IN-DEPTH: TRANSCRIPTION - REGIONAL UPDATE - JUNE 2019

COVER

AGENDA

SLIDE 5 - EU

THE EUROZONE SLOWDOWN IS MORE PROBLEMATIC THAN THE GLOBAL ONE

Starting with the Eurozone, the problem here is threefold:

- Demographic,

- High state and fiscal interventionism,

- Lack of technological leadership

If we add the political risk of some governments who want to penalize high productivity sectors while subsidizing those of low productivity, we have an economic challenge that will simply not be solved with liquidity injections and low rates.

With rates at zero and almost 1.8 trillion euros of excessive liquidity, the problem of the European Union is not the moderate global slowdown.

It is perpetuating a rigid, intervened and extractive model.

The United States or the United Kingdom have buffers to face a slowdown. Most Eurozone countries are dangerously ignoring it and, even worse, proposing large government spending and high taxes as the “solution”.

- The European Union has completely abandoned its reform agenda to bet it all on the mirage of monetary policy, while economic, demographic, state and political risks rise.

- Other than Germany, in the rest of the Eurozone the fragility of the economies is linked to both fiscal imbalances and excessive interventionism that make them more vulnerable to a change in the cycle.

- In France the word “crisis” appears on the front page of newspapers and economic programs as a real possibility. The entire country is aware that the slowdown is severe and tax reductions and measures to strengthen economic performance are announced.

- In the periphery, countries must be aware that they have exhausted their fiscal space and acknowledge their vulnerability to a modest change of cycle.

- The OECD index of leading indicators already shows a negative figure and the leading indicators published by the Ministry of Economy also reflect more than ten in negative territory.

That’s why the Eurozone should be more prepared. Because most countries do not have the capacity that others have to confront a slowdown.

SLIDE 6

In the EU we have a:

- ZOMBIFIED ECONOMY: Despite the ECB’s subsidy of the Eurozone’s banking system, it remains in a sleepwalking state similar to the non-financial, non-crony-capitalist zombified economy.

- Gone are the heady days of investment banking.

- There is now a legacy of derivatives and regulators’ fines.

- Technology has made the over-extended branch network, typical of a European retail bank, a costly white elephant.

- The market for emptying bank buildings in the towns and villages throughout Europe must be dire, a source of under-provisioned losses.

- On top of this, the ECB’s interest rate policy has led to lending margins becoming paper-thin.

SLIDE 7

We have a Negative Deposit Rate"

- NEGATIVE DEPOSIT RATE: A negative deposit rate of 0.4% at the ECB has led to negative wholesale (Euribor) money market rates along the yield curve to at least 12 months.

- This has allowed French banks, for example, to fund Italian government bond positions, stripping out 33 basis points on a “riskless” one-year bond.

- It’s the peak of collapsed lending margins when even the hare-brained can see the risk is greater than the reward, whatever the regulator says.

- The entire yield curve is considerably lower than Italian risk implies it should be, given its existing debt obligations, with 10-year Italian government bonds yielding only 2.55%. That’s less than equivalent US Treasuries, the global risk-free standard.

SLIDE 8

and additionally we have:

- INTEREST RATE SUPPRESSION: Government bond yields have been and remain considerably reduced through the ECB’s interest rate suppression and its bond-buying programs.

- The expansion of Eurozone government debt since the Lehman crisis has been about 50% to €9.69 trillion.

- This expansion, representing €3.1 trillion, compares with the expansion of the Eurosystem’s own balance sheet of €2.8 trillion since 2009.

- In other words, the expansion of Eurozone government debt has been nearly matched by the ECB’s monetary creation.

- Bond prices, such as that of Italian 10-year debt yielding 2.55%, are therefore meaningless in the market sense.

- This has not been much of an issue so long as asset prices are rising and the global economy is expanding, because monetary inflation will keep the fiat bubble expanding.

SLIDE 9

It is when a credit crisis materializes that the trouble starts. The fiat bubble develops leaks and eventually implodes.

SLIDE 10 - ITALY

THE 2ND LOOMING EU FINANCIAL CRISIS WILL HIGHLY LIKELY START IN ITALY VERSUS PREVIOUSLY IN THE "PIGS"

I have recently posted that the Italian Crisis in turn has the ear marks of potentially being triggered by a Turkish Crisis. Its ironic that the 2011-2012 EU Banking crisis stemmed from Greece and Cyprus. Now we have Turkey as part of this three country region of the world that bridges the EU with the Middle East.

