IN-DEPTH: TRANSCRIPTION - ZOMBIE CORPORATIONS ONLY TEMPORARILY HIDDEN

COVER

AGENDA

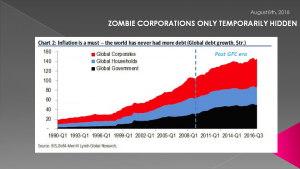

SLIDE 5

The specific catalyst MATASII sees for the next crisis is highly likely to be the record amount of debt that has been steadily piling up on corporate balance sheets over the past decade due to the near decade long record low rates. This is the primary Unintended Consequence of Monetary Malpractice brought about due to the rejection of Sound Money policies.

Since 2009, the amount of debt accumulated by Global Non-financial Junk-Rated companies has soared by 58% representing $3.7 trillion in outstanding debt, the highest ever, with 40%, or $2 trillion, rated B1 or lower.

This mounting wall of debt could spur a downturn because:

- Higher interest rates will constrain Corporate investments,

- Excessive use of leverage in the Technology, Commodity and Industrial industries make corporations highly vulnerable if the economy worsens.

The convergence of these factors along with cyclical peak earnings and an over extended & demographically weakening consumer is the real “perfect storm” for corporations that looms ahead.

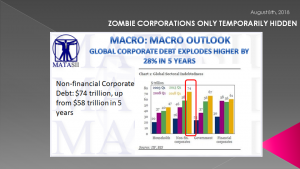

SLIDE 6

A just released International Institute of Finance report warned that Total Global Non-financial Corporate Debt has soared to $74T from $54T in just the last 5 years.

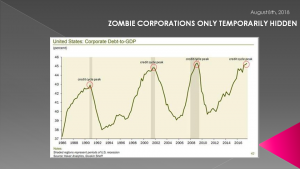

SLIDE 7

Since 2009, US Corporate Debt has increased by 49%, hitting a record total of $8.8 trillion, much of that debt used to fund stock repurchases. As a percentage of GDP, corporate debt is at a level which on every prior occasion, a financial crisis has soon followed.

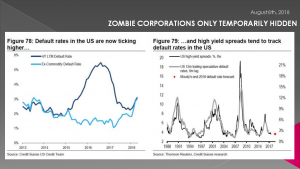

SLIDE 8

This unprecedented increase in corporate debt will undoubtedly and inevitably spur both more defaults, bankruptcies along with a sharp decline in employment if history is any indication.

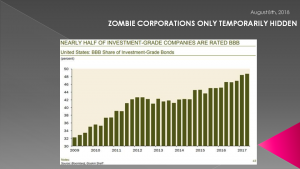

SLIDE 9

What is not yet fully appreciated is this is not simply a junk-rated company problem, since almost half of investment-grade companies are rated BBB (this being the lowest IG rating) and could easily and quickly slip to junk status in any economic downturn. Credit downgrades would result in an explosion higher in their already perilous financing costs.

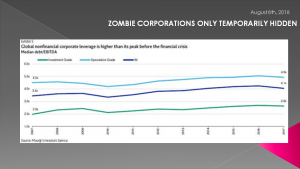

SLIDE 10

At MATASII we recently reviewed some of the latest McKinsey and IIF numbers that described the amount of corporate leverage that’s built up in the system.

Just a decade after the Great Recession, the average non-financial business went from 3.4x leverage to 4.1x. Corporations are now roughly 20% more leveraged than they were the last time "all hell broke loose".

CEOs and their boards seem to have learned little from the experience—or maybe learned too much. That is if they believe the Fed still has their back and therefore leveraging to the moon makes sense!

However, after listening to Fed Chairman Jerome Powell's July Humphrey-Hawkins Testimony we sense that he feels that the abusive increase in corporate debt is problematic and wants it brought under control - quickly.

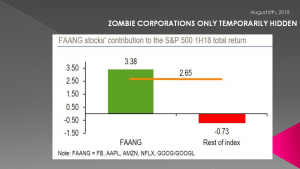

SLIDE 11

Consider this along with the fact that the breadth of the stock market is now so thin that it is supported by 5 stocks who are all using excess debt by any normal historical measure.

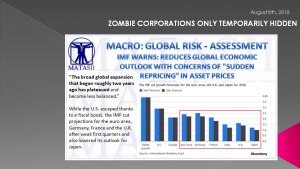

SLIDE 12

As we outlined in our latest UnderTheLens video, the broad global expansion that began roughly two years ago has plateaued. While the US fiscal tax boost has helped US corporations, the IMF has recently cut projections for the Euro area, Germany, France & the UK - while also lowering its outlook for Japan.

