IN-DEPTH: TRANSCRIPTION - MACRO OUTLOOK - MAY 2019

COVER

AGENDA

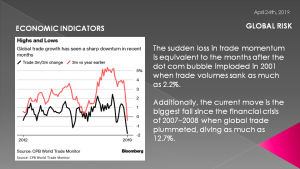

SLIDE 5 - ECONOMIC INDICATORS

The UK Telegraph writes:

"An industrial slump has been triggered by a perfect storm of factors, including China’s slowdown, the car industry downturn, Brexit paralysis and Donald Trump’s attempt to upend the international trade system with tariffs on European and Chinese goods," --- The Telegraph.

According to The Telegraph the sudden loss in trade momentum is equivalent to the months after the dot com bubble imploded in 2001 when trade volumes sank as much as 2.2%.

Recent trade growth numbers are the biggest fall since the financial crisis of 2007–2008 when global trade plummeted, diving as much as 12.7%.

Data from the CPB Netherlands Bureau for Economic Policy Analysis revealed that world trade volume dropped 1.8% in the three months to January compared to the preceding three months as a synchronized global downturn gained momentum.

SLIDE 6

According to IMF Managing Director Christine Lagarde:

"this is a "delicate moment" for the global economy as many countries are in the midst of a severe slowdown. The global economy has "lost further momentum" in the last six months"

The global downturn in trade is widespread geographically and Lagarde pinned trade volume deterioration on decelerating global growth and "the impact of increased trade tensions on spending" on producer goods.

According to the IMF the synchronized slowdown is expected to stabilize beyond 2020; however, in the meantime;

It's likely the world could be headed for a trade recession, if not already in one.

Again, according to Lagarde, "more or less, the synchronized global slowdown has put developed and emerging economies into its most vulnerable spot since the financial crisis".

SLIDE 7

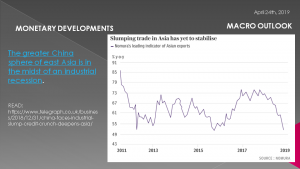

We showed this WTO chart in our latest Global Risk update but have appended updated chart on the right from Nomura showing the slowing is only getting worse.

SLIDE 8 - ECONOMIC OUTLOOK

The Economic Indicators are confirming our Macro Outlook.

One of the best macro cycles experts is the renowned Harry Dent. The following two charts are from his work. I interviewed Harry a couple of years ago and I encourage you to review the podcast / transcript and charts from that discussion as they are even more salient today as the "window" he warned about now arrives.

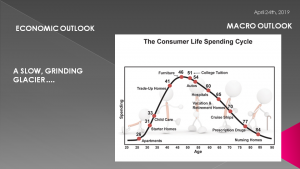

SLIDE 9

The post WWII era fostered not only a US Baby Boom but it similarly occurred in most developed nations.

Most analysts recognize that the heavy indebted Millennial's are simply not going to offset the spending changes occurring as that generation moves into their 70's.

SLIDE 10

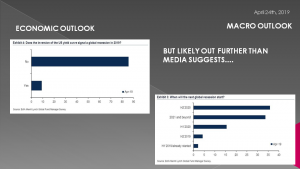

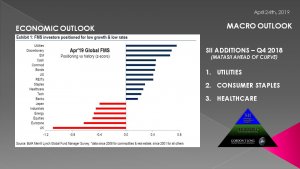

Wall Street's professional investors are preparing for the worst, with two-thirds once again falling into the "secular stagnation" camp ahead of what is now a consensus call for a recession in the second half of 2020.

According to the latest monthly Fund Manager Survey conducted by Bank of America which polled 239 investing professionals with an AUM of $664 billion in the April 5-11 period, investors are now positioned for "secular stagnation" - even as they dipped their toe into risky assets:

SLIDE 11

"They are long assets that outperform when growth and rates fall, like cash, EM and utilities, while short assets that require higher growth and rates, such as equities, the Eurozone and banks“

No recession: 70% of investors surveyed expect a global recession to start in the second half of 2020 or later...

A whopping 86% believe the yield curve inversion does not signal an impending recession, which begs the question: if everyone is discounting the yield curve as a signaling mechanism, why is everyone so convinced that a recession is coming... and tied to that, why is everyone so certain that a yield curve inversion does not indicate a recession?

SLIDE 12

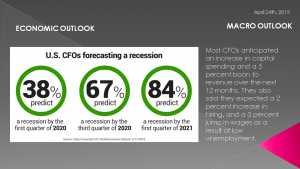

About 67 percent of CFOs surveyed by the Duke University Fuqua School of Business believe the nation’s economy will enter a recession by the latter half of 2020, while close to 38 percent are predicting a recession by the first quarter.