- Italy’s economy as measured in real GDP shrank for two quarters in a row, which puts it into a “technical recession”

Worries from France:

- We read stark warnings from French Economy Minister Bruno Le Marie: “Don’t underestimate the impact of the Italian recession.”

- Le Maire also conceded that while contagion in the Eurozone was definitely contained, the Eurozone “is not sufficiently armed to face a new economic or financial crisis.”

- The French government is now openly worried that such a crisis could begin in Italy.

- The economies of both Italy and France are tightly interwoven, with annual trade flows of around €90 billion.

- More important still, French banks are, by a long shot, the biggest owners of Italian public and private debt, with total holdings of €311 billion as of the 3rd quarter of 2018, according to the Bank for International Settlements — up €34 billion from the 1st quarter of 2018.

- French banks increased their holdings of Italian debt by over 10% in 2018, once again belying the ECB’s long-held claim that its QE program would help reduce the level of interdependence between European sovereigns and banks.

Worries from the IMF

- France isn’t the only Eurozone nation with unhealthy levels of exposure to Italian debt, although it is far and away the most exposed.

- According to the Bank for International Settlements, German lenders have €87 billion worth of exposure to Italian debt — up from 79 billion six months ago — and

- Spanish lenders, €75 billion — up from €69 billion.

- If you include derivatives, guarantees and credit commitments, German lenders are exposed to the tune of €126.53 and Spanish lenders, €89 billion.

- Taken together, the financial sectors of the largest, second largest and fourth largest economies in the Eurozone — Germany, France and Spain — hold no less than €600 billion of Italian debt, derivatives, credit commitments and guarantees on their balance sheets.

- Italy’s government is perfectly cognizant that French, German and Spanish banks are now far too exposed to Italian debt for their respective governments to even entertain the idea of pushing Italy to the edge. That knowledge is fueling the coalition government’s bravado, with some lawmakers now even talking about nationalizing Italy’s central bank, the Bank of Italy, for a total sum of €155,000 and taking control of its assets, including Italy’s large pile of gold.

The more the Commission tries to bring Rome into line, the wider the spreads on Italian bonds tend to grow, which in turn forces Italian banks to cut their lending. This risks deepening Italy’s economic slowdown, which would put even further strains on Italy’s fragile banking system. And that’s the last thing that France’s government or its banks want.

SLIDE 11

I also note that:

Italy is the first founding EU member, and the first G-7 nation, to officially sign on to Beijing's "One Belt, One Road" economic development initiative

Though Italy is directly defying Washington's warnings about the 'national security threat' endemic to doing business with Chinese state-backed companies, with Italy's economy mired in recession, and the outlook for growth dim, Beijing has offered Rome's ruling populists something that Brussels and the West haven't been willing, or able, to offer: An unprecedented economic boon

SLIDE 12 - FRANCE

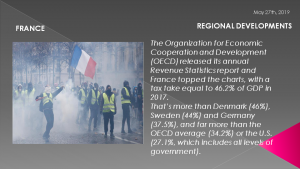

The Organization for Economic Cooperation and Development (OECD) released its annual Revenue Statistics report this week, and France topped the charts, with a tax take equal to 46.2% of GDP in 2017.

That’s more than Denmark (46%), Sweden (44%) and Germany (37.5%), and far more than the OECD average (34.2%) or the U.S. (27.1%, which includes all levels of government).

SLIDE 13

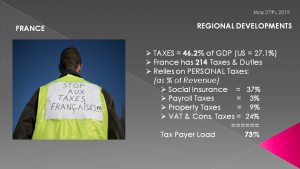

- France doesn’t collect that revenue in the ways you might think. Despite the stereotype of heavy European income taxes on the rich, Paris relies disproportionately on social-insurance, payroll and property taxes.

- Social taxes account for 37% of French revenue; the OECD average is 26%. Payroll and property taxes contribute 3% and 9%, compared to the OECD averages of 1% and 6%.

- The payroll tax is very regressive; it consumes a larger share of low and middle class earners than rich people.