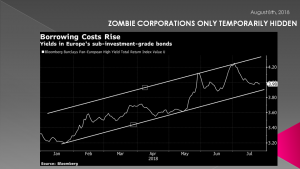

SLIDE 13

Meanwhile, borrowing cost in Europe have been steadily rising since the beginning of the year for sub-investment grade corporate bonds.

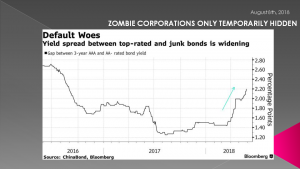

SLIDE 14

Additionally, the spread has been weakening between high grade investment bonds and High Yield Junk bonds.

SLIDE 15

Recent high profile mergers have resulted in many previously strong corporations now highly burdened with temporarily cheap debt. High rates could quickly make some of these corporations Zombie Corporations.

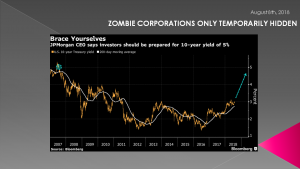

SLIDE 16

JP Morgan CEO Jamie Dimon has just issued an investor warning to possibly expect 5% 10 Year US Treasury Yields.

Corporate CEO's and their Boards are simply not listening - or maybe they simply perceive that they have no choice?

SLIDE 17

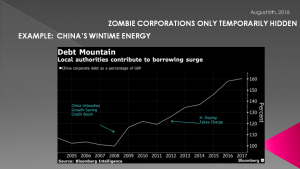

When credit was easily available in 2015, more than half of China's commodity companies were unable to pay the interest on their debt as their EBIT/Interest ratio was <1. As we noted at the time, all it would take is another down cycle in commodity prices for mass defaults to become a staple in China's massively over-leveraged economy.

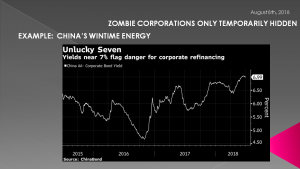

SLIDE 18

A month ago we posted at MATASII that the spread between China's AAA and AA- rated bonds has spiked in the past three months, blowing out to levels not seen since August 2016, and an indication of the market's growing fears about the recent surge in Chinese corporate defaults.

The failure of China's WinTime Energy may in fact be the Canary in the Coal Mine, as was the infamous Enron collapse nearly two decades ago?

As China Suffers Its Biggest Bankruptcy Of 2018, The PBOC Finally Panics

"Is It Time To Start Worrying About China's Debt Default Avalanche.

SLIDE 19

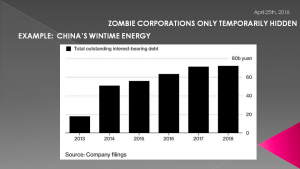

To be sure, for a long time, it was smooth sailing for this Chinese coal miner. As Bloomberg reports, the company from northern China grew and grew and grew, but mostly thanks to an unprecedented increase in its debt, which quadrupled in less than five years, ending up with a debt tab of 72.2 billion yuan ($10.8 billion).

The surge in Wintime debt came amid a near-doubling in size of China’s domestic bond market, now roughly $12 trillion and the world’s third largest. The government had encouraged companies to use bonds for financing as they embraced financial innovation to make the economy less dependent on state-owned banks.

Alas, the debt-fueled party is now over, and the company had no choice but to default after it was unable to rollover its debt, an event which to Bloomberg says (And I quote) "illustrates why this year will be China’s worst yet for corporate defaults."

SLIDE 20

Initially, Wintime’s strategy made sense - borrow to fund acquisitions and expand into areas including finance and logistics. And as long as borrowing costs were low, funding was easy to get and the miner took full advantage of creditors’ largesse.

However, things changed in 2016, when President Xi Jinping relaunched an aggressive deleveraging campaign, and put emphasis on reining in financial risks, after China's first great attempt to reduce debt crashed and burned in the summer of 2013, when overnight funding costs exploded and nearly took down the country's financial system.

SLIDE 21

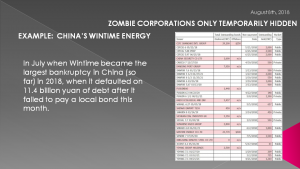

Fast forward to last month when Wintime became the largest bankruptcy in China (at least so far) in 2018, when it defaulted on 11.4 billion yuan of debt after it failed to pay a local bond.

That said, it will hardly be the last because through the end of May there had already been no less than 20 corporate defaults, involving more than 17 billion yuan, a shockingly high number for a country which until recently had never seen a single corporate bankruptcy, and a number which prompted not only Chinese banks to pull back from lending to other firms that use the funds to buy bonds, but also last night's PBOC easing response.

