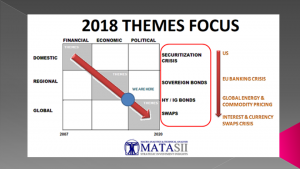

IN-DEPTH: TRANSCRIPTION - THE EVOLVING GLOBALIZATION CYCLE

COVER

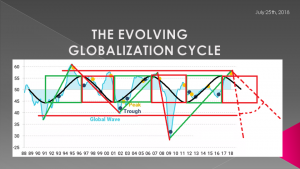

AGENDA

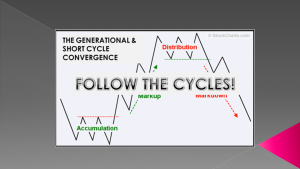

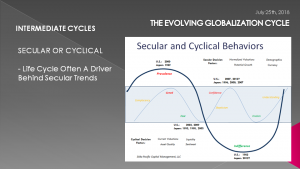

SLIDE 5-FOLLOW THE CYCLES

We have discussed cycles on a number of instances recently. The May LONGWave entitled "Follow The Cycles" was dedicated to this subject with a particular focus on the Credit Cycle.

There wasn't sufficient time in that release to explore cycles further and specifically on what seems to me to be an emerging cycle which I will call the Globalization Cycle.

SLIDE 6 - GLOBALIZATION TRAP

When I authored the 2014 MATASII Thesis paper entitled "The Globalization Trap" it was pretty clear it existed and was becoming more pronounced along with the shifts in Credit. Both cycles appeared to be closely linked.

Our Globalization Trap road-map has developed as we expected and our recent videos on Zombie Corporations speaks to the level of collateral impairment we are now witnessing and shown on this road-map.

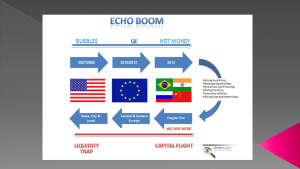

SLIDE 7 - ECHO BOOM

The work we did during that period on Emerging Markets predicted what we called at the time the "Echo Boom", which we felt surely lay ahead. It also has come to fruition as we see major cracks today across the Emerging Markets which we have been posting on MATASII.

This cycle aligned itself with the Globalization Cycle which in turn as you would expect, aligns with the Global Credit Cycle.

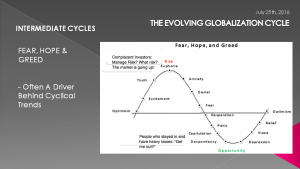

SLIDE 8

Many of the normal characteristics of Confidence & Fear are seen now working at a Global level within this cycle.....

SLIDE 9

.... as well as Central Bank actions being a lot more synchronized than ever before, whether by design or the natural forces working behind the forces of Globalization.

SLIDE 10

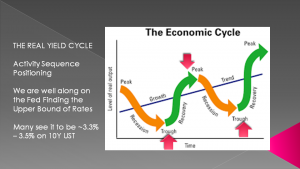

Where this is particularly relevant today in my estimation is in the assessment of Global Trade forecasts. Of course there is a strong correlation between trade and credit, so it is helpful to look at them separately to get a better understanding of what is likely to unfold in the near term.

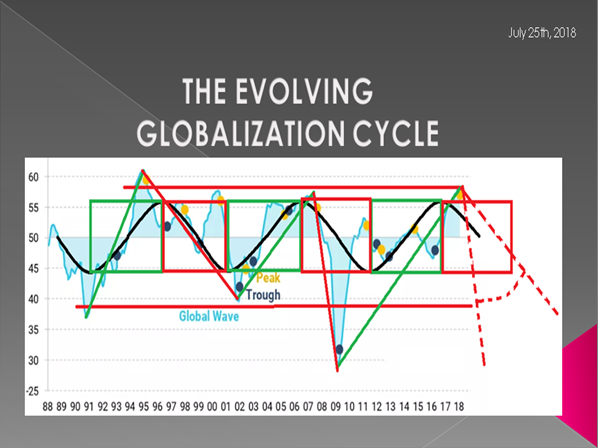

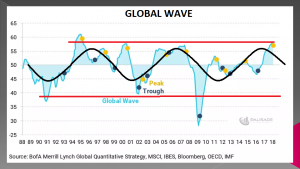

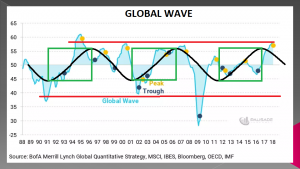

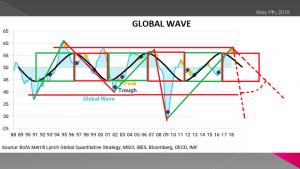

There is a Global Wave which I like that is based on data from BoAML, MSCI, IBES, Bloomberg and the IMF that is shown here.

