IN-DEPTH: TRANSCRIPTION- MACRO INVESTING IN AN ERA OF POLITICAL DISCORD

COVER

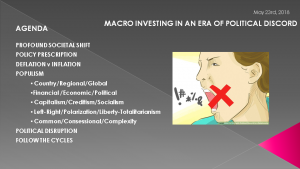

AGENDA

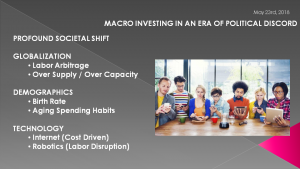

SLIDE 5 - PROFOUND SOCIETAL SHIFT

We are in the midst of a profound societal shift that we all realize but somehow we forget in the midst of the onslaught of everyday activities. The list of significant changes is long, but I have isolated three here.

We accept "Globalization" as though it has been with us for a long time when in fact 20 years ago prior to the Tech Bubble, the advent of the Internet and China's entry into the WTO, there were best selling books just coming out predicting the coming era of Globalization. What most failed to realize at the time was that Globalization would usher in two profound drivers of societal change. Labor Arbitrage and Over Supply.

54,000 US manufacturing facilities subsequently left the US to take advantage of cheaper offshore labor rates. Descriptors like Outsourcing, Offshoring, Downsizing, Rightsizing etc were coined and became part of the common global vernacular. As a direct consequence of Monetary policies of Quantitative Easing, global over supply, over capacity and under-utilization became common and with them lost pricing power. All these were powerful Deflationary forces.

The stealth shift of Demographics has also been occurring in parallel in a perfectly predictable manner. Reduced Birth Rates policies in countries such as China and Japan were societal game changers but were also seen in many other highly populated countries due to the availability of birth control pills etc. Separately the post WWII Baby Boom has now delivered an aging population in most of the developed economies with reduced consumption needs and now today the withdrawal / reduction of their savings in the form of retirement income. Both also powerful deflationary forces.

The impact of technology can't be overstated. The Internet has become ubiquitous and has transformed almost all industries and business models. Robotics is only now truly sweeping across society in the form of driver-less cars, "black factory" automation, retail kiosks and an endless array of products that increasing utilize integrated Facial Recognition, Artificial Intelligence and sophisticated mobility capabilities. Technology has become an additional powerful global deflationary force

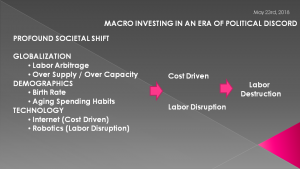

SLIDE 6

Besides profound deflationary global pressures these three shifts are having, they have been predominately targeted at cost reduction (versus dramatic new and major revenue enhancers). They have proven to be incredibly disruptive to existing labor employment.

In fact I would argue that together they have become major global destructive forces to net labor employment growth. Growth that is sufficiently reduced as not to be able to reduce the 600,000 new jobs estimated by the World Bank to be required within the next 10 years.

SLIDE 7 - POLICY PRESCRIPTION

All of these shifts have been with us for awhile and government's have been forced to act in some fashion. However, their policies can only be described as policies of delay or "kicking-the-can-down-the-road".

Policy initiatives that will solve the looming global problem of employment growth have been basically swept from public the narrative. This is primarily because there are no political answers and additionally the problem is global and our present political structure is built around the "nation state".

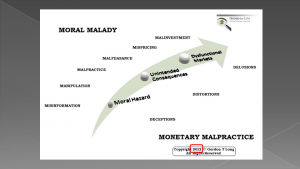

SLIDE 8

I have showed this diagram of Monetary Malpractice for years now. It has proved itself as matters have unfolded exactly as we anticipated in 2012 and outlined in many of our annual thesis papers including the 2013 paper on Statism.

The Monetary Policies of Quantitative Easing and Zero Interest Policy (or ZIRP) and a raft of other untested policies have delivered the expected Moral Hazard, Unintended Consequences and Dysfunctional markets, all perfectly predicable if these policies were allowed to be continued too long. Which they have were!

SLIDE 9

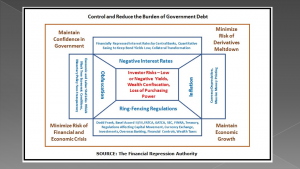

Our 2012 Thesis paper on Financial Repression spelled out this macro-prudential policy by central banks and government's who were entrapped, without solutions to these powerful shifts. I co-founded the "The Financial Repression Authority" to specifically track the expected advancement of these policies. The FRA still does this and I encourage you to follow our free articles and podcast interviews.