- Then Europe adds a regressive consumption tax, the value-added tax. In France, VAT and other consumption taxes make up 24% of revenue, and that’s on the low side compared to an OECD average of 33%. Consumption taxes often fall hardest on the poor and middle class, who devote a greater proportion of their income to consumption.

Add one more increase to an already high (and regressive) gas tax in France to the existing 214 taxes and duties and the people went nuts.

SLIDE 14 - UK

In the UK, Prime Minister Theresa May has simply been clinging on to a semblance of control over the manner and timing of her departure.

Shown here is the letter out last week confirming that her resignation date will be announced within a very few short weeks and is based on the condition of the PM bringing her widely hated BREXIT withdrawal back for an unprecedented fourth vote in the Commons.

She is in talks with the Labor Party to try and convince the opposition to abstain from the vote, which would increase the odds of the agreement passing.

Good luck with that!

It is looking more and more like an BREXIT with no agreement OR an election that will be fundamentally about getting the electorate to re-vote, since the "POWERS-TO-BE" believe they got it wrong the first time!!!

In the US we have had more than two years of the media and swamp not accepting the people choice of Trump. In the UK it was the Brexit vote. In both cases it has been obvious that Democracy is no longer working they way it used to at least appear it was???

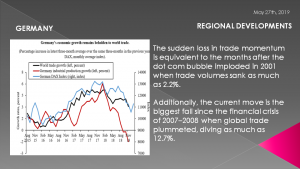

SLIDE 15 - GERMANY

Finally in Germany, on a closing note on the EU, we are now witnessing major issues in Germany. The two pillars of the EU (Germany and France) have both had their leaders basically ejected. Macron has lost all real political power based on his handling of the Yellow Jacket riots and Angela Merkel is leader in name only as managing her narrow coalition has usurped her former leadership powers on the EU's main stage.

Germany is quickly becoming a diminished giant, and that spells trouble for Europe. Slower Chinese growth and the woes of Germany’s auto industry are sending the economy into recession.

Germany’s near-recession in the second half of 2018 was a surprise to many. It should not have been.

World trade growth slowed starting early 2018 just when the German auto industry was dealing with a wrenching drop in domestic sales. This concurrent hit to two of Germany’s vulnerabilities — overwhelming dependence on buoyant world trade and accelerating obsolescence of its industrial structure — is pushing the economy into recession. Absent a heroic policy effort, a protracted German slowdown will curb European growth. It could fuel a further rise in nationalism, which would deliver another blow to the vision of a unified Europe.

SLIDE 16

Germany’s fabled manufacturers have reinvented themselves in past decades, but always within the same framework of engineering excellence, supported by an enviable apprenticeship system that produced generations of highly industrially literate factory workers. However, today, the global technological race is in science-and-mathematics-based electronic and computing technologies, where Germany is proving an also-ran. Among the world’s top 15 science and mathematics university programs, East Asian economies — China, Korea, Japan, and Taiwan — take prized spots along with the United States. No German—or European—university makes that prestigious list. Germany could easily fall into the world’s second-tier economic league unless the country’s leaders act with new urgency.

Germany is another example of a great economic power fearful of giving up a celebrated past and hence is trapped in the present. The politically powerful car industry is lobbying to hold back change. Helpfully, Chancellor Angela Merkel has argued against higher emission limits. For her, too rapid a shift could hugely disrupt the networks of production that generate wealth.

Merkel feels the ire of aging Germans hurt most severely by the continuing industrial attrition. Such older Germans are at the leading edge of the country’s increasing social and political tensions. The social trauma of this economic transition is eroding public support for Germany’s mainstream political parties. As new contenders vie for influence, the political system is fragmenting, threatening Germany’s vaunted political stability.

However, gradual obsolescence of Germany’s old industrial structure will weigh heavily on German growth, which will depress Europe’s already low long-term growth potential. The continuing rise in German political entropy will highly likely further erode the country’s grudging financial support of Europe.

SLIDE 17 -CHINA

Moving to China.

CHINA'S NPC / CPPCC REPORT: SUGGESTS CHINA HAS BIG PROBLEMS!

China’s manufacturing PMI is below 50; so is Japan’s; so is South Korea’s; so is the Eurozone’s; so is Australia’s services PMI; and Taiwan’s new export orders PMI sub-index suggest the US ISM is going to head below 50 ahead. That is called a synchronized global manufacturing downturn.