I have found it to be quite instructive, especially if we break it down carefully.

SLIDE 11

The Global Wave appears to have general levels of resistance and support shown here by the horizontal red lines.

There also appears to be a harmonic cycle shown here in black.

It approximates just a little over 5 years.

SLIDE 12

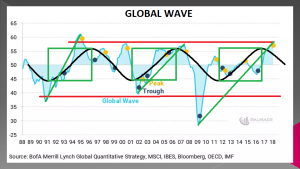

I have drawn three green rectangles which better isolates when the cycle would suggest the global wave can be expected to be rising.

SLIDE 13

I have now drawn three green lines which connect the actual cyclical peaks and troughs. As you would expect they all cut through our green boxes within periods the Theoretical Global Wave suggests they should be rising.

SLIDE 14

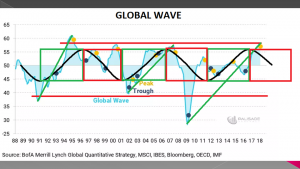

I have now drawn three red rectangles for the Theoretical periods when the cycle should be declining.

SLIDE 15

In the first two red rectangles I again connected the peaks and troughs with red lines. In the third box which theoretically should be underway now I drew both of the two previous lines as dotted possibilities.

The schematic strongly suggests the global trade should be slowing and soon, at an accelerating pace!!

SLIDE 16

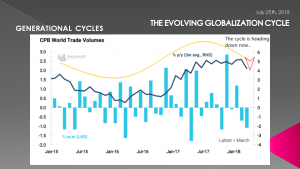

So lets now examine various charts of what is going on with global trade - many of which I have recently posted on MATASII with supporting details.

Here is the CPB World Trade Volumes. Clearly the % Y/Y 3 Mo Average has turned down as we see a dramatic recent drop in the % m/m change. Something is certainly happening here!

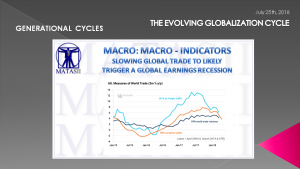

SLIDE 17

This shows a comparison of alternative reporting besides the CPB World Trade Volumes. It shows the IATA Air Freight Traffic report as well as the RWI Container Traffic reporting. Both of these are even worse and more pronounced in their turn down than the CPB World Trade Volumes.

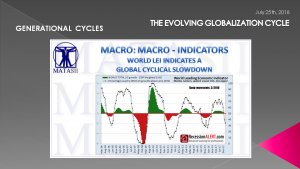

SLIDE 18

There is now a World LEI or World Leading Economic Indicator shown here. What we are expecting from the Global Wave is much more evident here and shows that the expected rapid slowdown is clearly present in the economic data used in the World LEI.

SLIDE 19

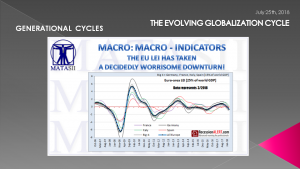

I also looked at the regional areas of the LEI data. I am very concerned about the EU.

The EU LEI suggests I have every right to be concerned. The deterioration is broad based across Europe.

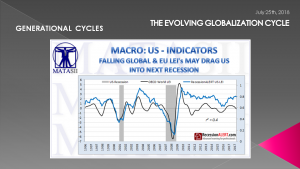

SLIDE 20

What the charts are suggesting is that the Global and EU slowdown is highly likely to drag the US into a recession within 12-18 months if not sooner depending on the escalation in the Global Trade war.

SLIDE 21

Corporate Sales Revenues are now falling rapidly, with the EU being much more dramatic than its LEI is currently signalling.

