IN-DEPTH: TRANSCRIPTION - TURKEY, EM & THE COMING EU BANKING CRISIS II - PART I

COVER

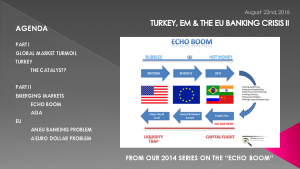

AGENDA

SLIDE 5 - GLOBAL MARKET TURMOIL

Global banking stocks are plunging, emerging market stocks are cratering, and emerging market currencies continue their stunning decline. The shakiness of global financial markets has many investors wondering what trouble the fall will bring to America where markets currently appear quite placid – at least on the surface.

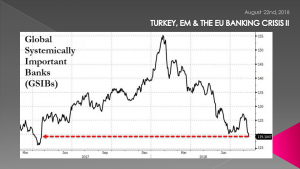

However, there are clear problems, as this chart isolates in the intersection of tightening Central Bank Monetary policies, the Globally Systemically Important Banks (GSIBs) and Emerging Markets.

SLIDE 6

Though the NASDAQ shown here still seems unaffected, these problems will soon wash ashore in America. The MSCI Emerging Markets Index is signalling this is to come.

SLIDE 7

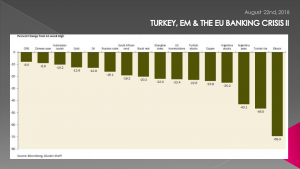

The Emerging Markets are leading the chart lower having fallen 20 percent from their peak - this means that they are officially also now in a bear market. When we examine all the global individual stock exchanges together we see we are well on the way to a potential global stock market correction - or worse!

Global stocks have now fallen beneath all key moving averages. Those key moving averages are important psychological thresholds for investors, and if we have a few more days like Wednesday August 15th we could see global financial markets go into full panic mode.

When demand for industrial metals falls, this indicates that an economic slowdown is coming. Prices for industrial metals have fallen to their lowest level in almost a year, and “Dr. Copper officially entered a bear market.

If the financial carnage continues this could be the beginning of another financial crisis like we experienced in 2008, and that would almost certainly mean a crippling global recession.

Of course once the next global recession begins, it is likely to be more painful than we have ever seen before in modern history, because the global debt bubble is far larger than it has ever been before.

SLIDE 8

Global banking stocks are now down a whopping 23 percent from the peak established earlier this year, and that means that they have officially entered a bear market.

European banking stocks have now officially entered a bear market, and all major European stock indexes are now red for the year.

SLIDE 9

The global carnage is increasingly becoming broad based with Turkey and Argentina particularly hardest hit.

- the Shanghai Composite closed at its lowest level since January 2016

- German bunds are trading back below 30 basis points.

- The Governor of the RBA just said what every central banker wishes they could -- that he encourages a weaker currency.

- The Malaysian ringgit is the latest Asian currency to experience the effects of slowing growth, sliding to the lowest in nine months.

- BTPs remain at levels the Italian government can’t afford as their equity markets continue to noticeably underperform their brethren.

… yet U.S. equities are impervious to it all.

As Gluskin Sheff's David Rosenberg notes, "No contagion, eh? The only folks that can't see it in the FX and commodity markets are spending too much of their day gazing at the SPX and Russell 2000. There is no decoupling, just lags."

SLIDE 10

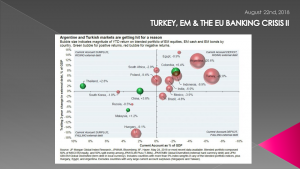

The growing contagion wave should be no surprise as warning signs from both Argentina and now Turkey have been evident for some time. With a strengthening US dollar and slowing global trade (which we outlined in detail in the last UnderTheLens video - "The Globalization Cycle") the contagion wave is steadily creating increasing havoc in most emerging markets.

SLIDE 11

There are many Emerging Market countries not getting the visibility they should – at least not yet!

SLIDE 12

While the market is finally paying attention to the accelerating Turkish collapse and specifically the risk of contagion to Europe, Asia, and ultimately, US capital markets, the truth is that this crisis has been a long time in the making. In fact, the first break in the "strong Emerging Market" narrative emerged in late April when as a result of rising US interest rates the dollar surge began in earnest (facilitated by China's first easing announcement on April 17), which in turn sent the both EM currencies, and EM debt reeling to be followed shortly by the plunge in the biggest EM currency of all: the Chinese Yuan.

