psychology and guessing at how people are going to feel about things a year from now: How they will feel about the market, the economy, company performance, the administration in Washington and so forth.

But I do not think that this can be done successfully.

SLIDE 7

Why?

Because simply said: “Our World is much too Uncertain to permit Certainty”.

We don’t know what’s going to happen and just as importantly, we certainly don’t know how the market is going to react to it.

Let’s go back two years to the run-up to the last US Presidential election. There were two things most investors were certain of:

- Hillary Clinton would win the presidency and,

- If by some fluke Trump won, the market would crash.

But what happened was Trump SHOCKINGLY won, and maybe more shockingly, the market went up.

If that’s not enough to convince you that forecasts don’t work I don’t know what will!- other than the loses many incurred!

SLIDE 8

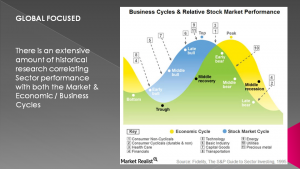

Getting back to Cycles, we have found over the years that you must first have a sense of where the market stands in its Economic / Business cycle. Then you must determine where the Market is in relationship to that Cycle (historically the market normally can be expected to lead the Business Cycle by approximately 6-8 months).

It is knowing where you are in the later is what determines the largest percentage of your odds for your investment.

- When the market is attractively positioned, low in its market cycle, then the expected return is above average, and you want to play offense.

- In contrast to that, when the market is unattractively positioned, high in its market cycle, then the expected return is below average, and you want to play defense.

- When you get this judgment right, then your results will be better than average.

Pretty simple so far - right?

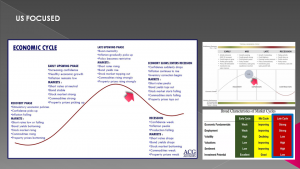

SLIDE 9

Here is where it starts to get interesting.

First you need to know where you are in the Economic Cycle for your Investment Area (i.e the US) and then where you are in the Global Economic / Business Cycle. The later is much trickier which you will see in moment.

With that under your belt you then need to consider the main factors which influence where the market is in its cycle. These are:

I.Fundamentals in the Longer Term

II.Risk in the Intermediate Term

III.Sentiment (Investor Psychology) in the Short Term.

SLIDE 10 - SENTIMENT: EXPECTATIONS (FEAR & GREED)

The market tends to reflect how the economy has been doing and how companies have been doing.

But most investors think naively that if good things happen, stocks will go up, and if bad things happen, stocks will go down. But sometimes the opposite is the case.

If Expectations are too high you can have good things happen, but investors are disappointed, and stocks go down. Or, you can have unpleasant events but if they’re not as bad as expected the market can go up.

Every event can be interpreted positively or negatively. For instance, rising interest rates can be a bad thing because it could crush businesses. But it also can be viewed as a good thing because it signals that the economy is strong.

SLIDE 11

Why is investor psychology so important?

Investors are not good at taking all the factors into account and balancing them. Usually they look only at the positives or only at the negatives.

In real life, things fluctuate between «pretty good» and «not so hot». But in the market, attitudes fluctuate between «all good» and «all bad».

That’s what happened a few weeks ago when interest rates on the long end started to rise. So it’s not enough to know what you think is going to happen event-wise. You also have to think about psychology and emotion, because where the market stands and what the market does is the result of the interaction of what events occur and how people react to them. If you can understand what expectations are factored into the market and where emotion and psychology stand, then you have a better chance of getting the odds on your side.

SLIDE 12 - RISK: GETTING THE ODDS ON YOUR SIDE

Think of a bowl full of lottery tickets. The makeup of the tickets changes as the market moves in its cycle. Let’s say, normally there are 60% winning tickets and 40% losing tickets in the bowl. But when the market is low in its cycle it may be 90% winning tickets and 10% losing tickets. And when the market is high in its cycle it’s 30% winning tickets and 70% losing tickets.

Before you decide to buy a lottery ticket, wouldn’t you like to know the composition of the tickets in the bowl?

In other words: If you think clearly about the composition of the tickets you can get the odds on your side. However, even when you have the odds on your side it doesn’t tell you what’s going to happen. You can have a bowl with 90% winners and 10% losers and you reach in that bowl and you pull out a loser. All you can do is get the odds on your side, so your probability of success is better than neutral. And if you can do that repeatedly in the long run you will come out ahead.