SLIDE 22

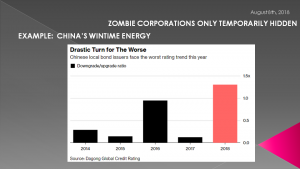

But how did no alarm bells go off anywhere as Wintime's debt exploded without a commensurate increase in the company's cash flow? Simple: as Bloomberg analysts cite, the trouble was that local buyers had little experience in doing credit research, and the local debt-rating agencies lacked the kind of differentiation among borrowers found overseas.

And the punchline:

"There was little need for due diligence until China began allowing defaults in 2014."

Which is a problem because as Qin Han, chief fixed income analyst at Guotai Junan Securities, wrote, "China’s economic growth was largely driven by debt and its corporate debt looks like a Ponzi scheme."

Qin also predicted that absent a government intervention, an avalanche of defaults is coming as "more firms may give up on repaying debt if they encounter financing difficulties."

SLIDE 23

Which they are because with authorities taking measures to curb leverage by clamping down on shadow financing, boosting money-market borrowing rates and tightening regulations on the asset management industry, companies are increasingly running into those - and more - difficulties.

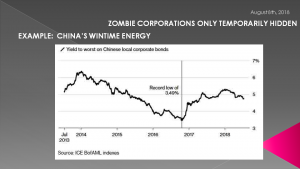

Nowhere is it easier to see the changing nature of China's "Ponzi" corporate debt history than in the financing efforts of Wintime itself, which after issuing more than 10 billion yuan of bonds in 2016 and again in 2017, was only able to find buyers for 3.6 billion yuan so far this year, according to Bloomberg data show.

Why? Surging interest rates of course: Wintime's borrowing cost for one-year bonds soared to 7% in 2018 from 4.5% in 2016.

The party officially ended on July 5 when the company admitted it would not be able to meet its obligations and Wintime defaulted on a 1.5 billion yuan note, triggering cross-defaults on 13 of its other bonds totaling 9.9 billion yuan. Of course, angry stockholders have been left in the void, with shares suspended from trading from July 5.

SLIDE 24

But wait's there more.

Recall that just last week China was threatened by a "vicious circle of panic selling" from market wide margin calls, as a result of the massive amount of stocks pledged as loan collateral, which according to some estimates is as high as $1 trillion and represents an aggressive means of obtaining funding - one that is constantly under threat of margin calls - and as a result is increasingly under scrutiny in China.

As it turns out, Wintime was also a poster child for its involvement in share pledging: Wintime Energy’s parent as of the end of March had pledged almost all its shares in the subsidiary as collateral for loans, according to public filings.

And now that the shares are not only worthless, but also halted, those counterparties who expected to be repaid in full, or even in part, are out of luck.

SLIDE 25

Of course, the scrambling parent has made some progress in obtaining credit lines to repay its stock-pledged by signing a strategic cooperation agreement with five banks including China Development Bank and China CITIC Bank. But all that would do is kick the can: after all at this point the company is using debt to repay another piece of debt, one which is for all intents and purposes worthless. Furthermore, the new credit line may have little impact on the ability to repay debt, if lenders impose strict covenants and seek assets for collateral.

SLIDE 26

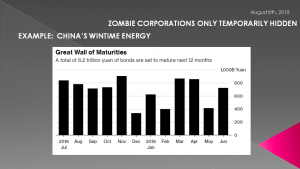

With Wintime down, bond investors want to know where the default wave will strike next.

Unfortunately, there are plenty of of targets: the average debt-to-common equity ratio at listed companies in China climbed to 100% at the end of 2017, the highest in more than a decade, according to Bloomberg. The problem is three-fold:

i) as a result of the recent emerging market swoon and commodity bear market, indebted companies are suddenly generated far less cash which puts them at far higher risk of default,

ii) Chinese corporate debt is up against a shrinking financing universe: the shadow-banking sector contracted by 691.7 billion yuan in June, the biggest net monthly drop on record, and

iii) rates for deeply indebted companies have been rising sharply.

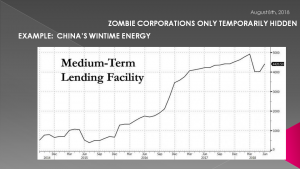

That explains why the PBOC recently announced it would use its Medium-Term Facility, or MLF, which currently has 4.4 trillion yuan outstanding to support the local bond market and banks, especially those that have invested in bonds rated AA+ and below.

In other words, the central bank confirms that China's debt mountain is indeed a Ponzi Scheme as the Guotai Junan analyst explained, however instead of this particular bubble to burst - something it can not afford to do as it would risk widespread public dissent and anger - the PBOC decided to do the only thing it could: kick the can, again.