Higher US rates finally caused a higher US dollar (courtesy of the PBOC), at which point "EM started to crack".

But while many had pointed to the collapse in the Turkish Lira, the Argentine Peso, and the Indonesia Rupiah, as cracks in the EM narrative, the truth is that we have an Emerging Market Debt problem across the board primarily as a result of:

- A strong US$,

- Slowing Trade and now

- Worries of a Global Trade war.

SLIDE 13

I have warned about and posted my concerns regarding Emerging Markets for sometime now. Specifically many including myself have set the critical Tipping Point in the Emerging Markets to be if the Brazilian Lira is to break the magical 4 handle.

In light of the latest emerging market turmoil, the Brazilian real - which plunged as low as 3.9287 vs the dollar after the Brazilian Finance Minister said he saw "no need to intervene in FX markets" - is now on the verge of crossing this key level that has been a virtually guaranteed predictor of accelerated contagion.

SLIDE 14

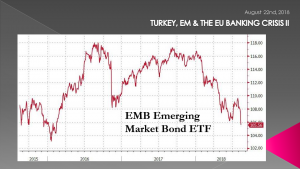

So far the media focus has been primarily about FX & Currency movements, but Bond & Credit prices are also getting hit which is driving up

1- Current Account funding,

2- Debt Rollover Costs and

3- Destabilizing certain Regional Banks.

A secondary "fail safe" EM-stress indicator is - to quote BofA's Chief Investment Officer Michael Hartnett:

“An EMB <107.50 is contagious ”

This means that once EMB, the JPM Emerging Market Bond ETF, drops to 107.50 - the level it hit right after the Trump election - it will be time to get out of the Emerging "Dodge City".

Where is the EMB today? It just dropped to 105.75, the lowest level since February 2016, and validating the negative signal about to be launched by the BRL.

It appears it is time to start worrying!

SLIDE 15

The main media focus today however is targetet on Turkey and its potential global contagion effects. This is not at all misplaced in my opinion! We at MATASII have seen the potential for a major debt default in Turkey for sometime now.

The initial phases of Turkey’s crisis have so far been a replay of past emerging-market currency crises. A mix of domestic and external events:

- An over-stretched credit-led growth strategy

- Concerns about the central bank’s policy autonomy and effectiveness

- A less hospitable global liquidity environment, owing in part to rising U.S. interest rates — destabilized the foreign-exchange market.

We feel there is better than a 25% chance of a Turkish default within 12 months. Erdogan is not following the three standard responses to a funding crisis:

- An aggressive monetary and fiscal response,

- Seeking help from outside such as the European Union or International Monetary Fund, and/or

- Creating a currency board/closing convertibility of TRY.

The present approach contains none of these elements, which could lead to further escalation and an overall EM crisis.

The concern to many is that Turkey will be forced to impose capital controls enforcing a near total loss of US$500bn of credit assets held by the global financial system. That is a large financial hole in a still highly leveraged system. That scale of loss will surpass the scale of loss suffered by the creditors of Bear Stearns and while Lehman’s did have liabilities of US$619bn, it has paid more than US$100bn to its unsecured creditors alone since its bankruptcy.

It is the nature of EM lending that there is little in the way of liquid assets to realize; they are predominantly denominated in a currency different from the liability, and also title has to be pursued through the local legal system.

SLIDE 16

Turkey will almost certainly be the largest EM default of all time, should it be forced to resort to capital controls, as we suspect. It could also be the largest bankruptcy of all time given the difficulty of its creditors in recovering any assets.

So the recent events represent only the end of the beginning for Turkey.

The true nature of the scale of its default and the global impacts of that default are very much still to come.

What we need to understand is that:

“Strong forms of capital controls produce a de facto debt moratorium, and very rapidly investors realize just how little their credit assets are worth!”