Against that background we have just seen what the alphabetti-spaghetti of China’s NPC and CPPCC have produced so far. The main headline is this:

CHINA SETS 2019 GDP GROWTH TARGET AT 6%-6.5%

....which sounds reassuring. Yet Chinese GDP growth is not a measure of what the economy actually does, but of how many empty apartments they are prepared to add to their inventory pile of 65 million. The details of what 2019 will apparently also promise looks equally good on the surface very much the opposite underneath:

- CPI growth of 3% (how, with deflation looming?);

- 11m urban jobs to be created (when there are reports of a softer labor market);

- M2 growth will be the same as nominal GDP growth, which implies around 9% - are FX reserves going to rise 9% too?

SLIDE 18

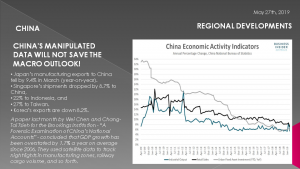

CHINA'S MANIPULATED DATA WILL NOT SAVE THE MACRO OUTLOOK

- Japan’s manufacturing exports to China fell by 9.4% in March (year-on-year).

- Singapore’s shipments dropped by 8.7% to China,

- 22% to Indonesia, and

- 27% to Taiwan.

- Korea’s exports are down 8.2%.

- Broad credit grew by $430B in March alone.

- Business tax cuts were another $300B.

- Bond issuance by local governments was pulled forward for extra impact.

- But once you strip out the offsets, it is far from clear that the picture for 2019 has changed.

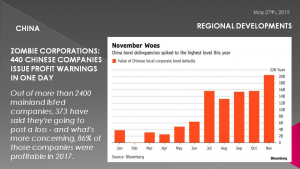

SLIDE 19 - CHINA

ZOMBIE CORPORATIONS: 440 CHINESE COMPANIES ISSUE PROFIT WARNINGS IN ONE DAY

- Beijing continues its relentless crackdown on shadow banking as the government is no longer backstopping every corporation, which has become a collective concern among market participants.

- Companies cited the country's economic slowdown (which is also catalyzing sales of Chinese-held U.S. real estate), as well as recent accounting changes that followed a $2.3 trillion equity market selloff last year,

- Out of more than 2400 mainland listed companies, 373 have said they're going to post a loss - and what's more concerning, 86% of those companies were profitable in 2017.

- "Private companies are particularly vulnerable to the economic downturn. The deleveraging campaign and the deterioration of their corporate health is normal for any economy that is shifting gears and slowing down."

- One reason why China's companies are suddenly "coming clean" was that "companies whose shares are already quite battered have nothing to lose by lowering earnings forecasts or taking large impairments for 2018. Many of these companies are actually ‘taking a bath’ to begin anew in 2019."

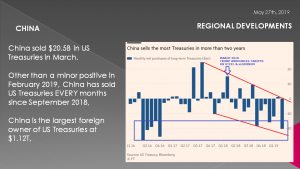

SLIDE 20 - CHINA

DE-DOLLARIZATION: CHINA DUMPS US TREASURIES AT FASTEST PAST IN 2 YEARS IN MARCH

China sold $20.5B in US Treasuries in March.

- Other than a minor positive in February 2019, China has sold US Treasuries EVERY months since September 2018,

- China is the largest foreign owner of US Treasuries at $1.12T,

SLIDE 21- JAPAN

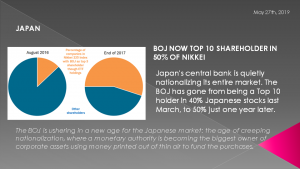

BOJ NOW TOP 10 SHAREHOLDER IN 50% OF NIKKEI

Japan's central bank is quietly nationalizing its entire market. The BOJ has gone from being a Top 10 holder in 40% Japanese stocks last March, to 50% just one year later.

- The Bank of Japan Is Now A Top-10 Shareholder In 50% Of All Japanese Companies.

- Bank of Japan now owns a stunning 75% of all Japanese ETFs

- As of March 2018, the Japanese central bank had become a major shareholder in nearly 40% of all listed companies.

- This, of course, in addition to the BOJ's trillions in Japanese JGB holdings, which at last check were over 100% of GDP and 43% of all outstanding.

- The BOJ also become the top shareholder in 23 companies, including Nidec, Fanuc and Omron, through its ETF holdings, but as of Q1, it was among the top 10 holders for 49.7% of all Tokyo-listed enterprises.