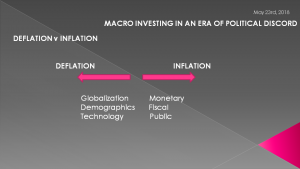

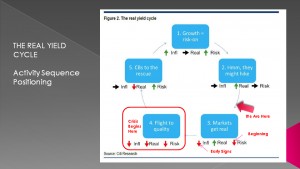

SLIDE 10 - DEFLATION v INFLATION

Simply stated, we have two tectonic forces pulling at each other. Deflation from the natural shifts we just described and Inflation as a result of the policy prescriptions being used by the powers to be to combat deflation.

SLIDE 11

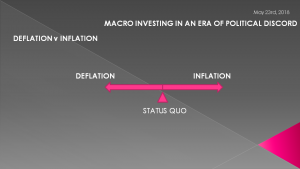

The current objective is most fundamentally about protecting the existing status quo within individual countries in its many forms. By attempting to keep these forces in balance it is hoped existing legacy systems will not be fatally affected.

SLIDE 12

The problem is that society is changing in many ways and making the leverage and effectiveness increasingly strained.

SLIDE 13 - POPULISM

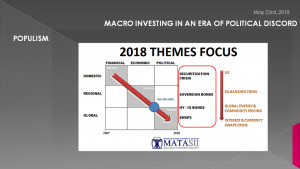

The extensive societal changes are laid out on the MATASII site through both the 41 Tipping Points we track and the Themes Abstraction grid and its associated posts within the Themes section of the Macro Analytics content tab. You will recognize this graphic from that Themes section of the MATASII web site. We originally drew this graphic just after the 2008 Financial Crisis to position our expectations of a potential unfolding road map.

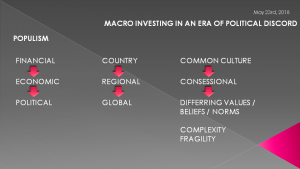

SLIDE 14

As the world becomes an increasingly globalized system, then it is to be expected because of the range of inter-dependencies, that the critical problems would inevitably shift from Financial to Economic to Political. That is precisely what has occurred. The cultural problems of differing values, beliefs and norms complicate problem understandings and resolution. Emerging problems are also much more technically complex and having evolved without planning and stress testing, the system as a consequence is very fragile and prone to abrupt failure.

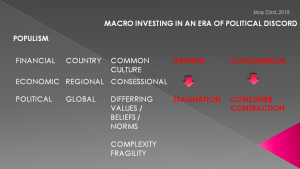

SLIDE 15

Major looming problems of Economic Stagnation and Consumer Contraction are not currently part of the public policy debate. They only await a crisis which may be too deep and quick to be addressed in the global manner in which it will need to be addressed.

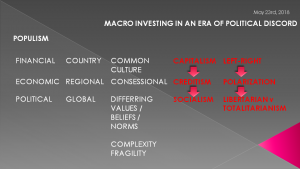

The shift in "populism" politics is telling us a lot about where we are likely headed and the investment challenges that lie ahead.

We have witnessed, and we at MATASII have written about many times, the growing populist politics that is Anti-Establishment, Anti-Status Quo and is the case of Europe for example Anti-EU. We are seeing increasing demands for succession votes on separation as in Scotland and Catalonia and even recently from some states such as California over fundamental disagreements on Sanctuary cities.

These are only symptoms telling us that the Social Contract has broken down. This is the unwritten contract between the electorate and political leadership whereby the government will continue to deliver improved standards of living for all and the opportunities to seek better lives for themselves and their children. When this stops happening social unrest quickly leads to more pronounced actions.

This is what is beginning to occur now as for example in the US as 43% of its citizens are now reproted as no longer being able to afford to pay for food and rent without some form of government subsidy or transfer payment. I encourage you to read the United Way's newest study on a class of Americans they call ALICE: Asset Limited, Income Constrained, Employed. The United Ways study found that this group does not make the money needed “to survive in the modern economy.” Between families living below the poverty line due to unemployment or disability and ALICEs, the study discovered that 43% of Americans were struggling to cover basic necessities like rent and food.

This is not unique to the US and can be found in many developed economies despite crippling government funded entitlement programs. This is the social contract breaking down.

SLIDE 16

We have outlined in previous UnderTheLens releases how the Capitalist system has morphed into a credit-centric system or what my colleague Richard Duncan refers to as Creditism. This shift is fundamentally about the plumbing of the financial and economic infrastructure. The current shift is towards something that is about Economics and Politics which I believe Bernie Sanders in the US gave us a peek into in the last US election primaries. The 74M strong Millennial generation appeared to flock to this older gray haired politician who espoused his form of Socialism through politics such as a $1.4T Student Loan forgiveness program.

