IN-DEPTH: TRANSCRIPTION - TURKEY, EM & THE EU BANKING CRISIS II - PART II

COVER

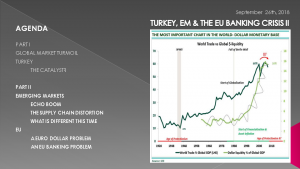

AGENDA

SLIDE 5

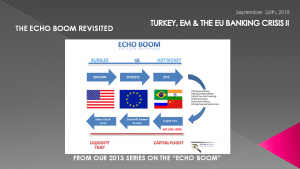

THE ECHO BOOM

We laid out what the Emerging Markets' problems would eventually be as a result of Quantitative Easing when we did a series of UnderTheLens videos beginning in 2013 entitled “The Echo Boom”. They can be found in the Macro Analytics YouTube Channel archives (here & here). Nothing that is occurring today should therefore come as any shock to our long term UnderTheLens subscribers. The serious concerns currently evident in the emerging markets should be seen as simply the necessary consequence of Global Monetary Malpractice.

SLIDE 6

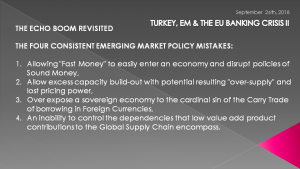

What we have is the four historic and problematic cornerstones of Emerging Market economies which we felt would once again unfold over time and which we based our Echo Boom Thesis on:

THE FOUR CONSISTENT EMERGING MARKET POLICY MISTAKES:

- Allowing "Fast Money" to easily enter an economy and disrupt policies of Sound Money,

- Allow excess capacity build-out with the potential resulting "over-supply" and lost pricing power,

- Over expose a sovereign economy to the cardinal sin of the Carry Trade of borrowing in Foreign Currencies,

- An inability to control the dependencies that low value add product contributions to the Global Supply Chain encompass.

You will note that today we are at the bottom of our 2013 graphic as the Echo begins with Capital Flight and what we projected as the problematic "Fragile Five"

SLIDE 7

........

SUBSCRIBER CONTENT ONLY