About 84 percent, meanwhile, believe a recession will have started by the first quarter of 2021, according to the study

SLIDE 13

What we need to fully recognize something that few talk about.. and that is China's real economic data!

The PBOC deserves plaudits for delivering a softish landing, but a landing it is.

The economy will probably bottom out at growth rates of 4.5% this quarter (on proxy measures). Such stabilization is not enough for a world that has come to depend on China to hold up the heavens.

The greater China sphere of east Asia is in the midst of an industrial recession. Nomura’s forward-looking index still points to a deepening downturn. “Those expecting a strong rebound in Asian export growth in coming months could be in for disappointment,”

SLIDE 14

MANIPULATED ECONOMIC NUMBERS

Especially when you consider that Chinese Data is deliberately misleading!

Xi Jinping had to beat expectations with a crowd-pleaser in the first quarter. The number was duly produced: 6.4%. “Could it really be true?” Of course it is not true.

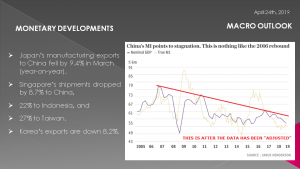

- Japan’s manufacturing exports to China fell by 9.4% in March (year-on-year).

- Singapore’s shipments dropped by 8.7% to China,

- 22% to Indonesia, and

- 27% to Taiwan.

- Korea’s exports are down 8.2%.

SLIDE 15

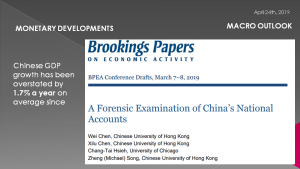

A paper last month by Wei Chen and Chang-Tai Tsieh for the Brookings Institution – “A Forensic Examination of China’s National Accounts” – concluded that GDP growth has been overstated by 1.7% a year on average since 2006. They used satellite data to track night lights in manufacturing zones, railway cargo volume, and so forth.

Bear in mind that if China’s economy is a fifth or a quarter smaller than claimed it implies that the total debt ratio is not 300% of GDP (IIF data) but closer to 400%. If China’s growth rate is 1.7% lower – and falling every year – the country is less able to rely on nominal GDP expansion whittling away the liabilities.

SLIDE 16

Debt dynamics take an ugly turn – just at a time when the working-age population is contracting by two million a year. The International Monetary Fund says China needs (true) growth of 5% to prevent a rising ratio of bad loans in the banking system.

The thinking is that China will rescue Europe. Optimists are doubling down on another burst of global growth, clinched by the capitulation of the US Federal Reserve. It will be a repeat of the post-2016 recovery cycle.

FISCAL FLOOD GATES OPEN

Beijing has opened its fiscal floodgates to some degree over recent weeks.

- Broad credit grew by $430B in March alone.

- Business tax cuts were another $300B.

- Bond issuance by local governments was pulled forward for extra impact.

But once you strip out the offsets, it is far from clear that the picture for 2019 has changed.

I stick to my view that the US will slump to stall speed before China recovers. Europe is on the thinnest of ice. It has a broken banking system. It is chronically incapable of generating its own internal growth or taking meaningful measures in self-defense.

Momentum has fizzled out in all three blocs of the international system. We are entering the window of maximum vulnerability.

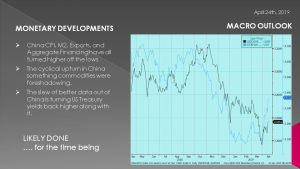

SLIDE 17 - MONETARY DEVELOPMENTS

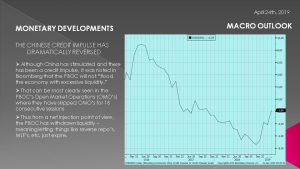

As you can see here the Chinese Credit Impulse has dramatically reversed.

Although China has stimulated and there has been a credit impulse, it was noted in Bloomberg that the PBOC will not “flood the economy with excessive liquidity.”

That can be most clearly seen in the PBOC’s Open Market Operations (OMO’s) where they have skipped OMO’s for 18 consecutive sessions

Thus from a net injection point of view, the PBOC has withdrawn liquidity – meaning letting things like reverse repo’s, MLF’s, etc. just expire.

SLIDE 18

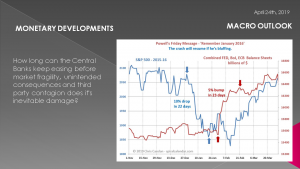

All the major Central Banks have now eased in some fashion or another,

SLIDE 19

This has had a significant impact on the Global Financial Markets. The question however is how long will this last? How long will the Central Banks keep easing before market fragility, unintended consequences and third party contagion does it's damage.