SLIDE 13

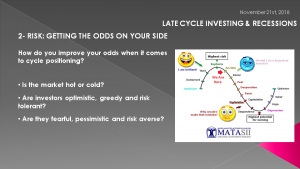

So how do you improve your odds when it comes to cycle positioning?

It’s very hard to make predictions of the future but it’s not so hard to assess the current environment. That’s how you can improve your results, and it comes down to one understanding:

- Is the market hot or cold?

- Are investors optimistic, greedy and risk tolerant?

- Are they fearful, pessimistic and risk averse?

When it’s the latter category, that’s when we want to buy. We want to buy when everybody discounts the positives and overrates the negatives. And if the opposite is the case, then we want to reduce our risk.

SLIDE 14 - FUNDAMENTALS

To understand the Fundamentals we must additionally appreciate the Economic & Business Sub-Cycles. They are:

- The Profit & Inventory Cycle

- The Credit Cycle

- The Monetary Policy Cycle

If you are finding this all too involved then you can appreciate why the MATASII site appears so detailed, involved and possibly complex. You must understand all this and apply it to make high probability investment choices.

SLIDE 15

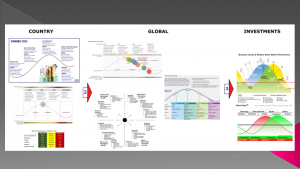

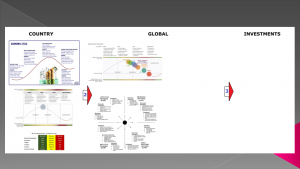

Let me schematically take you through how we do this at MATASII in arriving at our Strategic Investment Insights (or SIIs)

Don't try and read this illustration, but rather I just want you to see it as the roadmap of the illustrations I am going to show you. Notice we start on the left with country, then go to Global and end with Investment.

SLIDE 16

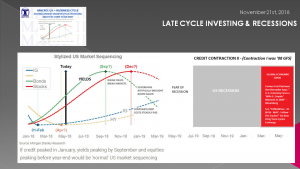

First we determine where we think we are in the US Economic / Business Cycle.

Economy Slows => Enters a Recession

- Confidence Suddenly Drops:

- Inflation Continues to Rise

- Inventory Correction Begins

Markets:

- Short Rates Peak: MORE RATE HIKES EXPECTED

- Bond Yields Top Out: MAJOR MOVES UP IN LAST 60 DAYS - PULLING BACK

- Stock Market Starts Falling: SOME SCARES - DOWN MARGINALLY IN US

- Commodities Starts Falling: OIL

- Property Prices Tops Out: RESIDENTIAL REAL ESTATE

SLIDE 17

Having a sense of this for your primary market (I understand that many you trade in other countries and on foreign exchanges)- obviously substitute your country.

Now we need to consider what many consider the Global Macro. This is where the real research comes in.

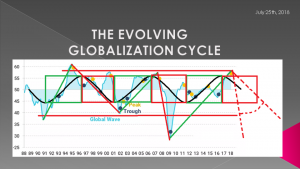

SLIDE 18

We recently did a full video on the evolving Globalization Cycle and where we are in it from a Technical Analysis perspective. I encourage you to review it if you haven't already. It can be found on the MATASII site and our YouTube channel.

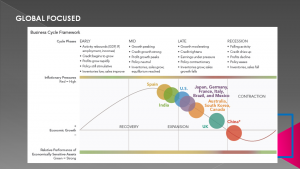

SLIDE 19

We don't go through every country but we do assess the countries we outline and regularly post on in our Macro Research area along with a three times a year "Regional" focus.

This is where we stand globally today.

China has an aster because we are using a "Growth Recession" premise where a significant decline in activity relative to a country's long term economic potential. The "Growth Cycle" definition is used for most developing economies such as China because they tend to exhibit strong trend performance driven by rapid factor accumulation and increases in productivity AND the deviation from the trend tends to matter most for asset returns.