A debt moratorium at the outbreak of The Great War in 1914 bankrupted almost the entire European banking system - it was saved by mass government intervention. While the imposition of capital controls in recent years has hit selected investors hard, in Iceland, Cyprus, Greece and key emerging markets, there has been nothing of this size and it is to be fully borne by financial institutions who believe they hold not just valuable credit assets but actually liquid credit assets!

The loss of hundreds of billions of assets recently considered liquid by global financial institutions, through the de facto debt moratorium of capital controls, will be a huge shock to the global financial system.

This is a different type of default and its nature, as well as its magnitude, will blindside financial institutions.

SLIDE 18

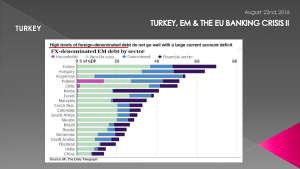

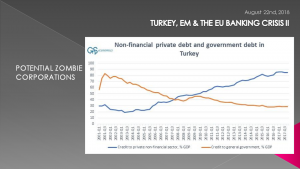

So far the problems in Turkey have been a Currency problem. The real issue is that it will soon become a debt crisis.

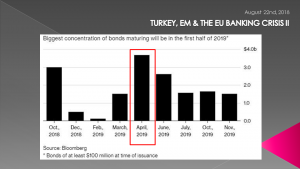

Investors fear that Turkish lenders will struggle to find the capital to repay about $34.4 billion of bonds sold during a decade of rapid economic growth and historically low global borrowing costs. Turkish banks alone have to service $7.6 billion in USD-denominated debt by the end of 2019.

"The material level of foreign currency borrowings among Turkish institutions makes them vulnerable," and if the Turkish Lira tumbled to 7.1, then the excess capital in the Turkish bank sector would be wiped out.

SLIDE 19

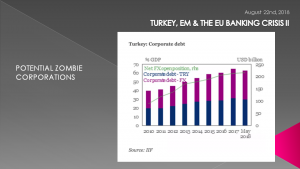

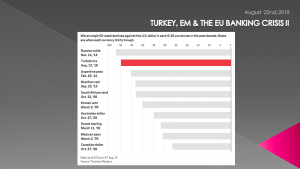

While the market has already punished Turkish banks, they are not the only culprits behind the nation's ravenous dollar-denominated debt binge, and there are no less than 16 billion reasons why the Turkish currency crisis, unless arrested early, would morph into a debt/rollover crisis.

According to Bloomberg calculations, major Turkish companies, financial institutions and the government are facing a "bond wall" of at least $16 billion in bonds denominated in foreign currency that are due by the end of next year.

The amount due by the end of next year is mostly composed of debt issued by Turkish financial institutions, and includes conventional bonds and Islamic sukuk bonds valued at a minimum of $100 million at the time of issuance.

Investors will be closely watching if banks and corporations - not to mention the government - will be able to maintain access to the foreign funding they need not only to keep economic activity humming as the country’s currency plunges, but rollover maturity debt. The alternative would mean mass defaults for the companies that make up the core of Turkey's economy.

SLIDE 20

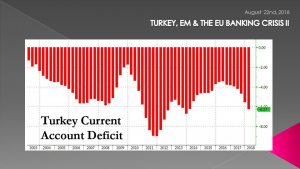

"So far, a currency crisis has not turned into a debt crisis," although that is largely due to the lack of imminent debt maturities: the longer the crisis plays out and the lower the lira drops, the greater the likelihood of a catastrophic outcome. The bigger wildcard is how the country will be able to maintain the critical inflow of foreign capital to keep its current account funded.

SLIDE 21

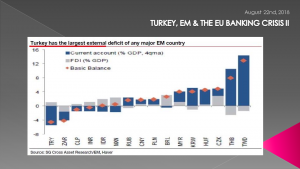

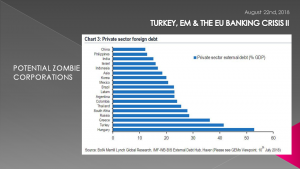

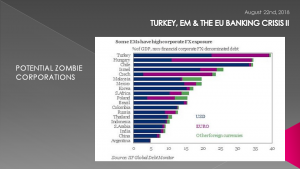

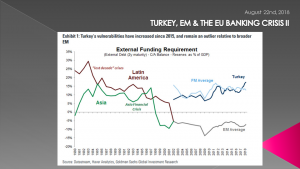

We highlight here Turkey's specific vulnerabilities on a relative basis: Turkey's external borrowing as a % of GDP is noteworthy.