The Bank of Japan will overtake a state-run pension fund - the world's largest - as the top shareholder in Tokyo-listed companies as early as 2020, even as concerns rise regarding the central bank's outsize role in the nation's capital market. Assuming that the bank maintains its current target of 6 trillion yen (just over $53BN at prevailing rates) in new purchases a year, its holdings would expand to about 40 trillion yen by the end of November 2020. This would place it above the Government Pension Investment Fund's TSE first-section holdings of more than 6%. In other words, Japan's central bank will soon be the biggest individual owner of Japanese stocks.

The BOJ is ushering in a new age for the Japanese market: the age of creeping nationalization, where a monetary authority is becoming the biggest owner of corporate assets using money printed out of thin air to fund the purchases.

The bank's ETF program "is eroding market discipline as companies are rewarded simply for being in major market indexes, rather than for having new business strategies or offering more dividends," the OECD said in a country survey published Monday, citing a previous Nikkei report.

"If the Nikkei Stock Average falls below about 18,000, the market value of the ETF holdings would fall below their book value,"

SLIDE 22 - JAPAN

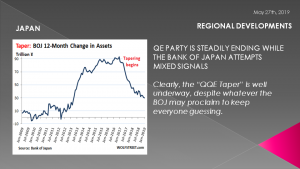

QE PARTY IS STEADILY ENDING WHILE THE BANK OF JAPAN ATTEMPTS MIXED SIGNALS

- In 2019, markets are facing a situation for the first time in a decade where the big three QE’ers – the Fed, the BOJ, and the ECB – will on net whittle down ever so slowly the assets on their combined balance sheets, with:

- The BOJ continuing to add a smidgen - the “QQE Taper” is well underway, despite whatever the BOJ may proclaim to keep everyone guessing.

- With the ECB maintaining what it has - the Fed has already reduced its balance sheet by over $400 billion since the start of its QE unwind in October 2017 and for now continues to run its QE unwind on automatic pilot.

- With the Fed continuing its roll-off - the ECB tapered its massive QE to zero as of December 2018 and is currently only planning to replace securities when they mature to keep its balance sheet roughly level

- QQE started in December 2012 as part of Abenomics. During peak QQE, in the 12-month period ended December 31, 2016, the BOJ’s assets ballooned by ¥93.4 trillion.

- Over the most recent 12-month period ended January 31, 2019, the BOJ added only ¥30.2 trillion to its balance sheet, the smallest such gain since March 2013

- The switch from regular QQE to the two-steps-forward-one-step-back QQE came without any announcement from the BOJ, which continues to say that “QQE with yield curve control” – the BOJ is targeting the entire yield curve, not just short-term yields – will be maintained for as long as needed to achieve 2% inflation.

- For the 12-month period ended January 31, the BOJ added “only” ¥25.4 trillion of JGBs and bills, a far cry from its assertions that it would add ¥80 trillion a year. It has not added ¥80 trillion of government debt since the 12-month period ended April 2017.

- Clearly, the “QQE Taper” is well underway, despite whatever the BOJ may proclaim to keep everyone guessing.

SLIDE 23 - EMERGING MARKETS

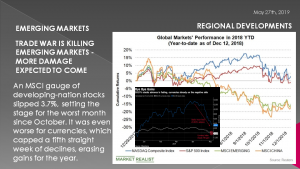

TRADE WAR IS KILLING EMERGING MARKETS - MORE DAMAGE EXPECTED TO COME

Another week, another leg of the emerging-market rout. It has been a steady decline which has recently began to re-accelerate.

An MSCI gauge of developing-nation stocks slipped 3.7%, setting the stage for the worst month since October. It was even worse for currencies, which capped a fifth straight week of declines, erasing gains for the year.

The direction of emerging-market equities is “hanging in the balance of the global risk environment” and likely dependent on U.S.-China talks at least in the short term . “We continue to see the near-term risks for EM as tilted to the downside, and the risk of additional tariffs being implemented is rising. Comments from China’s state media suggest that the chances of further negotiations with the U.S. over trade issues are unlikely in the near term.”

“There is more volatility to come. There aren’t a whole lot of things that can support EM right now.”