SLIDE 22

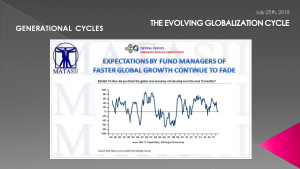

Global Funds Managers as you would expect have already recognized this and have been adjusting their growth projections.

SLIDE 23

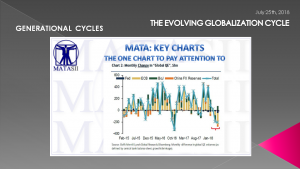

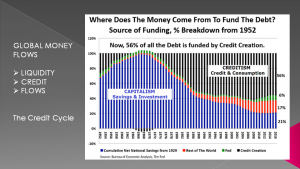

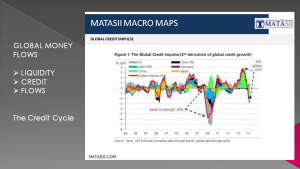

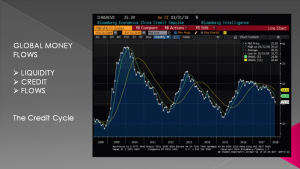

Needless to say all of this is following closely the slowing in the Credit Impulse and the slowing of Global QE (Quantitative Easing) which we have been highlighting for quite some time now!

SLIDE 24

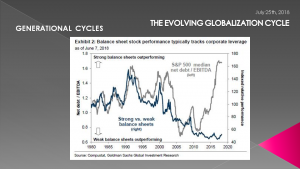

What we need to remember is that corporate debt to cash flows have been spiking as revenues have been increasingly languishing.

SLIDE 25

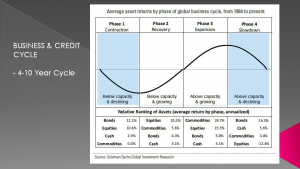

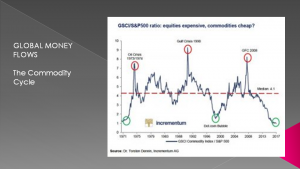

There is little doubt that the Global Business and Credit Cycles are rolling over as Bonds, Cash, Commodities and Equities levels support this view. The Institutional consensus is we are late in this cycle and are preparing accordingly.

SLIDE 26

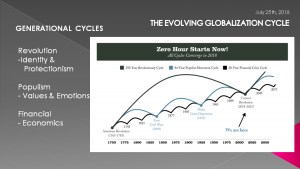

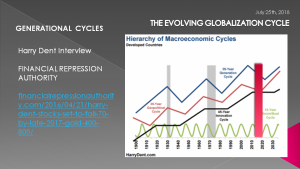

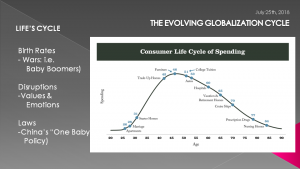

I have shown some of the following slides previously, but they are worth revisiting.

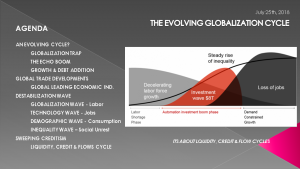

It isn't just the Global Wave and its 5+ cycle, but many longer term cycles are converging on this end of decade time period.

SLIDE 27

Many of these cycles are based on completely different data and societal changes - but they are all looking for major troughs in the next few years.

SLIDE 28

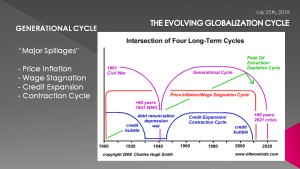

My colleague Charles Hugh Smith has developed his own cycle theory based on Price Inflation, Wage Stagnation, Credit Expansion and Contraction Cycles - it also tells the same story.

Something is coming and it is massive.

It is more than just financial and economic. It is Societal and therefore Political.

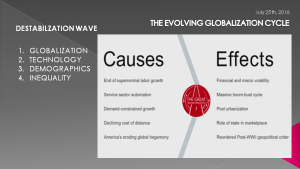

SLIDE 29

All these wave in my estimation are reflecting elements of four major destabilizing forces presently sweeping the global economy.