In particular, private sector external debt/GDP has grown at a very fast rate as a result of recent privatization tenders and large infrastructure projects which were run as public-private partnerships (PPP).

SLIDE 22

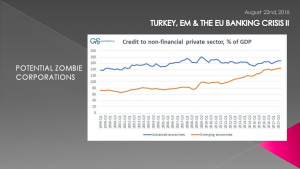

We see here that the level of corporate debt in Turkey and many Emerging Markets is extremely problematic. We have talked about this issue and the growing level of Zombie Corporations extensively lately.,

SLIDE 23

Global quantitative tightening if allowed to continue will bring an end to the current business cycle. This is for a multitude of reasons but the most pressing of them is the fact that QT will raise interest rates and suppress liquidity. It will raise the costs of indebted companies, drive zombie companies to insolvency and ultimately crash the asset markets. A global debt crisis of epic proportions and depression are likely to follow.

Turkey may show what it might just look like.

SLIDE 24

Most debt crises have been triggered by mistrust towards the finances and currency of the indebted governments. This time, the private companies are considerably more indebted than the governments. Because of this, the coming debt crisis will be harder to defeat than the previous ones. If the companies have borrowed massively from abroad, the falling external value of the currency will increase their interest payments and diminish their ability service their debts thus feeding the currency crisis. This is the heart of the crisis in Turkey.

SLIDE 25

The common response to a debt and/or currency crisis has been raising the interest rates and shoring up the government finances (with e.g. structural reforms) to increase the confidence of the international investors. More drastic measures have included capital controls, defaults or calling the IMF for assistance. However, with a highly indebted private sector, the rate raises damage the ability of companies to service their debt and to roll them over especially, if they are unable to halt the fall of the currency. Although the “order” of President Erdogan not to raise rates may seem counter -intuitive, the interest rate rises could just wreak more havoc by bringing more burden to the already damaged corporate sector.

SLIDE 26

Bloomberg reports that Turkish banking regulator BDDK has approved new rules on loan restructurings.

Banks can extend maturities, refinance, lend new loans, seek new collateral and sell debtors’ assets against receivables under the new regulation which will allow lenders to temporarily (there's that word again) suspend reflecting the negative impact of mark-to-market security losses on their capital adequacy ratio calculations.

SLIDE 27

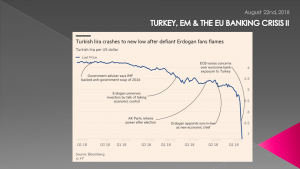

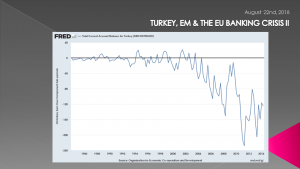

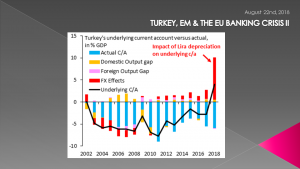

The Turkish Current Account is crippling! This chart reminds me of Greece prior to the the EU Banking Crisis.

SLIDE 28

Who is going to step in or continue to fund Turkey???

SLIDE 29

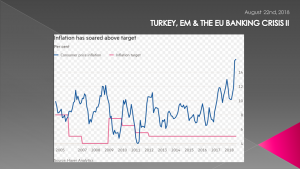

... especially as inflation pushes north of 15% and central bank rates are at 17%??

SLIDE 30

The 'rate of collapse' of the Turkish Lira is almost unprecedented in recent times other than the Russian Rubble in 2014

SLIDE 31

Obviously as the Lira plunges their already disastrous Current Account will only get worse when it is reported going forward!!

SLIDE 32

We simply can't forget and must recognize that we have two very unorthodox leaders at the decision pinnacle of the Turkish crisis!

Rather than opting for interest-rate hikes and an external funding anchor to support domestic-policy adjustments, the government has adopted a mix of less direct and more partial measures — and this at a time when Turkey is in the midst of an escalating tariff tit-for-tat with the United States, as well as operating in a more fluid global economy.