Or .. easy credit just stops working as lenders stop lending because borrowers are to risk, with poor collateral and borrowers stop borrowing because they have insufficient cashflows to maintain existing credit and zombie debt roll-overs are harder to get.

SLIDE 20

Despite what we said earlier, China CPI, M2, Exports, and Aggregate financing have all turned higher off the lows

The cyclical upturn in China something commodities were foreshadowing.

The slew of better data out of China is now turning US Treasury yields up.

CHINA IS NOW CONTROLLING GLOBAL RATES!!

IT IS STEADILY TAKING THE LEADERSHIP MANTLE FROM THE US.

SLIDE 19 - GEO-ECONOMIC DEVELOPMENTS

Shifting gears to Geo-Economic Developments, there are three points we must emphasize.

SLIDE 20

First is the De-stabilizing Impact is the just discussed Monetary Policies are having on the Macro Outlook.

The markets have become driven by central bank liquidity and no longer reflects fundamentals, true price discovery nor the correct pricing of risk.

We are effectively rotting the Capitalist system from the inside!!

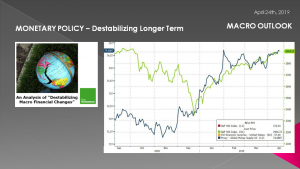

SLIDE 21

Think about the fact that Japan's central bank is quietly nationalizing its entire market.

The BOJ has gone from being a Top 10 holder in 40% Japanese stocks last March, to 50% just one year later.

The Bank of Japan is now A Top-10 Shareholder In 50% Of All Japanese Companies.

Bank of Japan now owns a stunning 75% of all Japanese ETFs.

As of March 2018, the Japanese central bank had become a major shareholder in nearly 40% of all listed companies.

This, of course, in addition to the BOJ's trillions in Japanese JGB holdings, which at last check were over 100% of GDP and 43% of all outstanding.

The BOJ also become the top shareholder in 23 companies, including Nidec, Fanuc and Omron, through its ETF holdings, but as of Q1, it was among the top 10 holders for 49.7% of all Tokyo-listed enterprises.

SLIDE 22

The second is De-Dollarization. Our Thesis 2019 paper on De-Dollarization laid out the serious risk of this accelerating direction and it gets worse daily as you can follow from our almost daily posts on new developments.

The development of a gold-backed digital currency is just one more sign that dollar dominance in global finance may end sooner than most expect. And we may be getting dangerously close to that point right now.

Russia and China are buying GOLD and reducing UST Treasury Holdings. There are practical problems with using gold as a form of currency, including storage and transportation costs. But Russia is NOW solving these transaction hurdles by combining its gold position with distributed ledger, or block chain technology.

SLIDE 23

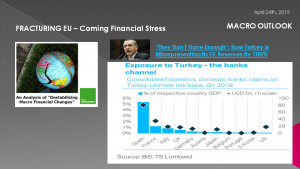

Thirdly, we are very concerned about the underpinnings of the EU economy and its fragile banking system.

There are many potential Tipping Points facing the EU and their banking system. The most recent which we posted on was the contagion from Turkey destabilizing highly dependent banks throughout Europe, but especially in already troubled areas such as Spain, Italy and France.

Turkey it appears is significantly misrepresenting their currency reserves - possibly by as much as 100%.

HEADLINE: "They Don't Have Enough": How Turkey Is Misrepresenting Its FX Reserves By 100%

Keep a close eye on Europe as collateral damage from the Asian slowdown as the EU just doesn't have the buffer to absorb the potential shock.

SLIDE 24

At a higher level the Macro Situational Analysis suggests three major drivers.

SLIDE 25

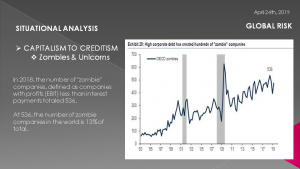

First the shift from Capitalism to Creditism and the emergence of Zombies & Unicorns.

In 2018, the number of "zombie" companies, defined as companies with profits (EBIT) less than interest payments totaled 536, not far off the highs seen during the Global Financial Crisis (626).

At 536, the number of zombie companies in the world is 13% of total

Ominously, low interest rates and the ability of lower-rated companies to issue debt has led to a rise in the number of "zombie" companies, i.e. companies that are extremely indebted and are unable to stay on their feet without the current backdrop of historically low interest rates.

SLIDE 26

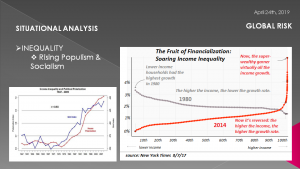

Secondly, growing Inequality and the rise of Populism and Socialist thinking

Political partisanship has risen in near-perfect correlation with wealth-income inequality, which it itself the hallmark of deeply systemic corruption, as the system is rigged to benefit the few at the expense of the many.