- Globalization itself and the labor arbitrage that goes with it,

- Technology - whether the internet, robotics or biomedicine,

- Demographics of falling birth rates and aging populations ... and

- Sweeping Inequality as Capitalism has shifted to Crony Capitalism and Creditism.

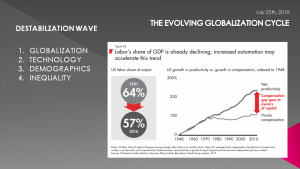

SLIDE 30

The most serious of the four is Inequality stemming from a lack of job growth with wages which support existing standards of living and the unwritten social contract between the elected (or rulers) and the people (or electorate).

SLIDE 31

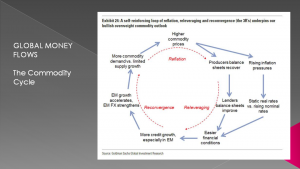

What we have is a growing global DEMAND PROBLEM versus the historically dominant supply or shortage problem. The later contributes to price inflation which is currently. The former to deflationary pressures.

SLIDE 32

Confidence is falling globally as fear grows with escalating Geo-Political tensions. We are in an era much more serious than the cold war. Trump's Trade War may trigger many unintended and unsuspected serious consequences.

SLIDE 33

Our global society is extremely fragile as its reliance on increasing credit will soon be seriously challenged. New, unencumbered collateral to support new credit is no longer materializing fast enough and an extremely highly leveraged global economy may not be able to sustain slowing credit growth, despite what the central banks will no doubt attempt to do to overcome this.

SLIDE 34

Corporations have not been investing in major projects as capital has been deployed to buybacks and dividends for short term stock performance. Nowhere is this more evident than in the commodities arena where mines are expensive and long term in nature and there has been a dearth of investment. Gold & Silver bugs are acutely aware of this.

Soon the preoccupation with short term P&L's is going to raise its ugly head as money and credit possibly become very expensive at exactly the wrong time. Zombie corporate balance sheets will have a significant challenge covering exiting debt if rates rise. Ever-mind raising capital for long term payouts.

SLIDE 35

The cycle of Reflation-Releveraging- Reconvergence may fail us.

SLIDE 36

Even if the central banks again go full steam with QE and other reactive incarnations, there is likely to be a serious period of financial, economic and political stress.

SLIDE 37

Political stress because the global powers to be won't be able to agree on what they need to do (or willing to do) in a coordinated fashion - in a timely fashion.

If the $600T Unregulated, OTC Global Interest and Currency SWAPS problem ever even "burps" the politicians will have no idea what to do and there is no central bank powerful enough to solve this global problem quickly and effectively by itself.

SLIDE 38

Global Flows are warning ...

SLIDE 39

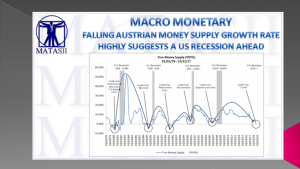

Money Supply is warning...

SLIDE 40

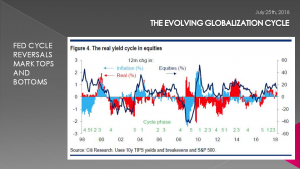

Yield curves are warning....

SLIDE 41

The level of Zombie Corporations are warning...

SLIDE 42

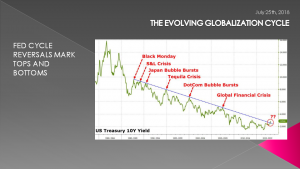

A four decade long falling rate cycle is warning ...

SLIDE 43

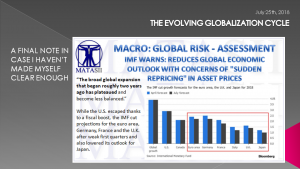

The IMF is now warning - which is something they traditionally stay clear of.

SLIDE 44

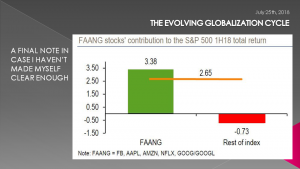

Even the stock market is warning if we pay attention to the alarming deterioration in breadth.

SLIDE 45

The Global Wave is telling us something. It may not be imminent but it is on the horizon. Plan accordingly.

We can only hope that they will print the money and it will buy us more time - again.