The back-and-forth of trade negotiations between the U.S. and China continues to be the main guide for markets as investors reassess the odds of a deal between the world’s two largest economies. The tone of the talks, which had seemingly improved late last week, soured again over the last few days after the White House barred companies deemed a national security threat from selling to the U.S. and threatened to blacklist Huawei Technologies Co. from buying essential components. On Friday, China’s state media signaled a lack of interest in resuming trade talks with the U.S.

“Investors have not turned significantly more bearish because most believe that the latest escalation in trade war tensions between the U.S. and China is merely a negotiating tactic to extract concessions ahead of a deal.”

SLIDE 24 - SITUATIONAL ANALYSIS

US-CHINA TRADE TENSIONS

"Cordial” Nature Disappearing

EU DISINTEGRATION HAS BEGUN

Italy & Failed BREXIT Agreement May be Lynchpin

FAILED GOVERNANCE & DIPLOMACY

Confrontational Tones the Norm

SLIDE 25 - SITUATIONAL ANALYSIS - 1

It now looks like the trade war talks were in reality NOT "constructive". Quite the contrary:

- Trump demands China put commitments into law.

- China replied that "no one should expect China to swallow bitter fruit that harms its core interests".

- Trump ordered Lighthizer to begin the process of imposing tariffs on all remaining imports from China This would impact an additional $300 billion worth of goods.

- China said it would retaliate.

- Then Trump warned China not to retaliate or it would face worse terms. Trump Tweeted "Love collecting BIG TARIFFS!"

- Kudlow said on Sunday he expected retaliatory tariffs to kick in but that it had not happened yet.

- China warned Trump on Sunday not to underestimate China's endurance and that China is not afraid to fight.

- China posted its own set of demands for further talks including the removal of all extra tariffs.

CHINA DEVELOPMENTS

The three demands are:

- The complete removal of all trade-war related tariffs,

- The US must set targets for Chinese purchases of goods in line with real demand and

- Ensure that the text of the deal is “balanced” to ensure the “dignity” of both nations.

The China's People’s Daily reported that the U.S. should take full responsibility for trade-talk setbacks because it raised tariffs on China’s products, state television reported. China sought a mutually beneficial agreement but the U.S. went back on its word, state broadcaster CCTV reported on Sunday.

According to people close to the talks, as the sides marched toward a deal that they hoped initially to close last week, they had gotten stuck in recent weeks on the question of lifting the U.S. tariffs in response to Chinese steps to address American complaints. When the U.S. insisted that it would leave tariffs in place, the Chinese threatened to blow up the discussions.

SLIDE 26

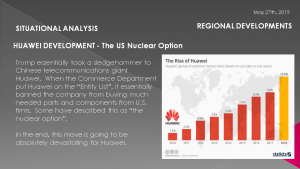

HUAWEI DEVELOPMENT - The US Nuclear Option

Now Trump has essentially taken a sledgehammer to Chinese telecommunications giant Huawei. When the Commerce Department put Huawei on the “Entity List”, it essentially banned the company from buying much needed parts and components from U.S. firms. Some have described this as “the nuclear option”, and I think that description is quite accurate. In the end, this move is going to be absolutely devastating for Huawei.

Of course the Chinese are absolutely furious about this. Huawei is viewed with great national pride in China, and this move is considered to be a direct insult to Chinese national honor. Most Americans are not paying too much attention to the details of the trade war, but in China this is a really big deal and people are extremely angry. In fact, there has apparently been a run on “Donald Trump toilet brushes” in China in recent days because the Chinese are so angry.

China has been lying, cheating, stealing our technology and robbing us blind. Technology leaders have been begging for our politicians to stand up and do something When Trump started talking tough about China it was evidence that someone really understood these issues.

SLIDE 27

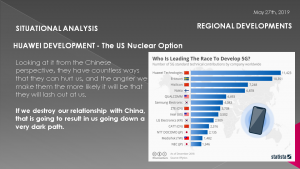

But I also want everyone to understand that trying to decouple from the Chinese economy would be extremely painful even in the most optimistic scenario. Our two economies have become extremely integrated, and we have become very dependent on China in many different ways.

China

- Buys our soybeans,

- They provide us with rare earth elements, and

- They own more than a trillion dollars of our debt.

When negotiating with China, you need to be tough but you also need a lot of finesse. Taking a baseball bat and slamming it into their kneecaps is not going to work.