There's a phrase that describes a socio-economic system becoming the means for personal aggrandizement at the expense of civil society itself: moral decay.

How else can we describe a system whose inputs and processes are rigged so the output is the vast majority of all income gains flow to the top 0.1%?

In Developed Economies As Growth Slows We Should Expect:

When a socio-economic system institutionalizes the extra-legal privileges of wealth and power, that is moral decay.

When government only responds in ways that first serve the interests of entrenched insiders, that is moral decay.

When the financial system is rigged to sluice income and wealth to the top of the wealth-power pyramid while strip-mining the productive class below via inflation and taxes, that's moral decay

SLIDE 27

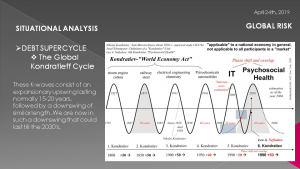

The third is the end of the Debt Super-Cycle.

We need to remember that the international economy operates in pulses christened Kondratiev waves after Nicolai Kondratiev (1892-1938), the Russian economist and statistician who first identified them. These K-waves consist of an expansionary upswing lasting normally 15-20 years, followed by a downswing of similar length. We are now in such a downswing that could last till the 2030's.

The new downswing results from more than the 2008/9 financial crisis.

There has been a wave of Chinese and Asian working-class resistance to exploitation, which has eroded profits.

In the West, paradoxically, the historic defeat of the unions has flat-lined wages. As a result, goods can be sold (and profits maintained) only by bolstering consumption through easy personal debt.

That makes the Western capitalist model unsustainable and prone to endemic bank failure.

The banks and their tame accounting firms are busy covering up this chronic instability via wholesale fraud. As a result, we are nowhere near the bottom of this K-wave.

SLIDE 28

In conclusion we need to remember we are in....

SLIDE 29

1- A SHIFT FROM A UNI-POLAR TO A MULTI-POLAR WORLD

The liberal world order, which lasted from the end of World War 2 until today, is rapidly collapsing. The center of gravity is shifting from west to east where China and India are experiencing explosive growth and where a revitalized Russia has restored its former stature as a credible global superpower. These developments, coupled with America’s imperial overreach and chronic economic stagnation, have severely hampered US ability to shape events or to successfully pursue its own strategic objectives.

As Washington’s grip on global affairs continues to loosen and more countries reject the western development model, the current order will progressively weaken clearing the way for a multi-polar world badly in need of a new security architecture.

Western elites, who are unable to accept this new dynamic, continue to issue frenzied statements expressing their fear of a future in which the United States no longer dictates global policy.

Confrontation will only accelerates the pace of US decline and the final collapse of the liberal world order.

This is precisely inline with our THESIS 2018: THE NEW WORLD ORDER where we argue the world is shifting from a Uni-Polar world controlled by US Policy to a Multi-Polar world.

SLIDE 30

2- THE WORLD IS INCREASINGLY BECOMING UNGOVERNABLE?

Inequality and its consequences of Populism and a shift towards Socialism is making the governance of many economies almost impossible and certainly chaotic. You need not look any further than US politics over the last few years.

SLIDE 31

3- ESCALATING SERIOUSNESS OF GEO-POLITICAL TENSIONS

We are witnessing escalating seriousness of Geo-Political Tensions. This weeks new threat is Iran threatening to shut down the Straits of Hormuz because of US Sanctions on Iran no longer being waived to certain previously exempt countries.

SLIDE 32

We believe global growth continued to decelerate through the first quarter of 2019. We expect the global economy to stabilize at low levels in the second quarter before more visible signs of economic improvement - led by China - become apparent in the second half of this year.

Ultimately, we think a global recession this year is unlikely and the policy easing underway in China is a material part of that projection. The recent shift in Fed policy should also reduce the risk of a recession; the central bank has moved very quickly from where it stood at the end of last year. While the Fed's pivot has not yet telegraphed a cut to the Fed funds rate, we think it's possible that it could head down that path quickly if U.S. growth weakens further.

The nimble response from these two particular central banks should diminish the downside risk and clear the way for a more constructive outlook on financial assets. We've seen this view start to play out in the equity market, but is likely to extend to other markets as well - especially in the fixed income, corporate, and emerging market sectors.

Within this context, we are constructive on both U.S. Treasuries and emerging market fixed-income securities.

SLIDE 29

So, in closing, as I always remind you – remember the answer will be to print more money.

It is the only answer politicians will ever agree on.

Until no one wants it or trusts It!

Invest accordingly.

SLIDE 29

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2019 turn out to be an outstanding investment year for you and your family.

Thank you for listening