FEATURE ARTICLES

MACRO

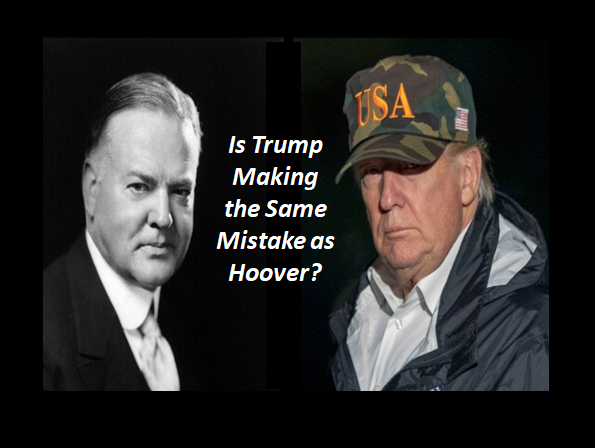

IS TRUMP MAKING THE SAME MISTAKE AS HOOVER?

-

- Lost income for individuals,

- Massive loss of business income,

- Firms are short of working capital and will simply close their doors for good and file for bankruptcy. This means the jobs in those enterprises will be permanently lost,

- Stock Dividends and Buy Backs which have been supported equity markets will be dramatically slashed resulting in Financial Market turmoil despite Fed Liquidity and Government Deficit Spending

-

- Misguided Fiscal & Monetary Policy Responses,

- Smoot-Hawley Tariffs (Trump Tariffs and Trade Discord)

- Excess Credit Expansion for too Long (Roaring 20’s).

-

- We need to critically understand that though the Fed can provide liquidity and keep the lights on in the financial system, it cannot cure:

a. Insolvency or

b. Business closures and Bankruptcies. - The economic downturn will persist because of Lost Income for Individuals.

○ Unemployment compensation and PPP loans will only scratch the surface of total lost income from layoffs, pay cuts, reduced hours, business failures and individuals who are not only unemployed but drop out of the workforce entirely.

○ In addition to lost wages through layoffs and pay cuts, many other workers are losing pay in the form of tips, bonuses and commissions. Even a fully employed waitress or salesperson cannot collect tips or sales commissions if there are no customers.

○ This illustrates how the economy is tightly linked so that problems in one sector quickly spread to other sectors. - There is a massive Loss of Business Income

○ Earnings per share of publicly traded companies are not only declining in the second quarter (and likely the third quarter) but many are negative.

○ Lost business income will be another source of lower stock valuations and a source of dividend cuts.

○ Reduced dividends are also a source of lost income for individual stockholders who rely on dividends to pay for their retirements or medical expenses.

○ Programs such as PPP and other direct government-to-business loans will not come close to compensating for the losses described above. The loans (which can turn into grants) will help for a month or two but are not a permanent solution to lost customers. - In addition to these constraints on demand, there are Serious Constraints on Supply.

○ Global supply chains have been seriously disrupted due to shutdowns and transportation bottlenecks.

○ Social distancing will slow production even at those facilities that are open and can get needed inputs.

○ One case of COVID-19 in a factory can cause the entire factory to be shut down for a two-week quarantine period.

○ Companies that depend on the output of that factory to manufacture their own products will also be shut down. - Beyond these direct effects of lost income and lost output, there are significant indirect effects on the willingness of entrepreneurs to invest and of individuals to spend.

- From lost individual income, lost business income, dividend cuts and bankruptcies will come a host of ripple effects.

- We need to critically understand that though the Fed can provide liquidity and keep the lights on in the financial system, it cannot cure:

After the stock market crash, President Hoover sought to prevent panic from spreading throughout the economy. In November, he summoned business leaders to the White House and secured promises from them to maintain wages. According to Hoover’s economic theory, financial losses should affect profits, not employment, thus maintaining consumer spending and shortening the downturn. Hoover received commitments from private industry to spend $1.8 billion for new construction and repairs to be started in 1930, to stimulate employment.The President ordered federal departments to speed up their construction projects and asked all governors to expand public works projects in their states. He asked Congress for a $160 million tax cut while doubling spending for public buildings, dams, highways, and harbors.

Praise for the President’s intervention was widespread; the New York Times commented, “No one in his place could have done more. Very few of his predecessors could have done as much.” Together, government and business spent more in the first half of 1930 than in the entire previous year. Still consumers cut back their spending, which forced many businesses and manufacturers to reduce their output and lay off their workers.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.