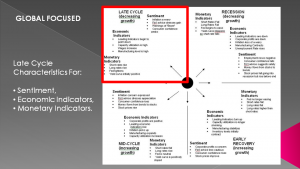

SLIDE 20

Next we attempt to synthesis these differing points in the Economic Cycle for a consensus reference point so we can eventually bridge to the Market Cycle. You can see that Sentiment, Economic Indicators & Fundamentals along with Monetary Policies play an important part here.

SLIDE 21

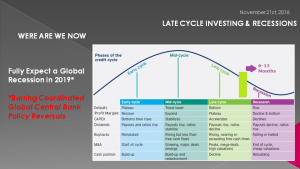

With this under our belt we move to an extremely important part of the synthesis. I and my colleague Richard Duncan have written extensively how we have moved from Capitalism to Credtisim in the era of Globalization and the Debt Supper Cycle.

SLIDE 22

Therefore the Credit Cycle is extremely critical and actually is the defining point in our analysis. The areas of Defaults, Margins, CAPEX, Dividends, Buybacks. M&A and EBITDA tell us about Global Flows and Liquidity.

SLIDE 23

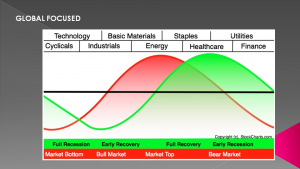

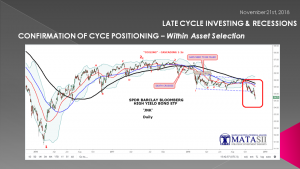

Armed with our conclusions on the Global & Country Economic / Business Cycle positioning, we now consider the Market Cycle.

SLIDE 24

We try and see how far ahead the Market is to the Economic / Business Cycle. Equity Sector performance is a big add here.

SLIDE 25

.. as well as sub-sectors and individual stocks like the FAANGS which are broadly held across the ETF Index dominion.

SLIDE 26

I know I have moved through this quickly and at a very high level but hopefully it helps in assisting why we track so many indicators and subjects at MATASII.

SLIDE 27

Our synthesis continues to give us extremely clear MATASII Date$, Timing zone$ and Bia$ which we post monthly as part of the MATA research updates.

This post here back in April identified pretty well the timing tops for IG / HY credit and Equities

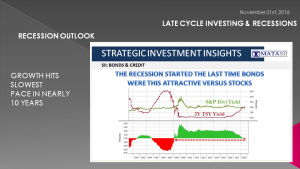

SLIDE 28

It allowed you time extremely well the Instruments within our number one SII - the Bond & Credit Watchlist

You have had plenty of time to be prepared for the shock that is hitting ETF's such as the JNK and HYG.

SLIDE 29

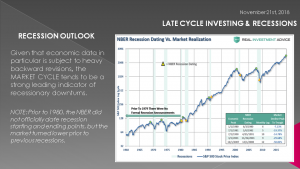

These tell tales also help you identify exactly when we can expect the next US and possible Global Recession. It is within 1-2 years but is being brought forward at an extremely fast rate as we talk.

SLIDE 30

You shouldn't be waiting for the Recession to happen - the time to act is now. The markets signal the event - not the lagging economic info.

That takes us to Investment Timing - not Economic, Business and Market Timing but rather specific SII and investment vehicles.

SLIDE 31

Here we find sectors, sub-sectors and instruments don't all act as we would suspect. Shown here is our Automotive SII where you can see most sub-sectors are short but one is long. The "whited" out area are the individuals financial investment instruments.

SLIDE 32

Many of our SII's show similar profiles and both short and longs. Our SII slection gets you into the areas that we expect movement. Our process tells you when and in which direction. This is where our extensive technical analysis and proprietary HPTZ process comes in

SLIDE 33

Here is APPLE's chart as an example. We nailed the up in the FAANG and NOSH stocks which was one our SII focuses in 2018 (and prior) but also got us out correctly and them shorted correctly as we head for our HPTZ.

We are going to discuss more on this element of our process in our December LONG Wave video, since that is where we focus on the Markets specifically.

SLIDE 34

So, in closing, as I always remind you – remember the answer will be to print more money.

It is the only answer politicians will ever agree on.

Until No one wants it or Trusts It!

Invest accordingly.

SLIDE 35

SLIDE 36