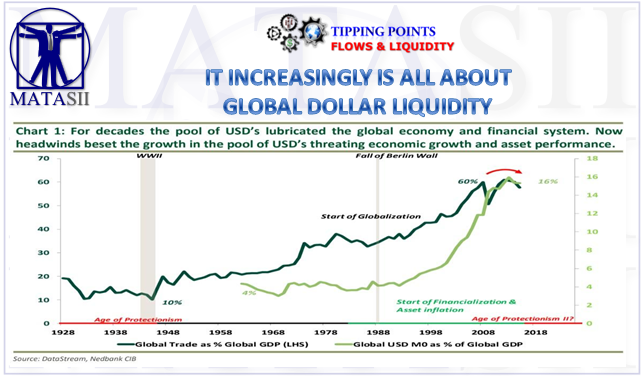

IT INCREASINGLY IS ALL ABOUT GLOBAL DOLLAR LIQUIDITY

Below are some charts & analysis from Nedbank's Mehul Daya, initially re-published by WorldOutOfWhack.com then further annotated with comments by Tyler Durden. All support the work and analysis we have written about at MATASII concerning the out of control global unregulated influence of the EuroDollar System.

It’s simple: it’s all about Dollar-Liquidity.

Slowdown in global trade is putting pressure on creation and velocity of Dollars via value-chains/Dollar-leverage since the Dollar is the lubricant of the global financial system.

Chart 2 – this is how the dollar gets transmitted into the world

Chart 3 – global trade vs USD vs Triffin dilemma

BIS writes in ”The geography of dollar funding of non US banks”

- US dollar liabilities of non-US banks grew after the Great Financial Crisis (GFC). At end-June 2018, they stood at $12.8 trillion ($14.0 trillion including net off-balance sheet positions) – as large as at the peak of the GFC.

- Banks raise relatively fewer dollar liabilities in their affiliates in the US since the GFC. This is due to a rise in the share of dollar liabilities booked in the country where banks are headquartered.

- European banks, which traditionally have had a large US footprint, have shrunk their dollar business and the role of their US affiliates since the GFC. At the same time, non-European banks expanded their dollar borrowing quite rapidly, but in recent years have also raised relatively fewer dollars in the US.

- A large share of US dollar liabilities of non-US banks are cross-border (51% at end-June 2018), implying that the location where US dollar funding is raised is different from the location of the funding provider.

- The global share of US dollar funding provided by US residents is significantly higher than that raised at foreign banks’ US branches and subsidiaries, though these shares vary across banking systems.

Global trade is slowing down and cross border trade is the largest supplier of USD into the global economy and financial system and as BIS summaries...

How might this funding configuration behave in times of market stress? Non-US creditors may be pressured to withdraw funding as they might face a dollar funding squeeze themselves. This in turn is akin to margin call on all assets which were beneficiary of dollar based monetary system.

Nedbank's Daya concludes:

"The consensus is that should the trade wars accelerate it will be inflationary. We agree there obviously be a price shock on the back of the tariffs, but we do not expect an inflationary cycle, we expect the opposite.

As the USD monetary base contracts, it will slow down money/credit growth which is deflationary. This will favour bonds and other yielding assets over growth assets."

The macroeconomic tailwind arising from the growth in the USD monetary base is under threat, leaving the global economy and financial system vulnerable to tighter financial conditions.

Investment implications:We remain structural USD bulls supported by our view that USD creation is slowing down. However, we expect central bank balance sheets to become even more important role in the financial landscape to manage the changes in the quantum of USD in the global economy – leaving traditional signals like the yield curve, volatility and IR differentials difficult to interpret compared to previous cycle. We will continue to rely on the USD and our measurement of USD monetary base.

[SITE INDEX -- TIPPING POINT: FLOWS & LIQUIDITY]

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-24-19 - WorldOutOfWhack.com- "The Lubricant Of The Global Financial System Is Not Working Anymore"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.