We give the last words to Gary Zhou, director of fixed-income at China Securities International, who said that "financial institutions were too generous in lending to firms a few years ago but not anymore. Lower investor demand is now met with huge maturity wall. Investors should watch out for default risks and how restructurings are done."

They should, unless the PBOC disintermediates banks entirely, and proceeds to buy near-insolvent corporate debt directly on its account, in line with what both the BOJ and ECB are doing. Last night's news confirms that this is precisely what the central bank is doing.

....

It is this spread, and other indications of bond market tightness that the PBOC wants to address using its MLF and the various other central bank lending facilities as tools for managing short- and medium-term liquidity in the banking system. It has to ensure that there is adequate liquidity especially with economic uncertainties, given the trade dispute with the United States. Indicatively, back in July 2014, when describing the PBOC's Pledged Supplementary Lending facility, that we asked "Is this China's QE"?

We now have the answer.

SLIDE 27

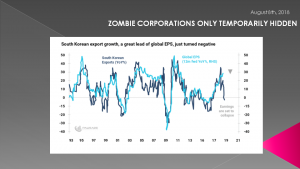

China's problems are quickly spilling into the Emerging Markets - which we have highlighted in numerous MATASII posts recently. South Korea is a well watched early warning sign for global trade. South Korea's export growth and a great lead for global EPS has just turned negative.

SLIDE 28

What Zombie Corporations now have is:

- Declining year-over-year world trade volumes

- The corporate bond yield curve inverting and the potential Trade war impact for markets

- Tightening monetary policy by Central Banks worldwide

- A looming global dollar shortage and collapsing foreign currency values

- The prominent ‘Global Wave’ indicator showing economic growth has peaked and now huge downside ahead

SLIDE 29

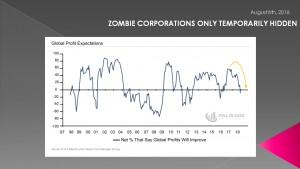

Lower global profit expectations are spreading in markets as a potential global earnings recession nears!

SLIDE 30

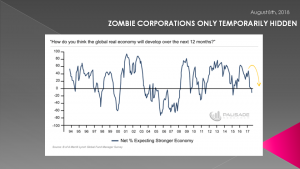

Bearish Sentiment is increasing as the perception of how well the global economy will do over the next 12 months is falling.

SLIDE 31

What we have is:

One: The economic and corporate profit outlooks are both bleak – and worsening. This shows us that the global earnings recession hypothesis is becoming more likely as the ‘smart’ money catches on.

Two: Thanks to Reflexivity, because these perceptions are becoming more bearish, we can expect the dollar to continue rallying and the yield curve to continue flattening – until eventually inverting. This will keep pressure on banks and emerging markets especially.

SLIDE 32

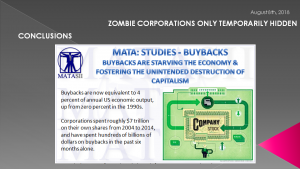

As we pointed out in a recent MATASII post, Buybacks are now starving the US & Global economy and fostering the potential unintended destruction of capitalism:

- Buybacks are now equivalent to 4 percent of annual economic output, up from zero percent in the 1990's.

- Companies spent roughly $7 trillion on their own shares from 2004 to 2014, and have spent hundreds of billions of dollars on buybacks in the past six months alone.

- All in all, public companies across the American economy spent roughly three-fifths of their profits on buybacks

- Lowe’s, CVS, and Home Depot could have provided each of their workers a raise of $18,000 a year, the report found. Starbucks could have given each of its employees $7,000 a year, and McDonald’s could have given $4,000 to each of its nearly 2 million employees.

- Surveys showed that corporations were planning to shunt money to shareholders, rather than putting it into research, mergers and acquisitions, equipment upgrades, training programs, or workers’ salaries.

- 40 to 60 percent of the savings from the tax cut are being plowed into buybacks. One analysis of companies on the Russell 1000 Index found that companies directed 10 times as much money to buybacks as to workers.

All of this will only increase inequality and impact consumer consumption im the US's 70% consumption driven economy.

Likewise, the number of Zombie Corporations which only increase as the next recession will show they were only temporarily hiding from the light of day.

SLIDE 33

As I often remind our listeners, remember they will print the money to solve any and all problems until such time as no one will take the money or it is of no value.

That day is still in the future so take advantage of the opportunities as they currently exist. Investing is always easier when you know with relative certainty how the powers to be will react. Your chances of

I would like take a moment as a reminder:

DO NO NOT TRADE FROM ANY OF THESE SLIDES - they are for educational and discussions purposes ONLY.

Thank you for listening and until next month may 2018 be an outstanding investment year for you and your family.

Thank you for listening!