Rather than sticking with the approach taken by numerous other countries — including Argentina earlier this year — by raising interest rates and seeking some form of support from the International Monetary Fund, Turkey is currently shunning both in a very public manner, including through strident remarks by President Erdoğan.

What few truly appreciate is that even if Turkish institutions have the ability to pay, something many analysts doubt, President Erdogen many are rightly concerned he will forbid them from doing so. There is no doubt that President Endogen has more than something of a Hugo Chavez about him.

This is potentially a large default and could prove to be almost a total default.

SLIDE 33

It appears Turkey is digging in its heels following the doubling of US tariffs on steel and aluminum. It is quite clear the escalation of the Lira's fall was brought on by political issues. Some believe President. Trump's actions involving the release of a missionary provoked the collapse of the Turkish Lira.

It will be interesting to see who blinks first.

Turkey is a member of NATO and yet it purchased a missile-defense system from Russia, and at the same time, it ordered several US-made F-35 fighter jets. I'm certain this caused many security issues and certainly brought into question Turkey's solidarity with NATO.

Furthermore, Turkey has been the gateway for massive refugees to enter the EU. Turkey's failure to control its borders has created a security risk to much of the EU and the developed world.

A combination of all these reasons provoked President Trump to double the tariffs on steel and aluminum. Turkey subsequently has retaliated with its own tariffs on automobiles and spirits.

SLIDE 34

Erdogen so far has resorted to:

1.Removing “Mark-to-Market” accounting requirements for Banks and Corporations,

2.Asking citizens to patriotically exchange their US dollars for Turkish Lira,

3.Stop importing i-Phones and US Electronic products,

4.Mobilized at least $15 billion from Qatar to be used for direct investment in Turkey,

It appears to me the issue with Turkey will be resolved through some method of negotiation with our State Department which will involve a more long-term fix with the international monetary fund (IMF).

SLIDE 35

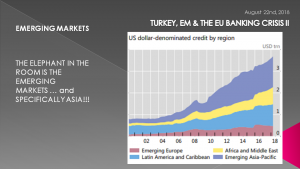

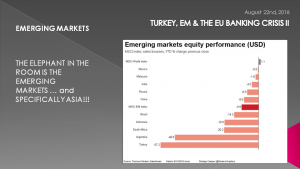

What I started with is the fact that the problem is is the overall Emerging Markets -not just Turkey

THE ELEPHANT IN THE ROOM IS THE EMERGING MARKETS … and SPECIFICALLY ASIA!!

SLIDE 36

Debt in the Emerging Markets has exploded and this debt comes with some very unique problems.

We believe as a result of this:

- As stated earlier, there is a strong 25% plus chance of a Turkish default within 12 months. Erdogan is not following the three standard responses to a funding crisis: an aggressive monetary and fiscal response, seeking help from outside (read: European Union or International Monetary Fund), and/or creating a currency board/closing convertibility of TRY. The present approach contains none of these elements, which could lead to further escalation and an overall EM crisis.

SLIDE 37

- There is a 40% chance that global recession arrives by Q4’18 or Q1’19. This recession would spring from the enormous underestimation of the damage done to SMEs and MMEs by: tariffs, a rising marginal cost of capital, and a USD that is too strong for the world’s indebted markets.

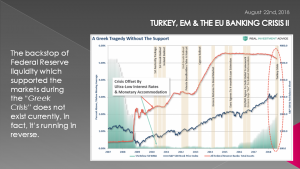

- There is a 80% chance a strong reversal of quantitative tightening from the Federal Reserve, supported by the European Central Bank and major central banks. The timing could be signalled as early as the Jackson Hole event. Overall, US monetary policy and growth have peaked, and the mini-crisis together with the Trump administration’s trade tariffs is creating a need to first pause and then reverse policy lower. The world is almost coming to a standstill, after all, from the Fed’s extremely hollow tightening.

We will continue this discussion in Part II where we will expand on the Emerging Markets further and how this will inevitably lead to another EU Banking Crisis.

We warned of this in our 2014 series on the Echo Boom. We encourage you to revisit these Macro Analytics videos which can be found on our YouTube Channel Archives.