If we destroy our relationship with China, that is going to result in us going down a very dark path. Yes, China is an evil empire that has no respect for human rights at all. There is no freedom of speech in China, over the past year they have been shutting down lots of churches and burning lots of Bibles, and they have been systematically throwing members of other religious minorities into concentration camps.

So I don’t have any sympathy for the communist Chinese government at all. I just want all of you to understand that they are a very dangerous adversary, and a protracted trade war could be truly disastrous for the entire global economy.

SLIDE 28 - SITUATIONAL ANALYSIS -2

SLIDE 29

EU DISINTEGRATION HAS BEGUN UNDER THE PRESSURE OF AN EU RECESSION, GLOBAL SLOWING & BREXIT

- EU NOW FACING RECESSION: Now that the global economy has stopped expanding and is on the brink of recession, under these changing conditions the monetary, systemic and economic dangers facing the Eurozone are rapidly rising.

- EU DISINTEGRATION BEGINS: There can be no doubt that the ECB has so far only managed to prevent a financial and systemic crisis materializing because of the background of a worldwide monetary and credit expansion inflating financial asset prices.

- ITALY THE LYNCHPIN: It takes little imagination to realize that in an environment of rising bond yields and falling asset values the Italian government and its economy will be exposed to intractable difficulties.

- BREXIT: Today, the EU is threatened with Brexit, which is yet to be resolved.

It is becoming increasingly obvious to independent observers that the EU supra-national socializing model is failing structurally, politically, economically and financially.

- The next credit crisis, which appears to be evolving from the seeds of today’s events, looks set to end the European dream.

SLIDE 30 - SITUATIONAL ANALYSIS -3

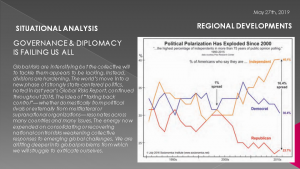

GOVERNANCE & DIPLOMACY IS FAILING US ALL

- Confrontational Tones Becoming the Norm versus the Exception,

- The number of Global Tensions Are Escalating,

- Broad Based Military Build-Ups Occurring,

WORLD ECONOMIC FORUM at this years DAVOS Meeting Cited Nationalism As One Of The Biggest Threats To Global Stability

- The WEF is worried that the world won't be able to nimbly cooperate and respond to threats if something isn't done about the increasingly "state-centered" politics (that is growing populism and nationalism),

- To quote them in their Annual Global Risks report presented at DAVOS in January:

Is the world sleepwalking into a crisis? Global risks are intensifying but the collective will to tackle them appears to be lacking. Instead, divisions are hardening. The world’s move into a new phase of strongly state-centered politics, noted in last year’s Global Risks Report, continued throughout 2018. The idea of “taking back control”— whether domestically from political rivals or externally from multilateral or supranational organizations— resonates across many countries and many issues. The energy now expended on consolidating or recovering national control risks weakening collective responses to emerging global challenges. We are drifting deeper into global problems from which we will struggle to extricate ourselves.

[...]

If another global crisis were to hit, would the necessary levels of cooperation and support be forthcoming? Probably, but the tension between the globalization of the world economy and the growing nationalism of world politics is a deepening risk.

- In searching for something - anything - to blame for the rise of populism (that is, aside from policy decisions dictated by increasingly out-of-touch elites) - the report hits on the growing occurrence of mental illness around the world, though they elide over the drivers of the "societal changes" that the WEF researchers believe are at the root of this problem.

- In my opinion the driver behind much of the growth in populism, nationalism, mass migrations and much of the social unrest is INEQUALITY - recently made much worse by failed Monetary Polices to stem the end of the Debt Super-Cycle.

SLIDE 31 - THEY WILL PRINT THE MONEY

So, in closing, as I always remind you – remember the answer will be to print more money.

It is the only answer politicians will ever agree on.

Until no one wants it or Trusts It!

Invest accordingly.

SLIDE 32 - DISCLAIMER & WRAP

I would like take a moment as a reminder

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

As negative as these comments often are, there has seldom been a better time for investing. However, it requires careful analysis and not following what have traditionally been the true and tried approaches.

Do your reading and make sure you have a knowledgeable and well informed financial advisor.

So until we talk again, may 2019 turn out to be an outstanding investment year for you and your family.

Thank you for listening