INFLATION EXPECTATIONS CURRENTLY DRIVING TREASURY YIELDS

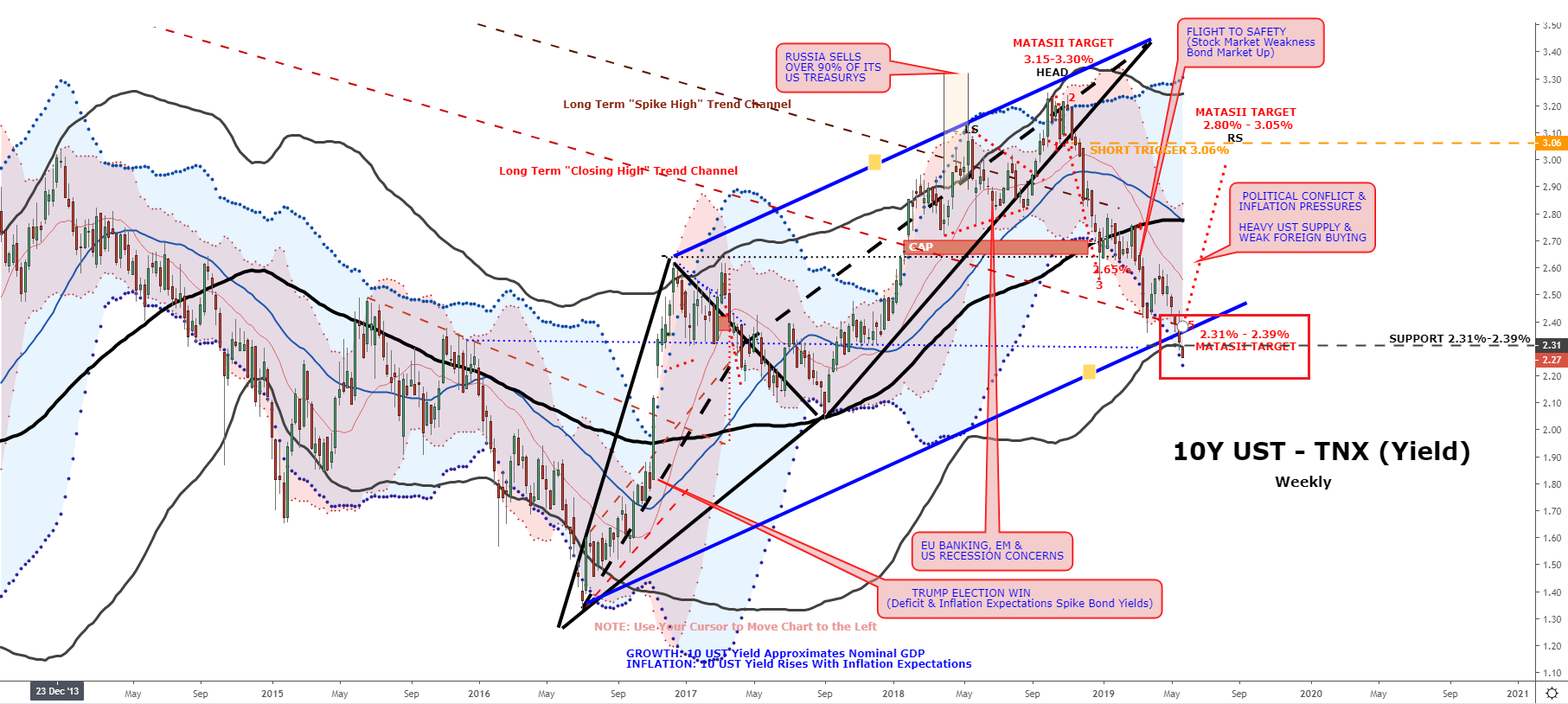

The first charts shows the US Treasury Yields as represented by the 10Y Yield - "TNX":

Note in the above TNX chart the October Treasury peaked in yield.

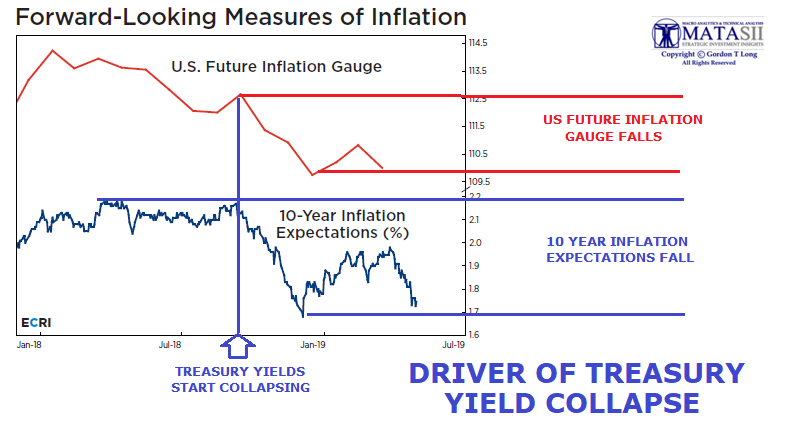

Now look at the ECRI's reporting on US Future Inflation Expectations for both the US Future Inflation Gauge and 10Y Inflation Expectations.

MATASII views the scare of Deflation / Dis-inflation now being nearly fully price in. Consumer Price Inflation is on the horizon.

The basis for this will be inflation pressures, likely associated with:

- Tariff pressures on US Consumers,

- Shortage of foreign Treasury buyers as China and Japan further reduce their holdings,

- Slowing trade reducing currency reserve growth and

- The on-going De-Dollarization factors outlined in this years MATASII Thesis 2019 paper.

Read recent MATASII posts:

- TRADE WAR CONSUMER INFLATION DEAD AHEAD!

- SII – BONDS AT CRITICAL TECHNICAL INFLECTION POINT WITH INFLATION PRESSURES LOOMING