Meanwhile the older 73M Baby Boomer generation is contracting their historic rampant consumerism as they prepare for retirement and start withdrawing investment capital to fund current expenses. The US retail sector is in serious troubles as Malls close down, big box store chains go out of business and franchise operations struggle. This is more than "going online" and being "Amazoned".

This is additionally about real disposable incomes no longer keeping up. The Consumer is retrenching in a 70% consumption economy and a consumer contraction of its growth rate is well underway. This is a major societal shift.

SLIDE 17

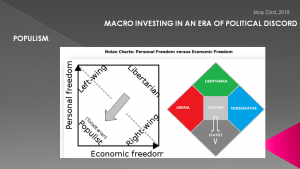

In our 2013 Thesis paper "Statism" I wrote about these shifts using Nolan charts. As much as the current polarization in politics between the views of the left and right appears to be, the real shift that is occurring is between the Libertarian beliefs and those of the Statists. Not that many years ago the secret of political strategy was to dominate the middle. That middle has shifted downwards - rather than just more left or right leaning.

SLIDE 18

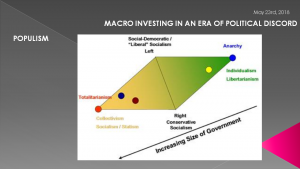

With the increasing size of government we are tipping towards "Social Democrats" and "Liberal Socialism" as Collectivism and its views become more politicly correct. Unfortunately this leads towards leaders who capture growing populism with harsher forms of government which promote nationalism to achieve its goals.

SLIDE 19 -

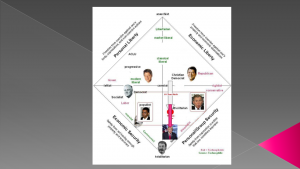

I drew this diagram in 2013 on where I felt we stood then in this migrational shift. Security on various forms was clearly winning out over the importance of Liberty. Left or Right was not the real issue. It was the direction of real government policies that was important not the campaign rhetoric.

SLIDE 20

After the election of Donald Trump and his first year and half in power I would suggest we have now moved further towards harsher forms of government policies to implement "Make America Great Again" and "America First". I am in no way besmirching President Trump here as he is nothing more than representative of the expected societal shift we forecast in 2013 as the likely outcome.

SLIDE 21 - POLITICAL DISRUPTION

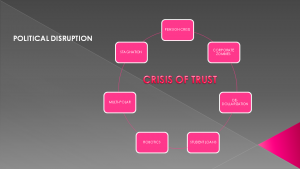

In our 2016 Thesis Paper - "Crisis of Trust" we argued that the failure of political leadership to resolve issues and address the real problems the electorate was facing in their daily lives had lead to a Crisis of Trust in the existing political system across most of the developed economies.

The ring here are some of the massive problems that have been left unresolved and will soon, like a Tsunami or Perfect storm overtake society. Many of these we have covered in detail in the 2014 Thesis "The Globalization Trap", in 2015 in "Fiduciary Failure", in 2017 in "Illusion of Growth" and earlier this year in the emerging "New World Order" annual thesis papers.

The reports lay out the facts not just speculation. This is the road we are on and Investors must therefore prepare accordingly. But how??

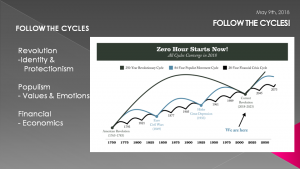

SLIDE 22 - FOLLOW THE CYCLES

In our latest Long Wave we attempted to distill these shifts and many of the major cycles underway, in such a fashion as to give you the sign posts to be watching for and taking action on. The essence of what we wrote about was how the Credit Cycle today in an era of Creditism has become paramount. It is the controlling global linkage when factored into Global Liquidity & Capital Flows.

SLIDE 23

We conclude we still have a ways to go before a lot of what we are talking about comes to a head which gives you sufficient time to prepare effectively. If you have not viewed the recent LONGWave video "Follow the Cycles" or March's UnderTheLens release of "Global Liquidity, Credit & Flows" I encourage you to do so in the context of what we have just described.

SLIDE 24 - THEY WILL PRINT THE MONEY

So, in closing, as I always do –remember: the answer will be to print more money. It is the only answer politicians will ever agree on, especially during a global crisis.

That will continue to be the case until such time as no one wants the currency or trusts it! That is when Hyper-Inflation arrives - not before.

Invest accordingly.

http://bit.ly/2x0JysY-Transcription